Ouch! :

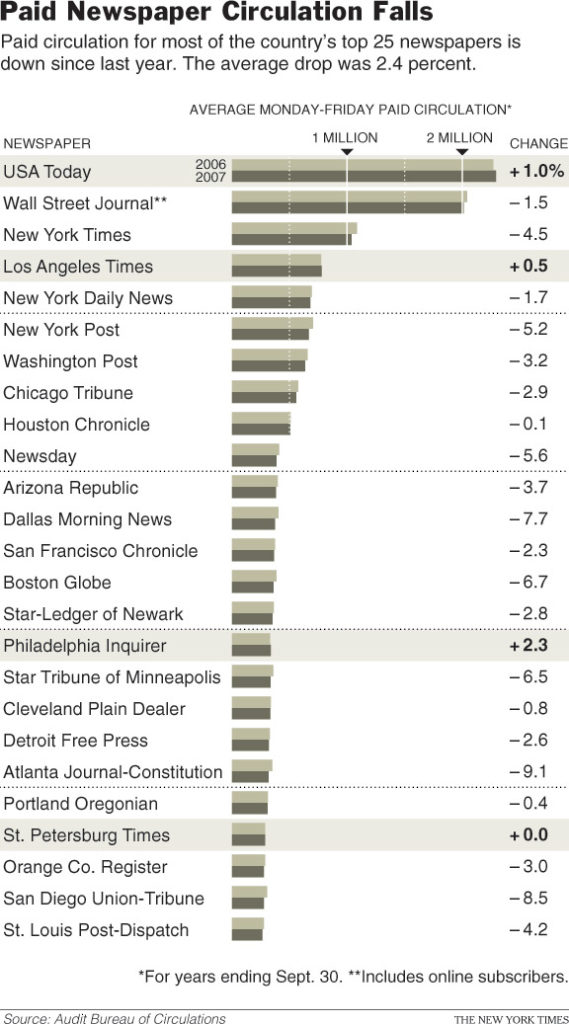

“The circulation declines of American newspapers continued over the

spring and summer, as sales across the industry fell almost 3 percent

compared with the year before, according to figures released yesterday.The drop, reported by the Audit Bureau of Circulations,

reflects the growing shift of readers to the Internet, where newspaper

readership has climbed, and also a strategy by many major papers to

shed unprofitable or marginally profitable print circulation.Among the nation’s largest newspapers, only a handful held their own

or registered slight increases in overall paid circulation for the

period from April 1 to Sept. 30: USA Today, The Philadelphia Inquirer,

The Houston Chronicle and The St. Petersburg Times. Most papers showed

significant declines, both weekday and Sunday.”

We looked at this issue in a prior linkfest: Why You Didn’t Pay To Read This.

>

Source:

More Readers Trading Newspapers for Web Sites

RICHARD PÉREZ-PEÑA

NYT, November 6, 2007

http://www.nytimes.com/2007/11/06/business/media/06adco.html

See also

Why You Didn’t Pay To Read This

Tim Harford

Slate, Saturday, Oct. 27, 2007, at 6:29 AM ET

http://www.slate.com/id/2176626/

5 newspaper giants in talks about online ad network

By Michael Oneal | Tribune staff reporter

November 6, 2007

http://www.chicagotribune.com/business/chi-tue_tribune_1106nov06,0,1513237.story

They still print newspapers? For real?!?!

why buy newspapers when we can read your blog and other erudite blogs and sites

just sitting here waiting for signs of the PPT Cavalry

our market(resource side) fascinating today with BHP bidding for Rio (mega scale niche bid)side result will be all the wannabees lacking scale and premium assets could be marked up while the rest of market focuses on reality

as jeffrey saut says its a market of markets and somewhere there is always a bull market

rgds pcm

another OT:

Who or what is propping up HOG today, yesterday, all week in fact…

Ciao

MS

Pete-

On cue here they come……

They should at least try and do a better job of hiding it….don’t you think??

Ciao

MS

nice little gap created by that blind buying at :58…..

Gotta go fill it now so it almost looks real….LOL

Ciao

MS

There’s the fill….this is just too easy to see happening. Seriously…if it is that easy to manipulate….I guess it is when everyone is sitting and watching.

Total Crooks…..

Ciao

MS

it’s got to be more obtuse than this

surely some globally complex micro tightly linked conspiracy trade involving all major proprietary desks with the S&P/DJIA as the vital linchpin

or is it that Washington and senior Wall Street are frozen in the headlights hoping something will happen (soon)

rgds pcm

I wish I knew what it was however it always begins at either :58 or :29….

Someone is propping this market up in a BIG way.

Seriously……would you buy like that from a low??? Creating a gap like that and then walking it down to fill it???

I’ve seen some strange things but that one qualifies as manipulation plain and simple.

If that gap had’nt filled there is no way the hordes jump on the momo train.

disgusting…..

