Last week, we noted that Reports of the Death of Inflation Have Been Greatly Exaggerated. The greenback has been in freefall, and that means the prices we (Americans) pay for commodities just goes higher.

A few examples: Oil is at an all-time high, having broken through $83 last week. 2008 could be the year we see Crude hit triple digits. Gold is at a 28-year high, having broken through $735, with $800 a realistic possibility. Copper is soaring.

Agflation is very strong: Wheat recently made all-time highs, along with recent big moves in Orange Juice, Corn, and Soybeans. Dairy prices are out of control, up nearly 100% over 24 months.

Just last week, CNBC ran a segment titled, “Is Inflation Dead?” (It should have been titled “Is Journalism Dead?”)

In light of all of these screaming prices, you know I have little faith in that BLS report of 0.1% decline in CPI. (Who are ya gonna believe, Us, or your lyin’ eyes?)

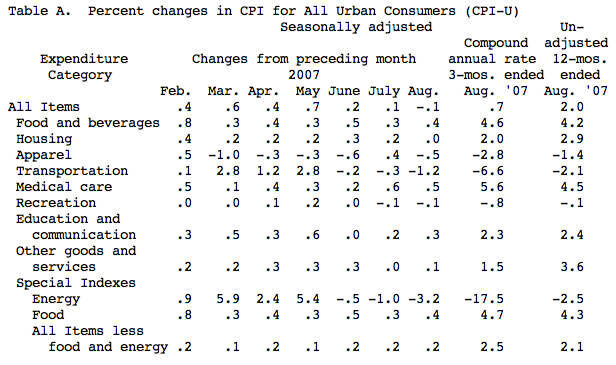

Let’s take a closer look at CPI:

BLS Table A. Percent changes in CPI for All Urban Consumers (CPI-U)

>

The BLS has transportation costs down 1.2%.Look at the above BLS table under the ‘compound annual rate 3-mos ended Aug ‘07’ column. Transportation costs are down 6.6%; energy prices are down 17.5%.

The benign CPI is due to lower energy costs over the past three months. Of course, the record surge in energy prices this month negates this. The September energy prices should be up more than the above 3-month declines. What do you want to bet that somehow this will be dismissed?

Yet every delivery comes with a

fuel surcharge, and we are told ‘motor fuel’ costs are decreasing.

