I did a really crappy job last night responding to Jason Trennert’s comments on inflation. Mostly because I was stunned that, at this point, anyone is seriously going to argue that inflation is benign.

I am paraphrasing, but Jason (an otherwise very nice guy) said words to the effect of “The Fed’s preferred inflation measure, Core PCE, showed little or no inflation (+1.4%).”

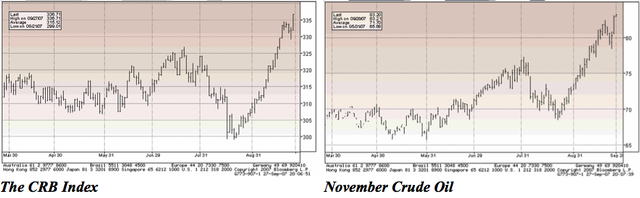

Meanwhile, Gold, Crude Oil, soft commodities and the CRB Index all rallied to new highs as the US Dollar $ declined to new lows. The front page of today’s WSJ has an article: Historic Surge In Grain Prices Roils Markets . . . but there’s no inflation.

I wonder what people will be saying when the September CPI comes out. It will be substantially higher due to soaring energy and food prices this month. Oh, wait, that’s not in the core. (Nevermind).

>

Gee, I wonder why the Fed prefers Core PCE as an inflation measure — instead of what is occurring in the real world?

Ironically, while Wall Street pundits and economists lap up obviously defective government data, the rest of the country is having none of it: According to this recent Gallup poll, public trust in the Federal Government — across the board, on nearly every issue — is at or near all time lows.

The government now ranks lower than it did post-Watergate:

“A new Gallup poll reveals that, as the organization puts it, Americans now “express less trust in the federal government than at any point in the past decade, and trust in many federal government institutions is now lower than it was during the Watergate era, generally recognized as the low point in American history for trust in government.”

Among the findings: Barely half trust the government to handle international problems, the lowest number ever. And less than half express faith in the government handling domestic issues, the lowest findings since 1976.

Faith in the executive branch has fallen to 43% — only 3% higher than it was just before President Nixon’s resignation in 1974. At the same time, trust in Congress, at 50%, is its lowest ever.

Gallup has asked about trust in government since 1972. It conducted this year’s poll Sept. 14-16 and found the following:

— Barely half of Americans, 51%, say they have a “great deal” or “fair amount” of trust in the federal government to handle international problems.

— Less than half of Americans, 47%, now have at least a fair amount of trust in the federal government to handle domestic problems.”

The apportionment of this can be debated. I put about 60% of it on the White House — primarily Iraq, Katrina, and the bifurcated economy — and 40% on the Congress.

When the GOP controlled the legislative branch, they were either spending taxpayer money like drunken sailors on shore leave, chasing interns, or having gay sex in airport bathrooms. You know, the business of the people.

Now that the Democrats control Congress, they appear to this Independent to be nearly as bumbling and incompetent as the executive branch.

It almost makes you think Mark Twain was right: “Why Vote? It only encourages them!”

>

Source:

GALLUP: Trust in Federal Government, On Nearly All Issues, Hits New Low

Even Less Than in Watergate Era

E&P, September 27, 2007 10:30 AM ET

http://www.editorandpublisher.com/eandp/news/article_display.jsp?vnu_content_id=1003647275

Low Trust in Federal Government Rivals Watergate Era Levels

Trust in state, local governments holding steady

Jeffrey M. Jones

GALLUP NEWS SERVICE, September 26, 2007

http://www.galluppoll.com/content/default.aspx?ci=28795

Historic Surge In Grain Prices Roils Markets

SCOTT KILMAN

WSJ, September 28, 2007; Page A1

http://online.wsj.com/article/SB119093856250042023.html

I wonder how much resonance there is in the following statement: No matter which party’s in power, I lose.

The CPI wasn’t always a political construct. In the 1970s it did by and large reflect peoples experience of inflation. But after the change to OER in the early 1980s it started a slippery slope that got us to the Boskin report of the mid 1990s. Now a low CPI is mostly a signal to the leverage class to start loading up on bonds.

The govetnment has a problem though. It is fighting geometric growth. They can manage inflation expectations for a while but in the longer term they are bound to fail.

BR,

Dont beat yourself up. You did fine with your 90 seconds. Even Jason had a slight smirk on his face when he said the CPI was low. I admit, I do like watching Kudlow, my only comment is, have 2, or 3 guests at the most on at a time and let them speak more. Larry is very knowledgeable, but he does tend to take over the conversation and talk his points a bit too long.

Vote Ron Paul. His platform ought to shake things up.