Ciao

MS

When all the players have the same desired outcome it does’nt take a conspiracy to make that outcome occur. In fact, it makes it a hell of alot easier to accomplish since there is not any one smoking gun to pin it down to.

I know it’s due for a pop however in the last hour-EVEN DOWN TO THE MINUTE??? It’s just all too neat for me.

Ciao

MS

gold just took a dive

Cu weak for a couple of days

USDLR in a hand basket

asset backed paper now on the walls

morgan stanley says 4 qrs for credit markets to return and liquidity has disappeared

I’m only a provincial but how much real money does it take to do this each day?

rgds pcm

I wish I knew the actual dollar amounts but I can say that there is really only ONE place in the world that has that type of reserves to even attempt that sort of operation let alone be successful at it.

I think you already know the answer……

And I don’t think the quant. boxes all had the same “buy” signal, certainly not at close to lows of the day with yet more uncertainty offered up in the form of “good news from the Fed”.

I think the traders know (at least on the ground) what is going on but they are conditioned to shoot first and ask questions later….like all the banks. Do I make money or question the reason???

We’ve seen the outcome of that dilemma last as long as it takes to enter in an order….

Nothing wrong with that…kudo’s to those who jump in on it however it sort of masks a larger problem….That we will be dealing with for another year.

Ciao

MS

yes michael its reassuring that its not kafka where you can’t decide whether you are crazy or everybody around you is crazy!

I can see the buy side each day but who will ultimately take the buy side? roll on those 10ks

getting down and dirty this has got nothing to do with bonuses has it?

or perish the thought preservation of equity in blind trusts?

rgds pcm

peter from oz,

Is it possible that it’s just that the bond session has ended, and the pressure on equities as a source of funds eases?

And to top off all the shenanigans in the markets,

the five and ten year Notes hit 52 week lows on yield!

WTF

What is a sane investor to do? (drink heavy?)

estragon

I’ll accept that in principle

except the swings/volume are abnormal for textbook interchange

but who takes over post 3pm

open to any suggestions?

rgds pcm

Peter and MS

isn’t this thread about newspapers taking a hit

at least try to bring the thread back when you hijack it

ie: I still get my local paper – cause I have searched 100 year old microfiches and I don’t want that to end

i am beginning to wonder that it does not take a lot of money to bring the market up at the end of the day.

all the seller would have done their job and gone away by afternoon, and all you have to do is buy the stocks listed in the major indexes to show that we did not do that bad today.

but google and aaple are still down like 5%, they must be part of nasdaq or S&P right?

somehow this market does not make sense?

it appears as a constant battle between longies and shorties.

but i have a feeling that longies are going to run out of cash(unless FED keeps supplying it) and shorties are going to win this battle.

peter from oz,

My guess is there are three factors at work post 3pm.

1. When the market begins to turn up, shorts cover. Short interest appears to still be fairly high, and shorts have tended to be burned if they don’t book profits quickly.

2. The pattern seems to be getting consistent enough to be self-reinforcing, so if the pattern appears to be forming on any given day, traders are likely jumping on for the ride. Futures seem to have a bias to weakness after hours when this happens, suggesting some profit taking after the trade.

3. Despite recent selloffs, I suspect the fear of missing upside still trumps fear of a sudden downdraft, and funds with excess cash relative to mandate look to lower their basis on the newly cheaper “bargains”.

Of course, all this is purely speculation. The masters of the universe may well be executing a well organized pump and dump.

Greg0658,

Good point on newspapers being the repository of history as it happens. The internet is too, but newspapers help understand what was seen as broadly important at the time.

Newspapers are also important in bringing cohesiveness to geographically local communities. The internet is a game-changer in that it facilitates the formation of interest-based communities, but this may have a cost in the form of diminished sense of attachment to local communities.

Didn’t mean to hijack the thread, but there wasn’t much of an on-message discussion going on.

As far as the www holding these words and thoughts for 100 years. That is doubtful. I wonder who and how the record stays electrified. Most likely Wiki will be around somehow forever, TBP – probably gone when BR fails to pay the bill, as with my site.

thanks estragon

very considered and succint

it suits my mode of thinking

an elongated run (maybe a lot of small shocks rather than one big one) to a cyclical bear market which will be devastating but not long tenured

i.e “good” stocks will be marked down below their intrinsic value

even the good old q factor will be useful

circulating your insight to some local dealers here

rgds pcm

sorry about the hijack

must say it worked to my benefit though

we are on daylight saving here so your last hour is 7-8 am and there is a lot of local noise as the morning shift drifts in

needed to plug in to some people who might know rather than ones here who are protecting a position or don’t know but need to appear they do or both

apologies again and thanks estragon, michael et al

rgds pcm

I’m working on a newspaper killer. It actually found some investors. I’m in a garage right now, fixing some bugs. Think Digg + Local News.

HoundWire.com

Your Comments: Although I get three papers per day, three mags per week, and several subscriptions on the internet, I cancelled the Chicago Tribune about three years ago. I didn’t see why I should underwrite liberal print crap.