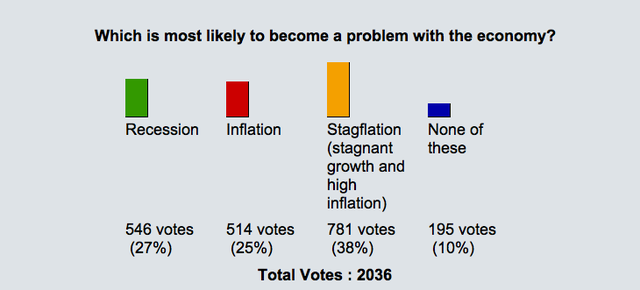

It appears that some of the public is no longer buying this nonsense. Here’s the results of today’s WSJ survey. When asked the question “Which is most likely to become a problem with the economy?,” well over half — 63% — said either inflation or stagflation:

~~~

Now that the Fed has all but abandoned their mandate of price stability, I suspect we are going to be seeing much higher costs for all commodities, foodstuffs, energy , metals over the next 12 months . . .

I try to judge inflation from my day to day life. Buying things such as groceries, dry cleaning, etc are clearly more expensive then before.

US dollar under W is LOWEST EVER !

http://graphics8.nytimes.com/images/2007/09/22/business/22charts.700.jpg

shows the dollar under George W. Bush is the lowest ever in floating era since 1971 ( which was the change from gold standard or Bretton Woods I )

I wholeheartedly agree with the 38% of people who said Stagflation.

“All items less food and energy”

Sigh!!

I’d be filthy rich if I could trade all securities, less downturns and corrections.

Can’t these idiots use moving averages to smooth out the “volatility” of food and energy?

Francois

Im not sure the fed totally abandoned price stability. I just think its clear that this new fed prioritizes a US economic slowdown AHEAD of inflation or pricing concerns.

Whether they are right is yet to be seen. But I just dont see how this fed will lower rates as aggressively as some are suggesting; in the low to mid 3’s in target rate. I mean, is 4.75% fed target rate really that restrictive?

At some point, it just seems the fed will go back to a tightening bias and I think future tightening will be more aggressive than this current easing campaign that we may or may not be in.

Also, if eurozone economies start to slow as a result of too strong a currency, perhaps some cuts by ECB; although they are only now wondering whether to stay put or raise. I think they stay put for a while. How could they be that happy with such a strong currency possibly slowing their economies in years to come?

The Fed abandoned the price stability quest years ago. The drumbeat of ‘inflation is out of our comfort zone’ with no action to match the words went on fo a long, long time and was accompanied by slowly turning a blind eye toward item after item that got away from them. An honest accounting – including, for instance, real housing costs, would have alerted the Fed much earlier to bubble problems. Since sequential bubbles seem to be the curse of our era, a Fed that does not learn how to deal with them is not of much use.

Anyone who has a brain, well, anyone who has to shop for themselves knows there’s inflation in everything. I recall several years ago, Jimmie Rogers would be laughed at when he would say, ‘Have you see the price of pepper lately?’ Well, have you seen the price of eggs? Last week our Costco raised them 46%. oops, sorry, we x-out food.

“Is journalism dead?” is a rhetorical question.

With all my cards on the table, I’m a big fan of the BLS, I think they do the best they can to measure employment and inflation.

If manufactured goods and houses are falling in price and wages are weak, it is possible that inflation is coming down. (plus gas prices were way down in August)

So take for a second that the BLS has it right on average inflation is -0.1% and generally soft. That means the big lumpy things like cars and houses are down, but the little everyday stuff is up (food especially).

What would that mean for INFLATION EXPECTATIONS ?

I’d say it would be bad, real bad. Even if it is true that inflation is down and low, it’s only because the house I buy every 10 years is down, the car I buy every 7 years is down and the dishwasher & dryer I buy every 5 years is down.

Those things do nothing for my expectations of inflation because they are so infrequent.

My inflationary world view is built by my every day experience, and that is up, up, up.

I’d say the Fed still has a problem.

Urban-

i never bought the economic slowdown argument.

the fed knew that the second half of this year would be sluggish. they predicted this last year, largely due to housing. that’s why they paused the rate hikes, b/c the slowing economy would have less inflationary pressure.

if they were really worried about growth, they would have been cutting then, not now.

also, where is the slowing economic data?

outside of the payroll report, everything is fine. the unemployment rate was 4.6%, gdp last quarter was over 3%, the NBER says no risk of recession, the manufacturing indexes are all up, the beige book showed moderate expansion, etc.

are they really afraid of slowing growth? or are they afraid credit contraction?

And where prices are not down I see smaller amounts in the boxes, or poorer quality.

I used to work for Nabisco foods 10 years ago. Even then the big move was “productivity” aka “how to make the products with cheaper ingredients and not have them be completely inedible”. There is a reason chips ahoy cookies no longer taste very good.