Breaking it down further, I blame the elites. Forget about a politcal Party, President or Congress. The elites are the modern day aristocracy. One day soon the assclowns will eat cake.

Larry Kudlow is a blowhard. The greatest story never told has left this country broke, it’s citizens broke and our entire economy dependent on trade partners that may at some point want to do us harm. Of course if you run with elites, you wouldn’t know just how bad it really is because you are associating with the top 1% in this country. Larry you are my assclown of the day!

The Congress’s approval ratings are about 11%, while the Bush’s ratings are about 25%. It seems to me the people hate the Democratic Congress more than the Republican president. I personally think both parties are terrible. BTW, why no mention of what the last Democratic president was doing with interns in the White House?

Barry, if the “true inflation” (including energy, agriculturals, etc) is so much higher, why are people willing to buy the long bond at

While the elites tell us how wonderful everything is, the dollar sits at 78.04 this AM. They will say it will help exports, and to a degree they are right, but imports always seem to strip any gains we ever make on exporting our goods.

It’s almost like a plan with a script.

Dmitri

The bond market is dominated by foreign central banks who have ulterior motives and leveraged hedge funds that care about financing cost.

You can no longer expect the bond market to reflect inflation expectations.

I guess it don’t matter what we see with our eyes as long as the bond buyers believe the CPI, all is well. I would not be intersted in being a buyer at 4.5% for 10 years. That would have to be the ultimate contrarian play. But what if they are right?

In the mean time we have to dechipher what, and when is going to trigger some overall reality into the market? Remember, don’t fight the FED? At some point the FED will be seen as boxing all of us into a corner. Anyone have any clues to what/where that bit of news, or piece of statistic might originate?

Dennis Gartman is on Squak Box now and he said he belives Inflation is more like 11% and can’t belive the Goverment is saying low 2’s

When thinking about inflation worldwide the best explanation on behalf of the central banks is a self nurturing paradox

« A horse for one is expensive but one horse for two is twice cheaper »

It’s a form of economic hypnosis isn’t it? The Fed heads are always talking about how anchored inflation expectations are–which is just a euphemistic expression for “how much are people buying into our BS that inflation is under 2%.”

They are at an advantage for several reasons. First, inflation is a big word for a lot of normal people. Too big to bother understanding. Secondly, regardless of Gallup polls, most people still believe the government, so if they say it’s 1.4%, it must be 1.4%.

I think we need to reframe the whole subject. Manage the expections ourselves with a campaign like, “This dollar don’t buy sh!t”

Mr. Sunshine:

http://news.bbc.co.uk/2/hi/business/7017568.stm

Barry:

Would you prefer that the FED raised interest rates in response to an oil shock?

Unless the answer to that is yes the FED should not be considering oil prices in its inflation calculation.

If oil prices are driven by monetary factors then they will spill over into core prices and you will see the effect anyway.

If oil prices are driven by a supply shock then output will tend to slow. Is that the time the FED should be raising rates?

Incidentally, my son was watching the cartoon “Arthur” over the weekend and there was a dog on there with really thick glasses named “Greenspan” and every time he spoke the other characters looked at each other and said, “I have no idea what he is saying.”

I don’t know why that was on a kid’s show, but it was funny to see it there.

It isn’t the end of the world to have a recession. It is this obsession to avoid a recession that led to the obscene credit expansion we had.

The FED shouldn’t be accomodating Oil price increases. If Oil prices go up the price of something else needs to come down. But the FED wont let that happen because they want to avoid economic slowdowns.

Oil price increases per se aren’t inflationary. It is the FEDs reaction to them that leads to lasting increases in inflation.

The dollar decline has been about 10% over the past year and is accelerating its decline at a rate of about 1% per month. The question is; when does this perceived orderly decline in the dollar turn into an all out rout? The dollar index is again hitting an all-time low and getting ready to break 78. But no worries mate—the government said inflation is tame, so get out those sunglasses the future is just too bright!!!!

It was Jeff Saut who said excluding non core items is like watching a skinny homeless naked guy walking to work! Gotta love the headlines about inflation. Journalism/urnalism…Samo samo.

As mentioned before, I think the government’s bizarre miscalculation of inflation starting in 2002 [led by the OER problem] is a huge issue.

Eventually, the plummeting dollar, SS deficit, Medicare deficit, and cheap money Fed Reserve will force rates much higher. Markets can stay wrong a long long time–but usually not forever.

