Abu Dhabi to the Rescue!

Late last night, the WSJ reported Citigroup will receive a $7.5B cash infusion from the governmental investment arm of Abu Dhabi (ADIA). Recall that in 1992 — the last credit cycle problem, and much deeper recession than 2001 — it was Saudi Prince Alwaleed who rescued Citi by provided funding.

If you thought Citigroup was not in deep trouble, than check out the terms of the deal:

• The investment authority known as ADIA will

become one of Citigroup’s largest shareholders, with a stake of no more

than 4.9%.• ADIA will receive convertible stock in

Citigroup yielding 11% annually.• Shares are required to be

converted into common stock at a conversion price of between $31.83 and

$37.24 a share over a period of time between March 2010 and September

2011.• The stake will exceed that of Saudi Prince Alwaleed bin

Talal, long known as one of Citigroup’s largest shareholders.

11-frickin-percent!

How’s this for ironic: Citibank has essentially become a sub-prime borrower — only without the advantages of teaser rates!

Here’s the best part of all: Futures skyrocketed on the news, and as I am typing this, the Dow is indicating a plus 120 points for the open. Yeah! Rescue plan! Things are so awful, we are going to get a Fed cut — Whooppee!

I enjoyed Bill King’s take on the matter:

“Given the state of the US and global financial system, the likelihood that known ills are only the proverbial tip of the iceberg, the record leverage, trillions of derivatives, an economy in or near recession and a deteriorating housing market that is already the worst since the Great Depression, if one is not now negative, it’s hard to conceive any non-violent scenario that would induce negativity.

The US and global financial system ills are on going, extreme and largely unknown and unquantifiable; plus the Fed is boxed by a terminal dollar and record debt. The Fed realizes that further rate cuts, like the past cuts, did NOTHING to alleviate problems and instead exacerbated problems by crushing the dollar.”

The timing is actually quite perfect: Markets are deeply oversold, with several indicators suggesting a bounce was overdue anyway. In a piece titled “The Lonely Bull’s Case,” my friend Guy Ortmann wrote yesterday that AAII poll, Equity Put/Call ratio, SPX Trailing P/E, IBES Valuation Model and the 21 day Overbought/Oversold Oscillator are all at levels that suggest a buying opportunity.

I only disagree about the duration — Guy thinks it will have legs, and I think the pop will be a selling opportunity . . .

>

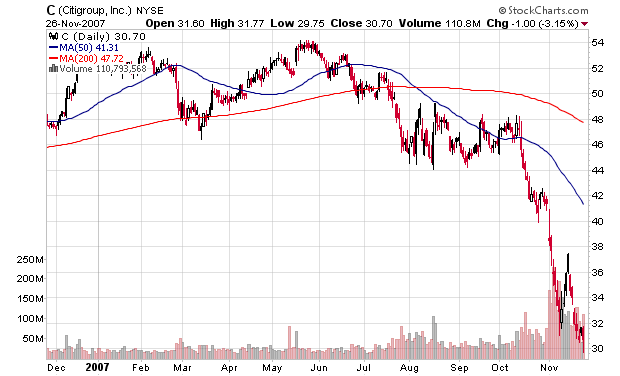

Citgroup, 1 year daily

graphic courtesy of Stockcharts

Source:

Abu Dhabi to Bolster Citigroup With $7.5 Billion Capital Infusion

Government Investment Arm To Become a Top Holder, With Up to a 4.9% Stake

ROBIN SIDEL

WSJ, November 27, 2007; Page A3

http://online.wsj.com/article/SB119613039399104832.html

Moin,

can´t resist… SCHADENFREUDE

From their 2006 report…..

….our return of cash to shareholders through our $7 billion stock buyback in 2006 ( Stock was between $ 45 and $ 55….)

Well done!

Will this cash infusion reverse Citi’s widely publicized plan to layoff (allegedly) 45,000 to 55,000 workers? This would amount to almost 20% of its total workforce if the higher number were correct.

I have to believe that the next up move, however big or small, will only be a precurser to a massive down move! Any suggestions out there as to where to get the best bang for your “buck?” Pardon the pun…or is it an oxymoron? lol

It’s good to see an American company pull itself up by its own bootstraps.

(Que scene of cowboy riding off into the sunset…on a camel).

OkieLawyer,

I would imagine that ADIA bought in BECAUSE of the plan to reduce staff and get out of less profitable segments. Why buy into a broken down house unless the owner plans to make massive changes to fix up the place?

The more curious question I have is that

(1) given Prince Alwaleed was basically rejected in his desire to have Sandy Weill put back in power and

(2) the current board is looking to undo all that Weill did to make Citigroup what it is today, and

(3) ADIA now supplants Alwaleed as the largest shareholder,

will Prince Alwaleed look to reduce his ownership in Citigroup? If so, any bounce in Citigroup may be short-lived.

And here I’ve been operating on the assumption that this go-round, China was going to be the country on whom we laid off our trophy properties, a la Japan and Pebble Beach/Rockefeller Center. Instead it’s the GCC! I’d say the oil producers, but I’m not sure how Congress would react if Putin or Chavez started making moves to buy up, say, CAT and AAPL. Okay, I do have a pretty good idea!

In terms of what this does to the markets, note that the bounce Asia took from it stayed in place. Europe opened mixed/higher on the news; it’s down pretty much across the board at this point, and fairly substantially so. At 3:30-4:00 this morning, our futures were up 100-125 bps–at that hour, I wasn’t making precise calculations, but those are good rough numbers. They’ve been moving down steadily since. So that would all certainly seem to argue for short term bounce rather than for year end rally. The currencies are saying the same thing.

