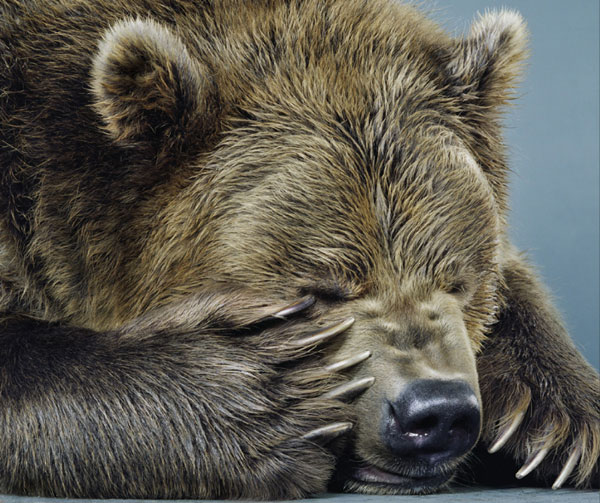

Chelsea Art Galleries in New York is showing a photography exhibit by Jill Greenberg called Ursine. It is, as you might expect, a show of Bears. (Interview with the photographer here)

My favorite is this one, which for some reason makes me think of Doug Kass:

>

Dougie: “Can this news get any worse? And the Market keeps making new highs! Geez, I’m heading back to the linoleum floor with my cheap bottle of Tequila!”

>

We always enjoy Doug’s reasoned arguments, and pass along the above with love.

Doug has some words in Abelson’s column this week in Barron’s:

Simultaneous bull and bear markets?

“But that they’re taking place at the same time doesn’t mean they’re otherwise equal. As Doug Kass, the redoubtable bear who runs Seabreeze Partners, points out, the bullish part of this hybrid bull-bear market, has been restricted pretty much to a relative handful of high-steppers (a number of which, as it happens, are prominent components of the Dow and the S&P 500 averages). Since Doug views everything through some expensive designer glasses darkly, he points to historic instances as demonstrating that narrow bull markets end badly.

In support of his forebodings, he cites the Nasdaq 100’s spectacular performance so far this year — last we checked, it had shot up a cool 25%, or some 448 points — as a startling illustration of how a few exceptionally strong stocks can give the impression of a big bull move. Of that roughly 25%, or nearly 450 points, gained by the Nasdaq 100, a whopping 230 points, or over half the index’s rise, has come from just three issues: Apple (135 points), Research In Motion (60 points) and Google (35 points).

No accident that each of that triumphant trio is part of the big, amorphous sector dubbed “tech”. For according to that perceptive observer referred to a few paragraphs above, the torrent of dough exiting the financial shares, which for so many years ruled the investment roost but lately have been feeling the effects of the credit chill, has flowed in gobs into techs, which have been largely out of favor for quite a spell.

No accident, either, he says, that Apple, Research In Motion and Google, wear the growth label. For, he believes, the long dominance of value over growth in investor preference is in the process of changing and, if and when the market regains its footing, growth will reassert its preeminence. The emphasis, though, will not be on current momentum favorites like Apple, Research In Motion and Google, but, instead, on that vast legion of growth stocks that have conspicuously lagged in markets ever since the dot-com bust.”

Interesting stuff — thanks Doug!

>

Source:

JUMP RIGHT IN — THE WHIPLASH IS FINE.

ALAN ABELSON

Barron’s OCTOBER 29, 2007

UP AND DOWN WALL STREET

http://online.barrons.com/article/SB119325399611470127.html

What I love about the photo is that he looks so annoyed/bothered about the situation (in an anthropomorphic way) yet is still so obviously dangerous with those killer claws . . .

Just looks tired to me. But the only time I ever saw a real wild bear in the woods, I was amazed at how FAST it could move (glad it was running away from me!). Bears can really fly when they want to. I was truly shocked at its speed through the brush. NO lumbering Yogi in my mind anymore.

Hello Big Picture,

My take on this is the finacial companies along with the Fed and Treasury are pushing us to a currency collapse.

Those of us that work and actually produce things are being marginalized. When there is minimal benifit to working anymore there will be a disaster in the real economy.

The purpose of those financial markets is efficient allocation of capital. Now, they are riding on us.

Expect the masses to start rejecting the system soon and deflation to follow.

Everything you say reeks of the begining of a deflationary spiral. I am near welcoming that as the system has become so ill. Nonproductive people who are playing investments are held up as idols. It will end badly.

Does Stephen Colbert know about this? ;-)

Why I’ve stoppped shorting the Dow.