The March/April 2007 FAJ has an article entitled: “DO the Markets care about the $2.4 Trillion U.S. Deficit?” The authors pretty well conclude that currently, the answer is no, but someday they will. I don’t know if it is available to non CFA’s online…

I’m wondering what the numbers would be if we measured inflation and unemployment the way they were measured in the 1970’s. I can’t run the numbers myself, but from what this site says we should be looking at might higher numbers in both cases. Are we in a stagflation situation that is simply masked by overly optimistic government numbers?

Dimitri, I found this informative:

http://www.portfolio.com/views/blogs/market-movers/2007/06/20/the-newly-normal-treasury-curve-good-news-or-bad-news

They really listen to you regarding inflation ex-inflation at Marketwatch:

From http://tinyurl.com/2rj5ok

“Consumer prices including inflation have also risen 1.8% in the past year, the lowest inflation in two years”

It’s good to distinguish one from the other. :-)

First, Dem control of Congress, especially the Senate, is slight. Some conservative Democrats vote with the GOP.

Second, many of the agencies are run by executive branch appointees. Not going to be a change there.

After 6 years of complete GOP control and barely a Dem majority in the Senate, it’s odd for people to expect a turnaround in government. This sense of “failed expectations” is a GOP talking point.

you know we must not forget something here..inflation, as a result of economic growth is not such a bad thing. When I was an equities trader, that was one of the broader macro trends I looked for to sustain a longer term trend (in this case weeks or months).

When inflation goes away, bye bye stock market gains and hello correction.

But in this world, I think its getting to the point of whether there is too much inflation in the pipeline and whether it is ALL a result of strong global economic growth? What if that growth slows down? We may be headed for a period of stagflation (I know you like agflation Barry) in the years to come.

Thank you wunsacon. It will take several competent adminstrations decades to undo the damage of this one.

Somebody please thank Rick Santelli for talking about the buying power of the dollar and inflation. He is sticking his neck out for the rest of us. I have a family of four, and I pay all of the bills. I am meticulous and frugal. The costs of supporting my family have nearly doubled since 1999. That includes property taxes, heating bills, health insurance, groceries, summer camp and other various expense but particularly groceries and health insurance which make up far more of our budget than the govt. would have you believe. Sorry, but wages have not kept up. Oh, and the fact that our house has doubled in value has not made matters better. Our taxes also doubled. I am a teacher. The fact of the matter is the very rich who apparently dominate the networks have no concept of what the rest of us pay to live. Somebody should ask Dr. Bernanke or any of the fed govenors how much a gallon of milk costs these days. We are right back in the Seventies and nobody in the White House will have what it takes to nominate a Volker.

As stated in a previous thread

The “gubment” does’nt want to show true inflation since it is responsible for determining entitlement benefits. Any official rise in inflation has to be met with a corresponding rise in entitlement payments.

Just like they do not want to show wage increases (no problem there…..they have’nt) as it would also show inflation.

Silly Rabbits…Cost of Living Increase’s…they are really just for elected officials.

Ciao

MS

If there is a disconnect between real inflation and core CPI, then would that not create an opportunity for a trader? If so, then leave the fools to their own demise. Yet again, perception is just as influential, if not more so, than reality in the minds of investors. Are we expecting market participants to be rational?

Don’t fight the Fed (or the crowd). While frustrating, this market environment should come as no surprise…

raft, funny how the “prices for services,” keeps rising. I wonder if that is because that represents, “working Americans,” who need to pay for the increases in the most used products that people happen to need in their everyday lives? (Somehow, a “volocity” of money concept creeps into my brain here?). Do the statistics take “number of times bought throughout the cycle,” into account?

IMO, the futures markets seem to be completely out of control. A good idea in principle, the prices of commodidities are being scammed by the likes of GS, ML, BS, etc. and the wall of money.

The fed flooded the economy with money to counter the Katrina shock. That money found it’s way through wall street into the futures trading pit. Incredibly, the trading commission quietly lowered margin requirements so the the “street” could lever up.

According to the theory of foreign exchange equilibrium pricing, the carry trade should have collapsed several years ago (SF Fed) yet remains suspended in mid-air.

Although the Fed is up to their ears in this debacle, the lameoid futures regulators, here and abroad, have been as absent as the banking regulators.

Why in the world should’t the contract margin requirements be raised when wall street (the futures market) begins pushing up commodity prices ? The first defense against speculators and insiders setting prices should be to take away the leverage.

We may then get a much clearer view of the actual, “free market” pricing. When cartel member GS BF’d Amaranth in the natural gas market, Amaranth held enough contracts, on margin, to control the world wide price.

JHX, if it walks like a duck and quacks like a duck….

