It’s A Low, Low, Low, Low-Rate World.

It’s A Low, Low, Low, Low-Rate World.

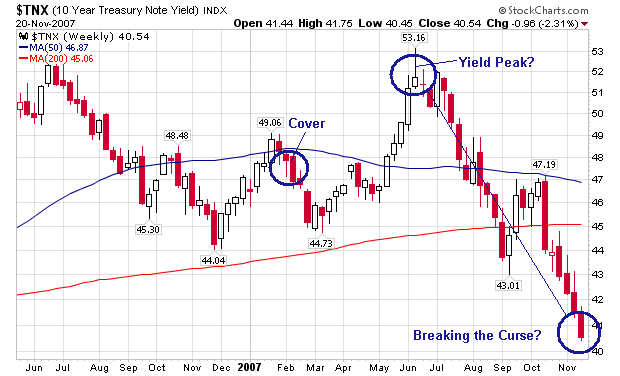

No, really — it is. The yield on the 10 Year was under 4% this morning — briefly kissing 3.99%.

You may be noticing about now that this lies in stark contrast to our prior discussion of Rates and the Magazine Cover Indicator (for more on the magazine cover indicator, see this).

To the wayback machine: Earlier this year, we noted (with an “Uh-Oh”) that Business Week’s February 19, 2007 cover story on our “Low, Low, Low, Low-Rate World” might be a contrary indicator that rates were about to tick higher. After that article came out, Fixed income rates went lower for a month, then rallied to a new 12 month high.

Things were looking grim for Messers. Mandel and Henry.

However, as the chart nearby shows, Yield on the 10 year has since plummeted. Have Michael Mandel and David Henry broken the “Curse of the Magazine Cover?”

It appears they have. The dominant theme of that February 19, 2007 remains intact: After some volatility, Rates have trended lower. We can quibble about the actual article content, which wasn’t exactly forecasting a major economic slowdown or recession — the likely cause of the current flight to bonds.

However, the key point — rates are low, and likely to stay that way — strongly suggests that cover failed as an indicator in this instance.

>

>

Does this invalidate the cover theory?

Not at all. To begin with, all of these cover indicators are merely anecdotal, rather than quantitative, evidence. As such, it is imperfect, and occasionally wrong. Perhaps interest rates not that big a cultural touchstone.