At the time I decided I wouldn’t be putting any of my 401K money into company stock. good decision.

Real global growth has likely never been stronger. Billions of people are experiencing rising living standards and upgrading their diets. That’s one reason why commodity prices are rising.

Another is supply shocks. We’ve created an entirely new demand for millions of bushels of corn that didn’t exist 5 years ago in the form of ethanol. And severe droughts in Australia have reduced wheat inventories to historically low levels.

Inflation may be understated, but much of the price pressure in commodities is due to real global economic growth and restricted supplies. Equillibriums prices are adjusting higher and peforming their rationing function.

12th percentile, that is an excellent story. It is those kind of quality losses that the BLS does not even attempt to capture.

Can you give us any more detail ?

Does inflation as pure numbers, adjusted as it is, measure our finances adequately anymore?

The quality/hedonic adjustments make sense, but Americans are addicted to ever-improving gadgets and crap. Cellphones, Internet access, cable TV and DVR are just one example.

Try to buy a car with manual windows…or a manual transmission?

Maybe it is better to come at it from the other side of the equation–the savings rate. That is the true measure of inflation of all sorts; the inflation of the cost of goods and the inflation of the American thirst for “more crap!”

Falling US$ and Inflation. In another blinders-on, myopic “journalistic” piece on the Call-No-Bubble-Corp television (aka CNBC), econ guy, Liesman (I like his guitar playing) narrowly focused on 16% of the US economy which is imports of which a significant portion comes from Asian nations with official and defacto US$ pegs. Liesman’s point was a falling US$ would have smaller impact on inflation than feared for the reasons he cited.

Of course he left out commodity prices which are set globally in US$. The disingenuous impression of 16% of imports as the only part of US economy at risk for inflationary effects of falling US$ effects leaves out the effect of all US domestic agriculture, energy and mineral production.

And, in addition, he left out the cost of foreign capital. Foreign investors own 33% of US corporate debt, they will need higher interest rates (inflationary) to convince them to accept the currency risk of a falling US$ debasing the value of debt they buy.

Shame on you Steve Liesman of Compliment-No-Bear-Corp television. Take the blinders off and go in for a brain realignment. Cheerleading as a production value at Cheerleaders National Broadcasting Company is nauseating.

Bought cheese over the weekend at the local grocer. Paid two bucks more for it than I was just a few years back. At this rate, I may be looking for the gubmint cheese soon.

My goodness. What has Bloomberg TV done? Everyone’s head is so big now…and their cameras are so unflattering. Betty Liu just had a terrible interview with Jim Rogers. Oh, where is Suzy Assad when you need her. I long for the Bloomberg of old.

If only Michelle Makori was on all day.

mb3,

I think they are afraid of slowing growth as a result of the credit contraction and all that goes with it; talk to Roubini about his insolvency concerns. That August jobs report is what gave the fed the opportunity to do what they did. Without that, I doubt they would have moved so aggressively. Knowing that fed action takes 8-12 months to funnel through economic system, I think this is a preventative move, which is somewhat rare for a fed to act on assumptions that a dynamic (credit squeeze) will as they say ‘forestall adverse effects on broader economy’.

The aug jobs data made some think the fed is already behind the curve though. I just cant recall in recent history when the fed cut rates from what I consider not restrictive fed funds rate when:

1. Stocks indices are 2-3% off record highs

2. Energy prices at record levels

3. High commdoity prices

4. Very weak US dollar

all at the same time? Obviously they think the ultimate side effects of credit squeeze is a very serious threat worth taking care of now, at the expense of future inflation and further weakening of US dollar.

I worry that there is not much more to go on easing side of funds rate, and that the more aggressive moves in the future will be on the hiking side. But who the hell knows

sanjosie…good rant.

Liesman plays guitar?

And continuing the printing of money for worthless pieces of paper (becaus if they had value they would’nt be “exchanging” them for cash) each and every day

Ben did a repo of about $10 billion today

and so did Hank.

You might think that the Treasurey and Fed were trying to actively abate any selling going into the redemption window…..

How could anyone get that idea when money is thrown at the market under the guise of an “auction”.

And we have yet another bottom call by Goldman……

Ciao

MS