Several issues;

Barry, is it possible to give more of a heads up when you are on Kudlow or do they not give youtime? I only watch him when you or Peter S is on since i cannot stand the one sided perspectives.

On inflation: the structure of the measurement is so FUBAR now that nobody can explain whats happening anymore.

Which is probably the goal.

All I know is bread and milk going up , gas for car has yet to see new highs, heating and Ac home is up, postage is up,

If only I bought more TVs and PCs during a year would my personal inflation be low.

77 handle on the dollar index.

greenspan/bernanke watched an earlier maestro at work, Arthur Burns, who also unleashed massive growth in money supply to help reelect Nixon in ’72 at height of another unpopular war. get ready for what comes next.

Exporting Inflation from China

Speaking of Inflation, you can actually see the official inflation rate of China here: Some of the actual data: Food inflation is running 7.65% year over year, led by meat and poultry (17%) and vegetables (20%). Health care in China was flat (0.59%) –…

Yahoo home page headline

Consumer spending higher than expected while inflation eases

http://biz.yahoo.com/ap/070928/economy.html?.v=4

Yes indeed keep catapulting the propaganda for Joe and Jane ‘Dumbass’ Americans ( which there are plenty of ) so they can keep on spending their way to serfdom.

Barry:

Would you prefer that the FED raised interest rates in response to an oil shock?

Unless the answer to that is yes the FED should not be considering oil prices in its inflation calculation.

If oil prices are driven by monetary factors then they will spill over into core prices and you will see the effect anyway.

If oil prices are driven by a supply shock then output will tend to slow. Is that the time the FED should be raising rates?

Posted by: Karl Smith | Sep 28, 2007 8:56:17 AM

You are asking Barry the wrong question. The FED should do whatever it takes to safeguard our currency and our banking system regardless of oil, food or any other damn commodity you might mention. Those protections were put in place to protect the citizenry, yet we have now allowed these protections to morph into a protection racket for the elitists of this world.

Let me ask you a question. With commodities going through the roof, the dollar falling into the abyss and questions arising concerning the liabilities and supposed assets of our money center banks, why in the Hell did they lower rates?

you know we must not forget something here..inflation, as a result of economic growth is not such a bad thing. When I was an equities trader, that was one of the broader macro trends I looked for to sustain a longer term trend (in this case weeks or months).

When inflation goes away, bye bye stock market gains and hello correction.

But in this world, I think its getting to the point of whether there is too much inflation in the pipeline and whether it is ALL a result of strong global economic growth? What if that growth slows down? We may be headed for a period of stagflation (I know you like agflation Barry) in the years to come.

Posted by: UrbanDigs | Sep 28, 2007 9:35:23 AM

Inflation is the oversupply of money and credit into a system. Rising prices are an effect and not a cause.

I actually spoke to a fellow trader who told me that the Fed is “only using the government’s inflation data, so it must be real.” Except that it’s the Fed’s data as well and, as we know, it’s B.S. I personally believe that the Fed’s unofficial mandate has gone from supporting employment and the dollar to supporting asset prices. Certainly nothing that has occurred in the last 20 years argues otherwise. To me, this explains what Marc Faber so astutely dubbed a “suicidal” rate cut.

I’d love to see a “free” market, in which market forces are left to do as they may, instead of having a Fed that seems intent on pursuing an asymmetrical monetary policy designed to rescue selloffs but which is seemingly completely ignorant of bubbles.

Like many of the posters on this site, I, too, have little faith in the Fed and personally believe that both inflation and the dollar’s weakening will increase in the future.

For 9 Trillion in Debt there is 900 Billion in circulation, pretty much the 10:1 reserve ratio, this just about says it all. Over at ITulip, Janzen discusses the FIRE economy (Financial, Insurance, Real Estate) of being 90% of the economy where P/C or Production/Consumption economy is a mere 10%.

http://www.itulip.com/forums/showthread.php?p=16690#post16690

>>>Fed monetary policy for the FIRE Economy is distinct from monetary policy for the P/C Economy.

>>>Low wage inflation is the primary objective of P/C Economy monetary and government policy because wages are the mechanism for transmission of inflation into the inflation cycle. Wage inflation can be managed via immigration policy, outsourcing policy to affect global wage arbitrage, and so on.

>>>Payments within the FIRE Economy may be 100 or more times the total payments within the P/C Economy.

>>>Asset price inflation and deflation occurs within the FIRE Economy without a direct impact on wages and goods prices within the P/C Economy. For example, housing price asset inflation ran more than 10% per year between 2002 and 2005 while consumer price inflation remained in the low single digits. Conversely, asset price deflation can occur in the FIRE Economy without necessarily leading to wage and goods price deflation in the P/C Economy.

