Another edition of our new series: Blog Spotlight.

We put together a short list of excellent but somewhat overlooked

blog that deserves a greater audience. Expect to see a post from a

different featured blogger here every Tuesday and Thursday evening,

around 7pm.

Next up in our Blogger Spotlight: RJH Adams (known as Rawdon) of Capital Chronicle. Rawdon was raised in a tiny emerging economy, and his professional life began as a dogsbody at the UK’s economics and finance ministry, HM Treasury. He subsequently moved to the finance functions of multinationals Xerox (UK) and General Electric (France) learning from the inside what making quarterly numbers really involves. In 2000 he left and co-founded an investment vehicle. He lives in the French Alps splitting most of his time between raising three small occasionally charming children and reading about economic development and investment."

Today’s focus commentary looks at:

How good is the Baltic Dry Index as a proxy for global economic activity?

Conclusion: Still worth looking at – but with a proviso since 2006.

As

China moves in 2006 to being a consistent net exporter of steel its

influence over an important driver of the Baltic Dry Index (BDI) – iron

ore for steel production – grows. But China’s massive growth in steel

output has come in large part though government intervention. This, to

some degree, is distorting the underlying freight rate picture.

To

what degree is key. The level and volatility of the BDI is influenced

not only by total commodity demand but also by fuel costs, seasonality,

fleet numbers, route bottlenecks and sentiment. These additional

factors should temper conclusions about the relevance of China’s steel

activities on the level of the BDI.

Discussion:

The

BDI has in the past been helpful to assessing global economic activity.

It is, after all, a reflection of real prices paid to ship production

inputs across the globe. Since March this year the index has been on a

tear, rising 70%, or 1,750 points.

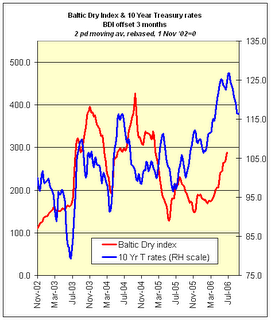

Exhibit 1: BDI vs 10 Year US treasuries, 2002-2006 ytd

Hang

on – aren’t we supposedly on the cusp of an economic slowdown? If

10-year treasuries still lead the BDI (as in Exhibit 1) a dip in the

BDI is around the corner. Some other indicators also suggest this may

be the case – drops in crude prices, widening US credit spreads,

inversion of the 10 year vs 3 month US yield curve, a flat S&P500

versus the prior six months and the Chicago Fed’s National Activity

Index all signal below trend growth in the US, the main driver of the

global economy.

Meanwhile, though, the BDI marches up.

Some

explanation for its rise lies in the summer heatwave in Europe. Several

nuclear reactors – in Spain, France and Germany – were shut down or

operated at reduced output because the waters cooling their cores were

too warm. Increased thermal coke was shipped to fire the power stations

plugging the energy gap. However, thermal coke is only 18% of the total

dry bulk trade; and these incremental shipments, a fraction within

that, cannot account for most of the BDI’s increase.

But huge

steel production by usual suspect China, demanding impressive

quantities of iron ore imports, might. China’s imports of iron ore

represented 13% of total dry bulk trade in 2005. Given that in the half

year 2006 Chinese iron ore imports jumped 23% that share has at least

held steady and probably risen.

Chinese steel production has

correspondingly accelerated. To June 2006 it churned out 35% of global

output and has become a consistent net exporter of steel since the

start of the year. Which is essentially the same time period over which the BDI has counterintuitively taken flight.

Exhibit 2: Chinese imports & exports of steel, 2000-2006

Image courtesy of the Iron and Steel Statistics Bureau

argued that China’s production has been driven by WTO violating trade

protections and subsidies. While both organisations might want to

consider the relative shades of kettles and pots much of what is

alleged rings true.

If so, China is in effect artificially

boosting freight rates on an unprecedented scale (by having become the

largest iron ore consumer and steel producer). Having saved non-sino

steel producers from their own chronic overcapacity through large

imports over the period 2000 to mid 2004 China is in danger of joining

the bane of the industry. And possibly just in time for a trough in the

global economic cycle.

Exhibit 3. Global steel production – demand led? Incremental growth is practically all Chinese

Image courtesy of the Iron and Steel Statistics Bureau

Image courtesy of the Iron and Steel Statistics Bureau

China is but one factor at work on BDI freight rates alongside fuel

costs, ship numbers, seasonality, sentiment, port and route traffic,

and global commodity demand / GDP changes. But it is there and is

becoming more politically thorny now the country is a net exporter of

steel: how does a nation employing over 2 million in steel production*

realign its output with demand without social turmoil – and without

provoking WTO trading partners?

In the meantime BDI readings should probably be interpreted with a bit of care.

*

A 2001 statistic, the most recent found. Since then China’s steel

production has tripled. Employment numbers have doubtless balloned too.

Goldman Sachs Global Investment report, March 22 2006; Iron & Steel

Statistics Bureau; ABN Ambro Thailand Transportation coverage, August

2006; Qingfeng Zhang, A Comparison of the United States and Chinese

Steel Industries; Review of Maritime Transport 2005, UNCTAD

Interesting. Fits with my prediction that when US consumption wanes sufficiently, the unprofitability of Chinese manufacturing over-capacity will become manifest. China will hit the wall like Japan in ’89.

As an addition to the BDI, I believe the comments from the folks at Marsoft.com might give a more complete picture.

BR,

It was a good thought you had, but the ‘Bloggie Spotlight of the Week Club’ ain’t workin’ very well.

I think you could get up more interest watchin’ an A&P truck unload.

Take it out back and quietly put it out of its misery….

actually enjoy the Blog spotlight

always nice to see some worthy spots receiving some credit for work well done

I’d read last month in the Baltic that Chinese cabotage had become a distorting influence on the BDI.

That is, as more – I think panamax size – vessels became engaged in Chinese coastal coal routes, fewer available for international commerce, putting upward pressure on rates.