It seems this Fed is willing to do anything to prevent housing prices from falling back. (Hey, they went up 100% in 7 years, if they fall back 20% what’s the big deal? The only people hurt are speculators and those that pulled too much cash out). So instead, all of us are going to pay more for everything else. Screwy logic.

GlobalSavingsSlut: “My goodness. What has Bloomberg TV done?” I never thought I would do this… actually turned to CNBC :(

Bloomberg is now nothing more than a commercial and data less! what a shame… who sold them on this crap.

Strasser: I am right with you. It is like it’s run by amateurs over there and it just keeps getting worse. Someone has taken them way astray, and there is a revolving door for the anchor spots.

Where oh where did you go Suzy Assad??

Will she show up at Fox in two weeks? or is it the old “spending time with the family” like Eric “family time” Bollings’ mea culpa.

B’Berg went to hell in January……almost as if they were resigned to fighting Fox which they will all become at some point.

Ciao

MS

Global Savings Slut, I saw Liesman play on air once – very good for a guy with a day job, too. Acoustic folk-style. I’d like to bring my dobro and pick with him.

The bond market isn’t being fooled. Long rates have been rising and taking mortgage rates along for the ride. The Fed has made the choice to INFLATE in an misguided attempt to prevent a DESERVED and MANAGEABLE recession. I’ve got some charts up to illustrate the point.

TheFinancialNinja

MS,

I agree it is like they’re trying to keep pace with the gimmicks of CNBC and soon to be FOX but it seems they can’t get the offscreen talent.

Their camera work is awful, their graphics pain me, and hiring Betty Liu from CNBC World is no step forward.

If they start with those Blair Witch handheld camera spasms that Pisani always has on him, I am going to radio.

Oooh, sounds like Amahdinejad’s heading back downtown.

I refuse to eat dairy anymore. ever since i stopped i lost 25 pounds and look and feel alot healthier. no more aching joints late in the day. and look at all the money i am saving except that soy milk is not so cheap either,

I’m a Deirdre Bolton man, personally. She’s hot!

12th percentile, that is an excellent story. It is those kind of quality losses that the BLS does not even attempt to capture

When you think about making chocolate cookies do you ever ask yourself, “hey, I think we’re out of butter, where is the PARTIALLY HYDROGENATED SOYBEAN OIL?” Below is an ingredient list for chips ahoy. No butter and very little sugar, caramel color… means bad tasting cookies. Fancy trusted brand name,total dominance of the cookie and cracker aisle,legalized bribery of the store managers to keep your products on end aisle displays and ruthlessly cutting prices on your product whenever anyone else hits the market with a test product and keeping them low until they are out of business when you then raise them back up means you can get away with it.

ENRICHED FLOUR (WHEAT FLOUR, NIACIN, REDUCED IRON, THIAMINE MONONITRATE [VITAMIN B1], RIBOFLAVIN [VITAMIN B2], FOLIC ACID), SEMISWEET CHOCOLATE CHIPS (SUGAR, CHOCOLATE, DEXTROSE, COCOA BUTTER, SOY LECITHIN – AN EMULSIFIER), SUGAR, PARTIALLY HYDROGENATED SOYBEAN OIL, HIGH FRUCTOSE CORN SYRUP, LEAVENING (BAKING SODA, AMMONIUM PHOSPHATE), SALT, WHEY (FROM MILK), NATURAL AND ARTIFICIAL FLAVOR, CARAMEL COLOR.

New product launches are risky and costly. Most new food products fail. So they just try to make things cheaper. Or at least they did 10 years ago and I’m sure based on their stagnant stock price its only gotten worse.

My favorite consumer complaint to the hotline, “hey, this no fat margarine doesn’t melt!”. Hmmm. There is a good reason for that, too. Check what its made out of.

I understand Dow Chemical is in talks to buy the Chips Ahoy brand.

All we need now is for BHP’s gold discovery to create inflation there too.

Stagflation, rising joblessness, record budget deficits, record bankruptcies, record home foreclosures, and the DJIA off almost 20% since 2000.

No worries. We can just tax cut our way out of it.

Yeah, that’s the ticket.

.

VJ: The DJIA isn’t down 20% from 2000 it UP 20%.

Barry wrote “Now that the Fed has all but abandoned their mandate of price stability …”, which is clearly a reason why there is at least a significant minority who disagree with the FOMC cutting the Fed Funds rates by 50 bp.

Usually most people are happy when the rates are cut. But I am curious: has there ever been a rate cut where so many have expressed such displeasure?

“”Is journalism dead?” is a rhetorical question.”

Journalism died when WWII started…

Anyone that doesn’t understand inflation will soon get a crash course in it as those of us that still have U$D assets move them offshore.

As soon as the U$D hits 77 I’m going to make Citi very, very sad…

It’s that high fructose corn syrup that will kill ya.

I found it listed in BREAD ingredients the other day – kept reading – every brand practically had it!