Note I’m not an economist and I wouldn’t even pretend to have the credentials to argue the correctness of any of this. But anecdotally, I’ve got a chem major with 12 years in industry working an automotive lube rack due to this “control mechanism”. In order to maintain the fee’s and interest accumulation of 90% of the voume of Debt. It would appear the “industrialist bankers” are willing to dismantle all the technical know how of the US, Why?? It can’t be just for profit it has to be about control, whose control, the people in power here want this? they wish to dicourage an entire generation of technical mind banks, till these advantages are lost? Inflation in the P/C economy will matter but not nearly so much as asset inflation in the FIRE economy. This is where we buy our homes and find RE to start our businesses. The paper traders are skimming such large percentages of the real economy as to treaten the very fabric of the American Dream “entreprenuership”, and if they get our intelligence along with it by discouraging, technical education in favor of financial education, we will be hurt.

SPECTRE – thats why I mentioned inflation as a ‘result’.

As you said:

oversupply of money/credit –> stimulative policy results in stronger growth –> inflation

Nice one Bazza, up the rebels!

Fed’s numbers are so “real” that gold had nothing better to do than gained 10.90 USD this AM.

Can’t wait to see what will happen when the numbers get unreal.

Francois

The Congress’s approval ratings are about 11%, while the Bush’s ratings are about 25%. It seems to me the people hate the Democratic Congress more than the Republican president.

That’s because the Congress was voted in to end the Iraq War and rein in Bush, it has done neither. In fact, it has worked to extend the Iraq War indefinitely and hand over more power to Bush. Believe it or not Congress has a higher approval rating among Republicans (who still give Bush like a 70% approval rating) than Democrats.

If Congress was actually doing its job, and working to GTFO of Iraq and act as a check on Bush, it would have very good approval ratings. For this reason, I bet Henry Waxman has very high approval numbers now.

IMO, the CRB and oil graphs are an explicit example of what people are bitching about. Every time the assholes at the Fed and treasury inject money to save the wall street trash, it goes right into jacking up prices.

The commodity inflation (soon to be consumer inflation) is a combination of moderate money supply growth, the Fed drastically reducing credit quality in exchange for long term bail-out loans, zero regulatory over site, low margin requirements, destruction of the GAAP standards for income recognition, and the US government piggy bank being distributed by Hank and the Carlyle group.

I am beginning to think that we are witnessing another republican coupe attempt. If you think about it, destruction of middle class wealth is the first necessary requirement for the over-throw of the US.

We may have to remove these people by armed struggle. Better hold on to the 2nd amendment awhile longer. Now excuse me while I adjust my aluminum foil cap and climb back under the pyramid.

“Now that the Democrats control Congress, they appear to this Independent to be nearly as bumbling and incompetent as the executive branch.”

Oh, I dunno.

Here’s just SOME of the legislative initiatives the Democratic Majority campaigned on and then passed:

* Enacted all the original 9/11 commission recommendations into law

* Enacted legislation raising the Federal Minimum Wage

* Enacted into law sweeping ethics + lobby reform legislation

* Enacted legislation repealing a provision in a 2006 statute that granted the Attorney General the authority to make indefinite interim appointments of U.S. Attorneys

* Enacted legislation that cut the student loan interest rate in half, which also contained the largest increase in college aid since the GI Bill in 1944

That’s in their first eight months. Contrast that with the previous SIX YEARS.

.

Joshua,

“That’s because the Congress was voted in to end the Iraq War and rein in Bush, it has done neither.”

That’s because it takes 60 VOTES to overcome a filibuster in the Senate. The Democrats have passed both with majorities in both houses, but the Senate Republicans filibuster.

Let’s assign the blame appropriately.

.

Gas prices are heading back up. September will probably look ok, October sales are gonna suck, I think.

Everyone’s hopes pegged on Christmas this year – but the discounting is gonna be HUGE.

It will be a very bad wakeup for folks.

Germanys CPI measure soured to 2.5% for the last mounth, with food and energy leading.

how come US CPI is lower despite of declining dollar that makes energy cheaper for Europe.

Will be interesting how the ECB reacts – whether it stays tight or will be forced to ease b/c of the dollar, deny their policy and open the gate for inflation

Truth is… the fact that CAREER politicians exist is BS. Let’s start solving some problems by only allowing ONE 4 year term without possibility of a repeat for EVERYONE in an elected position, I bet we’d see some things get handled…

60-40?