Note that this is at much higher rates than BAC got for its investment in CFC–is that an indication that Citi’s a lower credit than Countrywide? BAC’s converts were in the money at the time of that deal, while ADIA’s are slightly out. As I recall, the BAC deal hasn’t worked out so well to date. Hmmm.

Burnett came on the today show this morning and said this was great news for the market and with a big smile stated that the news will be well received and look for a very much higher market today….wohoooo!

WOW! 11% !!! That is insane. That really speaks to some desperation on the part of Citi. I heard this on NPR this morning but they didn’t mention the 11% rate. I think I’ll buy some Citi shares when they get into the low teens.

I know when I have to borrow huge amounts of money from Mom and Pop just to keep the lights on it’s great news all around.

Barry you were just quoted on FBN “Citibank has essentially become a sub-prime borrower”

agree with your summary barry

from about 2pm our time yesterday same bounce same lemmings same clients not perceiving a sell opportunity

just a glass of water to a drowning man

with oil close to $100 a bet of $7.5bb at 11% is chump change with a safety net

no administration will let citi go under and this just tarts up a pretty sick 10k

rgds pcm

Interesting read…life is a circle.

http://www.pbs.org/wgbh/pages/frontline/shows/wallstreet/weill/demise.html

If you have 5 minutes.

…and yes folks it IS Abu Dhabi and it’s NOT Abu Dubai (as Doug Kass says repeatedly in his article this morning on Realmoney)

…and yes folks it IS Abu Dhabi and it’s NOT Abu Dubai (as Doug Kass says repeatedly in his article this morning on Realmoney)

…and yes folks it IS Abu Dhabi and it’s NOT Abu Dubai (as Doug Kass says repeatedly in his article this morning on Realmoney)

Posted by: Bob A | Nov 27, 2007 9:32:47 AM

_____

Oh. It’s not Dubai? Okay, then – everything’s cool.

Unless sandy weill has a magic wand that he can wave to increase the salaries of lienholders, there’s not one doggone thing he can do.

This money from abu dhabi simply rearranges deck chairs on the Titanic.

let’s see:

CFC has issues with it’s $51 billion LOC from the Fed Bank of Atlanta that is disguised as a bailout.

Now Citigroup (largest bank in the country) gets bailed out to the tune of $7.5 billion and most likely will still lay off over 17k soon.

Add in the latest helicopter drop of $14.75 billion

http://www.newyorkfed.org/markets/omo/dmm/temp.cfm

And that is totally a bull_____ market.!!

Gotta love the spin today folks…..

Ciao

MS

In the optimistic version, it’s not 11%: It’s 11% for four years, with a return of only about 2/3 of the principal at the end. (Required to buy, floored at $31.83, for maybe a $20 stock.)

If the forward has a positive value (and it probably does today; I’m not running the numbers, any more than I would on BofA’s CFC-at-18 option, which is at least a real option), then the cost is actually appreciably greater than 11%.

michael

PPT now benched as A Team required to get wall street out of the cellar (from time to time)

but how many quality assets at deeply discounted prices will they really want when/if offsetting oil price doesn’t provide the hedge

rgds pcm

The big C is too big to fail so make sure everyone loads up on it, but not quite yet.

Peter-

Only “they” know what the assets truly are. I would’nt want to speculate on that since I (as well as millions of others) do not have anything that resembles accuracy on the part of the banks. We are just making it up it seems. In the last two weeks I’ve read from two VERY different sources that if the banks had to value at market then they would instantly be insolvent.

But we continue to cheer bailouts as if they were not really relevant…….which is of course sillier than anything I could come up with.

Today’s market can be summed up by this:

“Investors cheered yet another bailout”

take a look over at the street.com…they still think it’s “contained”..with all the hoplessly optimistic “don’t sell” articles.

BTW the cost of living personified…..it was 85d in my back yard yesterday…..again today.

Ciao

MS

Irony of ironies in that Citigroup is being touted as the reason that the market is up in just about all the mainstream financial web sites but they decline to mention that C is down for the day and hit a new 52 week low to boot.

“investors”………who are they anyway….

Ciao

MS

Erm. The converts are mandatory, so looking at this as just an 11% bond (versus a 7% dividend yield on the common) misses the point, I think, Barry.

Now, we can argue that the dividend is not sustainable, or that the bond is pretty far subordinated in the capital structure, etc, but I think that your readers deserve better than this uncharacteristically facile post.

“convertible stock in Citigroup yielding 11% annually.”

And the market celebrates that?

I smell…fear!

Francois

I penned a different take on this deal at http://crookery.blogspot.com/2007/11/citibank-adia-and-that-pesky-11.html.

Why oh why is it that when people hear “convertible” and 11% they jump to conclusions wthout looking at the detail.

This is a mandatory, or reverse convertible, a PERC, a DEC or one of the many monikers which mean a trade where you buy the stock and sell a call on it, thereby receiving fair value yield enhancement in return. A typical convert owner has a par out if the stock does not perform. This trade stuffs ADIC with 235m shares if they crater, and takes shares off them if they rise.

If Citi is that desperate for funding, then a dividend cut is going to be next on the agenda no matter what Citi’s management say. Citi won’t be able to justify $11billion in annual dividends going forward, if its borrowing costs is this high. More importantly its capital ratios need to increase and one way is by cutting dividends.

This deal might not have been a bad one for Citi afterall, based on the following:

Andrew Clavell writes in his post: “Put another way, Citi has raised tax deductible, upper tier capital funds for 4 years at a cost equivalent to another financing source of Libor+150. Smart business.”

http://seekingalpha.com/article/55467-citi-s-capital-infusion-and-that-pesky-11-interest-rate