HFCS is like crack to you blood sugar and sends insulin soaring – people become insulin resistant and develop diabetes and obesity, heart disease –

but hey, no national health care for you – you’re an American!

Better stop eating like one, people.

Oh, and the bread is now sold in tiny loaves too, to look like its cheaper.

As for those cookies, ew. I’ll make my own, thanks. Partially hydrogenated oils, don’t even get me started on those artery-clogging crap foods….

I’ve been following markets for forty years and there is always the brilliant economists who don’t like the inflation, economic, payroll numbers for various reasons and parse out the components to show that underlying what we are being told there is a whole other story that is quite the opposite. And they throw in their anecdoal ‘proof’ rhat their personal purchase prices are going sky high. Same old stuff.

Since the TIP vs Coupon T-bonds indicate a low 2.5% inflation rate, BR and all that write in the BP blog have a simple way of making your pronouncements pay off in big profits: Either short the long bond directly or combine that with a purchase of a like maturity TIP. Or you can just short zeros or buy one of those leveraged ETFs which are short bonds.

BR and you bloggers should write about how you are taking advantage of foolishly low published CPI.

One wonders if food-related hedonic corrections take into account the health impacts of the food we eat.

Also, I was surprised to see that half-gallon ice cream containers are now 1.75 quarts. When did that happen?

Inflation expectations are everything, IMO. They drive salary requirements, purchasing/saving decisions, etc. As more and more people see through the CPI calculation games and base their expectations on their personal experiences, the game is up.

Got gold?

Norman,

The TIP adjustments are based on the Urban CPI which is controlled and published by the government. Why in the world would you use TIPs to hedge inflation risk?

Norman,

I believe BR has made it pretty clear that he’s putting his money where his analysis is by going long commodity related and foreign equities. IMHO, the short treasury / long TIPS idea runs counter to BR’s assertion that the CPI (on which I believe the TIPS rate is based) isn’t accurately reflecting inflation pressures.

If I’m wrong, perhaps our gracious host will so kind as to cuff me about the face a bit for presuming to speak erroneously on his behalf.

I am no expert which by now should clearly be obvious. I do however do my fair share of reading and yes I question the merits of the Debt-Based Monetary system. All that being what it is my inclination is to believe the warnings related to ” first by inflation then by deflation the banks and the corps that grow around them… with regards to redistribution of the wealth.

Mish at his blog has been arguing DEFLATION others here have also mentioned this and it has largely been written off.

Gary North Just published this over at LewRockwell’s

http://www.lewrockwell.com/north/north568.html

His charts show money supply contracting significantly for the last 2 months, I not sure what this means for consumables but it could have devastating consequences for assets. Most here are thinking Weimerica, I haved arqued there has not been enough pain yet for a committment to reflation and reflate from where we haven’t even had a substantial market correction yet. These moves by the FED seem completely aimed at a rescue of an endangered financial system. Not an inflation aimed at helping the Debt-Distressed to service their obligations with depreciated dollars as I had hoped earlier, this can not be accomplished while shrinking the money pool. Granted by the graphs presented its only 12B so far but the direction is opposite a reflating policy direction.

Is the analysis by North also somehow flawed?

PLEASE, gold is not at 28 year high! PLEASE. Inflation adjusted gold compare to the early 80s (the all time high) would be 350 bucks today. Very far from the all time high of $870.

Stormrunner,

I left a reply to you on the “shock & awe” thread which may be apropos.

stormrunner,

How relevant is the monetary base when credit growth has been as obscene as it has been.

No one is saying the Fed is currently monetizing excessively (unlike the PBOC). The problem is that the FED started accomodating credit growth as soon as it started wheezing a little.

Fullcarry,

I think the monetary base is very important in the current context. A lot of the growth in credit has been disintermediated (functionally outside the core banking system), but there’s a reintermediation process going on now. This is bringing the interaction of credit and money closer together and is almost certain to involve expansion of the money base to accomodate it.

What isn’t clear to me is the ultimate speed and extent of the reintermediation and how the expansion of the money base will interact with the economy generally.

Estragon,