That’s ridiculous. The blame belongs overwhelmingly to Bush and the large Republican majority which controlled Congress from 2003-2007. Mostly Bush, though. He’s the Commander Guy.

Putting 40% of the blame on the current Congress, or the Democrats who just reached 50 Senate votes in January, is ridiculous.

Starting to look very bad for the dollar……

Fenner-right on! That’s because Jimmy Carter nominated Volcker!

The country cant grow without inflating. My new slogan is Inflate or Die!

>>>The blame belongs overwhelmingly to Bush and the large Republican majority which controlled Congress from 2003-2007

As I stated earlier, it would appear the “industrialist bankers” are willing to dismantle all the technical know how of the US, this is how our country is controlled, it is controlled by the men that issue the currency, how could the moniker of GOP or DEM even matter. I own the restaurant, you manage it, who decides who gets the best seats and the best food. The monetary system is designed to create just this level of opacity that people can be fooled into thinking it was and individual or a particular party responsable for the direction of policy when its the money. The money dictates the policy not the other way around. It will take someone with no connections to the money to turn this thing around, someone who gets his support from the people, some one like Ron Paul.

Bush is just following the script, a world run by the industrialists and banking elite where sovereign nations have no role and actually hamper the free flow of goods and labor. Maybe this vision is superior to the current installation.

Question is, superior for who?

http://www.coasttocoastam.com/shows/2007/08/18.html

http://www.solari.com/news/announcements/08-07-07/

Catherine Austin Fitts

Assistant Secretary of Housing under Bush

Tapeworm Economy & Black Budgets

Ian was joined by investment advisor Catherine Austin Fitts for a discussion on various financial- and economy-related topics. Fitts spoke about black budgets—money used by the federal government which is not reported in their financial statements—and how they are used to fund (on a non-transparent basis) corporations performing secret military and intelligence functions. She said the people who control these ‘covert’ cash flows end up manipulating the ‘overt’ world.

She described how money can be laundered through publicly traded companies, using the European Union’s lawsuit against RJR Nabisco as a case study. Fitts explained stock ‘pump and dump’ schemes, pointing out that not only can stocks be pumped up and dumped but so can real estate, countries (Iraq), and even the planet. Fitts noted problems with the central banking warfare model, which she said helped make America successful but is not sustainable and no longer works. She also explained what she calls the ‘tapeworm economy,’ in which a small group of insiders centralize political and economic power to make money in a way that actually destroys wealth.

«Barry, if the “true inflation” (including energy, agriculturals, etc) is so much higher, why are people willing to buy the long bond at <5%?»

This is an interestingly disingenuous question, because it uses the generic “people”. people who are not grossly ignorant of economics know that families, businesses, government and foreigners are different types of agents and can behave very differently.

Now, it so happens that by and large private citizens (“families”) have avoided buying debt like the plague, and have gotten as indebted as they could as long as they could, to buy real assets, not bonds.

It also happens that USA businesses have been also borrowing like crazy in a kind of easy internal ”carry trade” to buy foreign assets, buy foreign currencies and invest heavily in production abroad.

It also happens that the USA government has been selling as much long term debt at < 5% as they could, and they have even reintroduced 30-year fixed rate instruments, hoping to find suckers.

As other have remarked the major net buyers of long bonds at < 5% have been foreigners, which have been doing so largely as their central banks have been setting USA monetary policy via what are in effect ''open market'' intervention, buying USA securities in order to keep the dollar high (or to subsidize the Iraq war stealthily).

«When inflation goes away, bye bye stock market gains and hello correction.»

What do you think, that a political system (both Rep and Dem voted for it, overwhelmingly) who are losing an unpopular guerrilla war can afford to add to that market losses and a correction? Because they are idiots?

As long as the war news are bad, the happy happy financial music has to go on.

«The costs of supporting my family have nearly doubled since 1999. [ … ] Sorry, but wages have not kept up. Oh, and the fact that our house has doubled in value has not made matters better.»

But it has for most of homeowners, who have been able to enjoy the lifestyle of rentiers, and for new homeowners. Many flippers made a lot of money thanks to that. In general rentiers, like pensioners and people about to retire, have been thoroughly delighted with the increase in value of their assets, never more so than in England, where they have gone up further and faster than in the the USA:

http://www.economist.com/world/britain/displaystory.cfm?story_id=9267826

«For a decade, buying a house has been a one-way bet, which is one reason why more people are anxious to make it.»

«what has looked for a decade like the closest thing yet seen to a mass lottery win.»

Clearer than that…

«Our taxes also doubled.»