When it does work correctly, the results can be spectacular — think of the infamous Business Week “Death of Equities” cover that set up the greatest Bull market the world had ever seen, or Jeff Bezos as Time Magazine’s Man of the Year marking the top of the internet bubble.

~~~

Perhaps now someone at Business Week will see their way clear to getting me a copy of that August 13, 1979 “Death of Equities” cover . . .

>

Sources:

It’s A Low, Low, Low, Low-Rate World

Michael Mandel and David Henry

Business Week, FEBRUARY 19, 2007 http://www.businessweek.com/magazine/content/07_08/b4022001.htm

Treasuries Rally as Stocks Drop; Ten-Year Yield Falls Below 4%

Daniel Kruger and Lukanyo Mnyanda

Bloomberg,Nov. 21 2007

http://www.bloomberg.com/apps/news?pid=20601087&sid=a.OYR87ZNPPc&

Previously:

Uh-Oh: It’s A Low, Low, Low, Low-Rate World

The Big Picture, February 12, 2007

http://bigpicture.typepad.com/comments/2007/02/uhoh_its_a_low_.html

Rising Bond Yields (or, The Magazine Cover Indicator Lives!)

The Big Picture, June 05, 2007

http://bigpicture.typepad.com/comments/2007/06/rising_bond_yie.html

It’s A Low, Low, Low, Low Medium-Rate World

The Big Picture, June 09, 2007

http://bigpicture.typepad.com/comments/2007/06/its_a_low_low_l.html

For 20 years I have heard that, if the dollar falls rapidly, foreigners will pull out of Treasuries, interest rates will surge and the Fed will be forced to raise rates (even if during a recession) in order to attract capital.

Can we finally put this myth to bed?

Any discussion?

A man who revisits his predictions, even when off. My head is going to explode.

Magazines covers are pretty great at seeing the black swan way after it happened. Also, I think the timing is off just a little, we might have low rates until it all blows up completely.

Have any of you guys ever seen this really neat site ? an amazing amount of info ! Sort of ties into your subject here Barry . Hope it is useful – Bill

http://mortgage-x.com/general/mortgage_indexes.asp

“Myth to bed?” Economics, markets etc. run in cycles. Rates are artificially low because

1) It is a flight to quanity. Used to be flight to quality.

2) Gazzillions of dollars needing a short term home.

3) Incompetent funds managers.

The question is; would you lend Uncle Sugar YOUR money at current rates for 10 or 30 years? I think not.

Out on the limb, within 6 to 10 years, 10yr treasuries will yield 15% to 20%.

Buy a farm with someone elses money.

Low rates will persist as long as China feels that to be in their interest. Private flows (both domestic and foreign) are probably already negative. US debt price support is now largely coming from official and quasi-official flows in defence of currency pegs.

China’s premier, Wen Jiabao, has joined the chorus voicing concern about the dollar’s recent weakness.

No one has made a bigger bet on the dollar that China’s government to the tune of around $1.2 trillion in fairly long-term dollar-denominated debt.

What about a scenario where foreign demand for all US bonds — not just demand for CDOs and riskier bonds — disappears !

What happens then to the US economy ?

Yields at 12 CST

Five Yr (3.36%)

Ten Yr (4.02)

Ross….

Hell no I would not lend to Uncle Sugar!!!!

And oil at $99 bucks….WTF???

Complete irony…There is so much fiat

money, that there is nothing worth buying….

My take,

Ross is either right and 10 Yr treasury goes to 15-20%

OR

Just like Japan…0% yield – and people will still be buying like mad!!!!!

Happy Thanksgiving!!!!

km4,

What happens then? It depends on how the fed reacts. My guess is the fed inflates (defacto default).

People, I am as bearish as most of you, but BX is a screaming buy. Trading near book value, close to 6% dividend yield. This thing is a no-brainer, recession or not.

BX a no brainer?

they’re not going to have any earnings for probably a year or so, due to the expenses and compensation packages from the IPO.

it’s even written in their prospectus.

i’d rather buy a 10 foot pole.

It may be your interpretation that is off and what was considered really low will in retrospect appear remarkably high.

I remebered that BW edition ‘DEATH OF EQUITIES’ as having somewhat different

cover art (for Western US mail subscribers?) than what’s shown here…

[Trashed my copy long ago- sorry.]

WE’RE-IN-THE-MONEY? (1933)

We’re out of money, we’re out of money,

We’ve lost alot of what it takes to get along.

We’re out of money, the skies ain’t sunny

Before it’s through inflation may do us wrong

We see headlines about bad loans and bailouts

Now when we see a mortgage banker we’d like to cry

We’re out of money, come on, it ain’t funny

We spent it, lent it, sent it to China & Iraq

Happy Holiday’s Everyone!

My bet leans toward Japan on interest rates. Slower domestic growth, asset deflation, weaker currency, permanently lower purchasing power, slower immigration and population growth……well, it was good while it lasted!!!

If you look at ALL KINDS of rates, LIBOR, yeild on various bonds selling at steep discounts, then the curse worked. Credit is tight and rates are high

Ahhhhh, yes… thanks, Barringo for harkening back. Only, you used the wrong bullet topic heading. This is the better one:

http://bigpicture.typepad.com/comments/2007/06/its_a_low_low_l.html

…I did some of my best work there. That was the birth of the “Death Row Inmate” genre!… It’s probably my stand-alone best characterization, even better than Dr. Benber N. Anke… and Bondie!

Oh, the nostalgia!

Lori,

You know the common connection between these three individuals?:

Y.A. Nkmichane,

Pormea Nutterin, and

Mr. Enso L. Vent?

You could get any one or all of them multiple credit cards.

Lori beat me to it !

I think’s she’s right. Credit spreads on many assets have blown out and rates are higher for all of them.

Also, as has been noted here often enough, resets on mortgage rates have been the kick in the a$$ that has driven this crunch and equity fall. For many, many homeowners interest rates have just begun to rise and for many more the rate rises are yet to come.

So effectively credit rates in the US have risen. Are they still low? Probably. With resets, are they still going to go higher. Probably. Are foreigners going to hold Treasuries much longer? To some extent I think yes. But I can tell you now, they are getting nervous. Cap gains are offsetting fx losses now. But if $ fall accelerates and cap gains on lower T yields decelerate, will they blink? I think this is why the Fed has been very cautious about promising lower FF targets even though it’s becoming increasingly likely the mkt will force lower FF target. Trying to boil the frog (lower dollar) slowly and orderly as to not produce a panic.