That could very well be true at some point. But as Gary North points out the Monetary Base hasn’t really been growing recently.

I do not view a flat MB as a deflationary signal though because broader money aggregates are growing strongly.

i always wondered why gold is so important when people talk about inflation??

i look at gold as a psychological value….which may go down irrespective of inflation as soon as investors find a better place to put their money.

not everyone is crazy like indians to buy gold every year because its a 2000 year old tradition (and a sign of prosperity)

isnt silver has more industrial use than gold, or what about platinum or titanium??

of course gold is definitely better than “Create-Any-Time-As-Needed” USD.

one more thing i have noticed…..right now people have a ton of cash and not sure where to invest….but i guess most are going international….i guess we will be exporting inflation big time (already did since last 4-5 years)

Stormrunner:

The big gun the Fed has in its arsenal of weapons is reserve requirements, which directly effects debt availability.

techy,

Gold is important because its an relatively unbiased measure of the price level. It is precisely because Gold doesn’t have much industrial use that makes it so useful as such.

Winston yes but this should act to deter or encourage new lending depending on requirement direction. If the real money pool M1 does not expand where does the new additional “money” come from to service the prior plus additional debt?

I agree with the inflation thesis in general- a reflection of X orders of magnitude of credit inflation and the Chindia demand pull, but this has to be taken against the backdrop of a massive credit disruption as presented in the link in yesterday’s Linkfest- Are we headed for an epic bear market? It’s a must read!

While we focus on the waves/inflation we have to be mindful of a potentially vicious undercurrent. The interview with S. Das would curl my hair if I had any.

Stormrunner – “If the real money pool M1 does not expand where does the new additional “money” come from to service the prior plus additional debt?”

Offhand, how about PIK bonds, negative Am. mortgages, etc.?

Estrogen does this not imply that on the private side “later money” gets liquidated for “now money” personal choice I get it, of course if there is not enough “now money” in circulation even the monetary systems “later money” would need to be tapped. That pesky transfer of wealth again where rather than building an estate for your heirs you liquidate your property at reduced prices to pay elevated living costs

Not trying to be quip, your knowlege of the system far exceeds mine. My mind keeps seeing the p/p+i dual pool arrangement and no matter how complex the faucets, M1 eventually needs to be able to service M3, I believe your bleeding M2 to accomplish this. Still at some point M1 needs to trend positive to get the money into the hands of the debtors to service the debt.

also,just really hate the Neg AM concept all together

@Donna:

“It’s that high fructose corn syrup that will kill ya.”

Castro is rolling on the floor laughing his a$s off watching fat americans on his tv.

Estrogen

By PIK did you mean “Payment in Kind” as in barter. For the government to get their tax dollars and the banking system to retain their strangle hold, this is underground currency in direct competition to the FED, though I like it, not practical and the first highly publicized case of “jailed for tax evasion” will stop that cold

Stormrunner,

Payment In Kind isn’t underground bartering, it’s the issuance of new debt in lieu of cash payment. Sort of a bond version of negative am option arms. AFAIK, there are no tax implications (assuming the PIK was contractually agreed to).

Norman,

“The DJIA isn’t down 20% from 2000…”

Right, which is why I posted it was “off almost 20% since 2000“.

“it UP 20%”

Wrong.

The last time I checked, the DJIA was DOWN by about 19% in inflation-adjusted dollars since 2000.

.

Sorry Estrogen I got my definition here stopped at first example

http://www.investopedia.com/terms/p/paymentinkind.asp

The use of a good or service as payment, instead of cash. Also known as “paid in-kind.”

You meant this,

Another example is the use of securities instead of cash as a deposit into a retirement account.

I think this would be a taxable event in most circumstances.

Estragon

I did reply to your post over at shock and awe, before I say anything else my replies were quickly typed your screen name I’ve bungled, unintentionally, I usually cut and paste. This is the only caveat here, “no edit function”. Long term I get this, short term ??

I had laid out a similar analogy from the money supply side of the equation as opposed to the asset side some time ago. Maybe you could reference the flaws in the logic.

http://bigpicture.typepad.com/comments/2007/07/hulberts-4-big-.html

Posted by: stormrunner | Jul 16, 2007 11:59:34 AM

Stormrunner,