You are part of the unproductive, lazy, low value added bottom 80% of the economy. If you were one of the people who contribute most to the economy earning a much larger income, especially if from capital gains, you would have been rewarded with much lower taxes.

Let me ask you a question. With commodities going through the roof, the dollar falling into the abyss and questions arising concerning the liabilities and supposed assets of our money center banks, why in the Hell did they lower rates?

The Fed has no particular interest in a strong dollar. The US is a large semi-closed economy. A falling dollar does little to ignite inflation independently of commodity prices.

As for commodity prices. The trend in commodities is primary not inflationary. That is, do you really expect oil and gold to continue to rise at their current pace for the next decade?

If thats true then their effect on long run inflation is muted and not of as of yet of much concern. Moreover, core inflation is not just moderate, its tame.

For those complaining about OER, are you suggesting that we should now be factoring in declining housing prices into our inflation measures?

Lastly, the credit crisis was precisely why the Fed lowered rates. Risk of a credit crunch and asset deflation is much worse than a small bump in inflation. The US cannot risk repeating Japan’s mistake and sliding into a long painful depression.

The Fed leading the public to focus on Core CPI rather than real world inflation is just as reckless as the mortage lenders leading the public to focus on teaser rates and no down payment loans.

The Fed kept rates too low to long. The fed and state regulators were derelict in their duty regarding lending, loans, bank reserve requirements, etc. TALK ABOUT MORAL HAZARD! The fed is a serial offender.

The Fed’s culpability is even worse than the mortgage lenders and Wall Street scams artists. The Fed knew what the problems was and did nothing.

The idea that Mr. Greenspan, the smartest central banker in the world, did not know about the subprime predatory lending practices and the other elements of this crisis is an insult to Mr. Greenspan’s intelligence. Ditto for Uncle Ben. The fact that these Fed chairmen and all the other federal regulators of bank, mortgages, etc. allowed this crisis to develop is reason for a Congessional investigation and Federal prosecution where warranted.

What did Mr. Greenspan know, and when did he know it?

What did Mr. Bernanke know, and when did he know it?

What did each and every member of the FOMC know, and when did he or she know it?

What did the FDIC know, and when did it know it?

What did ______ (fill in the blank) know, and when did he know it?

It would help Congress get into action if the press would stop treating Mr. Greenspan and Uncle Ben as if each Fed chairman is all-seeing, all-knowing. Where are the Woodwards & Bernsteins to investigate one of the greatest financial scandals in U.S. history.

This crisis is not over, and may get much worse. Congress needs to find and punish the guilty. Federal and State prosecutors need to bring the guilty to trial and justice.

Enron was peanuts. Enron was a misdemeanor compared to this felony.

Lateus, I normally agree with your posts but disagree with the proposition that term limits will improve government. Government is exceedingly complex. Governing well is a challenge. It’s silly to elect people, walk them up the learning curve, and then lose that investment.

Sorry I can’t be of more help by suggesting some other easy alternatives. But, I’m pretty sure short term limits would result in even *less* being done.

The Cleveland Fereral Reserve has this to say: “Inflation, a rise in the general level of prices caused by excessive money creation, is not an easy thing to measure. Prices for individual items fluctuate constantly for reasons that have nothing to do with inflation, and an accurate measure of inflation must distinguish between these relative price movements and inflation.”

Inflation….caused by excessive money creation. If such is the case, then what in name of sanity is the reason to monitor arbitrary price inceases/decreases?

This is like saying, “O.K., we know the problem is the limit on your Visa card, so to make sure you stay within your budget we will monitor the price changes of the items you buy.”

If excessive money growth is the problem, then how about monitoring m-o-n-e-y growth?

There is a reason for the sense that a depression is a possibility, and that is due to the fact that neo-fishers are paddling the canoe – monitoring CPI was a worthless exercise during 1927-1929 and is again today.

Where in CPI is the provision for excessive debt creation? It wasn’t there in 1929 and its not there today.

This most definitely qualifies as a Yut-Yo Moment:

Libor Costs Soar as Banks Seek Funds Over Quarter-End (Update3)

By Gavin Finch

Sept. 28 (Bloomberg) — The cost of borrowing pounds, dollars, and euros overnight rose as banks sought funding over the quarter-end amid a credit squeeze, and as U.K. lender Northern Rock Plc borrowed more money from the Bank of England.

The London interbank offered rate that banks charge each other for overnight loans in pounds rose 20 basis points to 6 percent today, the highest in 10 days, British Bankers’ Association figures showed. The corresponding rate for dollars rose 21 basis points to 5.30 percent, and the euro rate climbed 6 basis points to 4.23 percent.