It’s important to remember in periods of hyperinflation (as we’re entering now), what is important is not the nominal price change of an investment but whether or not the price is increasing as fast as the cost of the goods you eventually want to purchase with that investment. Zimbabwe is the country with the highest rate of inflation in the world. In percentage terms, the Zimbabwe stock index is up more than the Dow. However, a single roll of toilet paper (the ultimate tangible asset) costs $200,000 in Zimbabwe currency.

Bernake and Paulson will inflate the supply of paper and electronic currency fast enough that the nominal stock market averages will increase. However, they will increase far less than the cost of tangibles. That’s why I’ve stopped shorting the Dow and am going long silver instead.

margin loans at record high here in oz

Jon Nadler, senior analyst with Kitco Bullion Dealers, called the gold market “massively overbought,” given that prices have piled on $100 an ounce since Sept. 1. _*The market is “running on raw emotion and pure speculative fever at this point,” he said.

nice photo

he just looks worried for everybody

we bears are a caring lot!

*_rgds pcm

If the market participants are really more interested in growth vs. value – why is the Russell 2000 lagging so far behind the Nasdaq. Both of them are considered “growth areas.”

Dear Uncle Dougie,

I wouldn’t start sweatin’ Natalie’s next birthday party yet… You’ve got almost another 6 months.

—

Dear Uncle AA,

You know what omnidirectional anthropomorphism would be for you?

…That’d be when everything about the bitchin’ market just keeps coming up bof·fo:

http://www.thefreedictionary.com/boffo

…no matter how you turn, especially the most boffo part… if you catch my drift [alt. ‘drift:’ General meaning or purport; tenor], and I’m sure you do with the wide panorama, view, aspect, or, dare I say, vista and perspective, you have from the tall canyonlands of Wall Street.

—

And for you, Uncle Barringo:

http://www.cartoonstock.com/directory/c/carrier_pigeons.asp

Dave said:

If the market participants are really more interested in growth vs. value – why is the Russell 2000 lagging so far behind the Nasdaq. Both of them are considered “growth areas.”

Russell is about 20% financial services, like S&P, while broad Nas is only 10%. But most of the action has been in $NDX which has 0 direct exposure to financials and is where the money has been going. So, the further you stay away from financials the better, at least for now.

==whipsaw==

Dave said:

If the market participants are really more interested in growth vs. value – why is the Russell 2000 lagging so far behind the Nasdaq. Both of them are considered “growth areas.”

Russell is about 20% financial services, like S&P, while broad Nas is only 10%. But most of the action has been in $NDX which has 0 direct exposure to financials and is where the money has been going. So, the further you stay away from financials the better, at least for now.

==whipsaw==

John Mauldin linked to a fascinating Forture article describing one of the shittiest RMBS created this cycle. It happens to be sponsored by the most revered bank on the street, Goldman Sachs.

It boggles my mind why Goldman would risk it’s reputation packaging and peddling this garbage to generate a few million in fees. Incidently, rather than take the fees in cash, Goldman apparently decided to retain the riskiest equity tranche as compensatin for the deal. So, ultimately no fees were ever actually realized from the deal since the equity tranche evaporated long ago.

So they risked their institutional reputation creating this crap for the fees, ultimately didn’t realize those fees, but recently printed a monstrous earnings blowout quarter in part by making directional downside bets against the crappy mortgage paper they helped create and peddle to investors around the world.

What a business.

http://tinyurl.com/2jx63j

yes it does look like dougie kass when he’s annoyed with kudlow for not letting him speak..or being talked over by kudlow when he does speak.

Here is how I see the current bull cycle ending.

It’s 2017. Over the previous 10 years, market breadth has continued to narrow until all US stocks but one are trading at book value. All remaining equity capital has flowed into AAPL which continues to beat it’s forward guidance of “break even” every quarter and now trades for trillions a share. Singlehandedly it has continued to pull NDX and SPX to all time highs. Kudlow points out these all time highs on his TV show every night as evidence of Goldilocks 3.0 (although only 1% of the US population can still afford a television). Finally, one quarter, AAPL misses by $1.00 (which is equivalent to a penny in 2007 dollars). One analyst downgrades AAPL from “Strong Buy” to “Buy”. But everyone sells.

@Al Czervik

By 2017 all traders will have replaced the sell buttons on their computers with a “buy more” button. The only options in the future will be “buy” and “buy more”. Selling is a thing of the past.

Barry,

Since I know you discredit the phoney inflation numbers just like me you might find my recent post over at the

SMT interesting.

US markets making new highs on very narrow breath, the price of stuff a.k.a. raw materials going up, up and up, a dollar converted into a professional diver, and that barbarian relic called gold with a high not seen since 1980. (monthly close)

Gee! What’s not to like in this bull market?

Francois