If I understand your Jul 16 post, I think you’re correct. In the absence of debt (both public and private), there can be no money in a fiat money system. The very purpose of money is for the settlement of debt in lieu of a direct and contemporaneous exchange of goods and services.

That said, aggregate levels of debt don’t necessarily have to increase constantly, nor should they. Broadly speaking, debt levels (both public and private) should increase or decrease by roughly the same amount and at roughly the same time as increases or decreases in expected output of goods and services in order to develop equilibrium (i.e. avoid the buildup of unsustainable imbalances) and allow optimal use of resources.

Stormrunner:

You make a good point and that is the problem with housing – how do you service Ponzi debt without new debt. Answer: you don’t.

We are seeing a sea change – deflation and inflation occuring at the same time. Deflation in housing; inflation in hard commodities.

The dog is chasing its tail and the end result is a certainty – a worn out dog.

Estragon,

The number of posts there was almost as extensive as in this thread at the risk of being over bering I will repost the analogy.

With my limited knowledge I will attempt to summarize.

I’m starting a new country it has a barter system economy which it has outgrown. I have been drafted to create a private banking system to facilitate trade within my closed system.

Tenet 1, the currency I create will be, by government fiat or declaration accepted for the purposes of trade and taxation.

Tenet 2, the repayment of all extended debt will be enforced.

I start my bank; note I am a private citizen so a member of the government will assist me with running the enterprise.

For the purposes of simplicity I’ll keep the numbers low and use existing units (dollars)

A thousand dollars worth of something gold for instance is deposited in my vault it is cumbersome to divide up and trade.

The country is somewhat large so I create 10 branches to each of these 10 branches I allocate $100, (high powered money) note at first this is merely a ledger entry.

I coordinate with my government assistant to create a mint to print the necessary new currency

At each branch a 10 to 1 reserve ratio is established so these branches each extend credit at interest to the tune of $900 keeping a $100 reserve using the newly printed money this initially expands the money supply ten fold.

This money is then spent in the economy and a price level ensues.

If I lend the money out a 5% interest, principle and interest payable in 1 year, there is not enough money in the economy to service the debt, $9000 extended + 5% of $9000 or $9450. Remember there is only $9000 in circulation.

To remedy this situation I must constantly be lending and printing to ensure enough currency exits to service the debt the more I issue the more that is required.

This is said to be a synopsis of the mechanics of the Federal Reserve – Fractional Reserve Banking System.

Federal Reserve chairman quotes are inserted to support this description in the videos

Caveats:

Even though currency is needed, it is manufactured out of thin air by a private system in the final analysis who do you think controls the supply me or my government helper.

If all debts are repaid all monies are removed from the system but not to worry this can not happen because there is not enough money in the system to repay all debt. Also it would not be in my best interest to destroy my system.

The banking system the only non productive component gets to keep all this interest which it can use during credit crunches engineered to cause deflation to keep run away inflation in check also to my benefit to acquire real assets at the deflated price level.

The first receivers of the new currency created after the initial price level is set get to use it at the old price level which modifies the amount of money in the system creating Eclectic’s new ‘wave of recognition’ or inflation.

After a time the currency itself isn’t even necessary anymore for the purchase of assets a signature on any convertible contract by anyone in my system with to promise to pay by the borrower represents new money. Ledger entries being all that is necessary.

Barry, I noticed you didn’t include the chart from the same report you took your table that shows the Core with the All Items report.

I’ve written a short bit on it here:

http://tradinggoddess.blogspot.com/2007/09/goldilocks-and-inflation-hawks.html

Even with energy prices added, the spread between the All Items and the Core CPI will likely be no more than .25% on the next report.

And, since the report is lagging, I’m not sure whether one can use it to say that inflation isn’t dead.

Bloomberg: CPI Inflation Data is a “Lie”

We have long railed against the absurdity of the CPI data. The ridiculous adjustments, the lack of correlation between CPI prices and reality, as well as the Fed focus on the core (inflation ex-inflation). For the most part, the media has dutifully rep…

Wait–you’re betting with the majority surveyed Barry? (just a question)