Interbank market rates have soared as concern that losses on securities linked to U.S. subprime mortgages will spread keeps lenders from providing money to all but the safest borrowers. The Financial Times newspaper said today Newcastle-based Northern Rock had been forced to return to the U.K. central bank for more money after a Sept. 14 bailout to stay in business.

“Coming up to quarter-end you would expect to see a small spike in Libor, but with the market so short on cash it’s particularly vulnerable at the moment,” said Oliver Mangan, chief bond economist in Dublin at AIB Capital Markets, a unit of Ireland’s second-biggest bank. “People are reluctant to lend cash while banks are scrambling to hoard as much of it as possible. This is keeping rates elevated.”

Libor for pounds, euros, and dollars has typically risen between 4 and 11 basis points over quarter-end for the last four quarters, the BBA data shows.

`Abnormally High’

The cost of borrowing pounds for three months was unchanged at 6.3 percent, after touching a nine-year high of 6.9 percent on Sept. 11. The cost of borrowing dollars was also little changed at 5.23 percent and the euro rate stayed at a six-year high of 4.79 percent.

The pound three-month rate exceeds the Bank of England’s key interest rate by 56 basis points while the equivalent dollar rate is 48 basis points over the Federal Reserve’s benchmark. The difference between the rate for euros and the European Central Bank’s refinancing rate is 79 basis points.

“Libor spreads to official rates continue to sit at abnormally high levels,” said Charles Diebel, head of European rate strategy at Nomura International Plc in London. “Spreads have scope to re-widen.”

Northern Rock has borrowed a further 5 billion pounds ($10 billion) since the bailout and it now owes the central bank almost 8 billion pounds, the FT said.

Northern Rock fell as much as 5.4 percent today, while the value of U.K. home-loan providers Bradford & Bingley Plc and Alliance & Leicester Plc, which also seek financing in money markets, declined.

«The Fed leading the public to focus on Core CPI rather than real world inflation is just as reckless as the mortage lenders leading the public to focus on teaser rates and no down payment loans. The Fed kept rates too low to long.» [ … subprime lending … ] «The fed and state regulators were derelict in their duty regarding lending, loans, bank reserve requirements, etc. «Congress needs to find and punish the guilty. Federal and State prosecutors need to bring the guilty to trial and justice.

Enron was peanuts. Enron was a misdemeanor compared to this felony.»

But this is quite crazy — because that is political issue, not a criminal one. And as to the politics, both the administration and Congress and most voters, who are homeowners or flippers, have been enthusiastically demanding low interest rates and more lending.

As Brad De Long is fond of saying, ”the cossacks work the czar”, and here the czar is the USA voting public, demanding free money as of a political right.

This has happened in the UK too, and I’ll quote again the Economist on the politics of it:

http://www.economist.com/world/britain/displaystory.cfm?story_id=9267826

«For a decade, buying a house has been a one-way bet, which is one reason why more people are anxious to make it.»

«what has looked for a decade like the closest thing yet seen to a mass lottery win.»

If the Fed were acting on political grounds, then the Fed is in violation of its duty to remain independent. In reality, the Fed may never be completely free of political influence. But for anyone to claim that what happened at the Fed is simply a political issue is to provide another basis for Congressional investigation: political influence and potential criminal wrongdoing at the Fed.

The wrongdoing is not either political or criminal…it is all kinds of wrongdoing: political and civil and criminal. Congressional investigations are needed into: Reckless disregard of fiduciary responsibilities; irresponsible management of banking system and lending system; dereliction of duty; condoning reckless and improper lending practices; deliberate deception (lying) of the public and Congress regarding real inflation in the U.S.

Congressional investigations are needed into the entire rotten system:

The Fed, the Office of Federal Housing Enterprise Oversight (OFHEO), Fannie Mae, Freddie Mac, U.S. Treasurer, FDIC, SEC, the American Association of Residential Mortgage Regulators, etc.

Congressional investigations are needed into the revolving-door, conflict-of-interest created by allowing Wall Street wolves (such as Rubin and Paulson) into the U.S. Treasury henhouse.

Congressional investigations are needed into the nature of Mr. Greenspan’s and Mr. Bernanke’s communication and collaboration with Wall Street. Yes, some type and amount are appropriate, but some type and amount

may not be appropriate, and may be illegal and criminal.

Over the past 30 years Congress has conducted many investigations into the most secret national intelligence and security matters. Surely, the clear conflict-of-interest between the Federal central bank and Wall Street is worthy of Congressional investigation. Maybe it is time to change the charter of the federal reserve to insure that the public interest is not subservient to Wall Street interest.