My Comments: The PPT lives, usually at 2:15.

Newspaper’s are going the way of the gooney bird before long aren’t they?

Printing plants, pulp mills and delivery trucks are soon to be replaced by Wimax and thinner lighter less costly viewers.

Did you know that housing price declines are going to stop in June 2008? I bet you were unaware that mortgage defaults will not only stop accelerating, but reverse back to their low end scale exactly in June 2008! Bank losses will stop and and funky level III assets will recover their full “mark to model” values on the first weekend of June 2008! All I can say is, that’s a relief. All the upset and turmoil in the market is starting to be depressing, so if we can just wait until Spring of 2008, all will be great.

The above lunacy is a rough encapsulation of the FED, the banks, the home builders, the retailers, and anyone on financial TV. Reading through FED testimony, listening to conference calls, and watching CNBC for a while brings repetition of the Spring 2008 miracle. Not even Miracle Max from “The Princess Bride” could provide that kind of magic. Those rebound forcasters must be living in Never Land. In case they did not get the memo, even Never Land is being foreclosed on:

http://www.tmz.com/2007/11/06/neverland-in-foreclosure/

The San Diego UT did a bang-up job during our recent fires, even starting a blog for the latest fire news. It was great to see them using the Internet in such an effective way.

I haven’t been a fan of the UT in the last few years, but I have to commend them for doing a particularly good job in this case.

But I still won’t subscribe again. Their politics still annoys me.

As for the “McPaper”, the USA Today, the only reason their subscription is large is because they are ubiquitous in hotels. I would MUCH rather see hotels carry the local paper in their area, so it would be possible to know what is going on in the local area. I usually find the McPaper to be pretty much useless.

Local papers need to find a better niche market, like actually covering the news in their local area. But that does require paying real reporters, rather than just running real estate advertising and other local ads. Why should I bother to pick up a paper that is useless to me? But if I’m in a town for a few days, it would be nice to actually know what’s going on there. The McPaper doesn’t cut it.

NYT and LA Times and other nationals are online, and I read them there. I won’t go out of my way to pick up a national paper at a news stand, though.

The kids (20’s, 30’s) don’t read newspapers anymore, they are to busy playing computer games. I sometimes think of the day when they are in their room playing the latest combat video and in marches a real Chinese or Russian camando. Do you think they’ll realize that it isn’t part of the game?

Justin, but at least they’re prepared for computer-simulated attacks.

There’s good and bad in this. The internet is great. But, we might be headed for some trouble remaining in touch with reality.

Gathering facts on many stories is expensive. But, a lot of us, myself included, are becoming free-riders to fact collection. Bloggers (e.g., Barry) repost a lot of information and provide a range of analysis. More and more people are relying on these sources. But, little of the “hits” — and the associated advertising revenue — is making its way back to the fact collectors.

If fact collectors don’t earn a return on investment, then capital will flow away from fact collection. For instance, instead of having reporters’ boots on the ground in Iraq, we’ll rely more heavily on Pentagon press releases. And, as you can see from Sanchez’s statement basically about not wanting to dissent while serving, you know you need independent fact collectors. (Don’t want to make this a political debate. But, that’s a decent example.)

Just an observation. This isn’t something I’ve studied or am about to study…

right on wunsacon

I must say I tend to agree with Estragon’s second point however it is surprising that when traders are asked about that very thing occurring they just sort of smirk and say things like “stocks seemed cheap”……..

or “everyone else was buying”-which actually is more palatable as a reason but offering up the former is just like saying “we do this for a living and how dare you question it”.

Well so do I and I question it and can come up with a far more plausible scenario than “stocks seemed cheap” answer that passes for some sort of financial acumen that is presented as mana.

As far as “hijacking” this thread…..sorry but that happens in almost every thread so I feel no remorse in speaking to a very real and timely action in the market as it occurs.

Remember it’s friday….what wonderfully optimistic piece of news should we encounter today??? I’m almost afraid to ask as I thought for sure we’d have been surprised with yet another rate cut this morning…the futures sure acted like that early last night…

Ciao

MS

on your thread then MS – I saw a commercial play once on CNBC – it was for a company that was selling – route around router connection software or a ISP – it was orange background and had a flow chart appearance – I wanted to check them out but never saw again

Please accept my apologies for making an on-topic comment.

I see the print newspapers in a downward spiral:

– newspaper publisher experiences financial pressure

– they remove features to save some money

– readers are angered, upset, and stop buy the paper

– circulation goes down, ad revenue goes down

– rinse, lather, repeat

It used to take a couple of days to read the local Sunday paper.

Now I can finish it before noon if I want to.

I do not find the Internet to be an acceptable substitute. There

are many virtues to paying a small amount for someone else to do

the editing, collecting, and assembling of news and features into

a compact and convenient package. And how will we line our

birdcages and wrap our fish?

Nothing can replace a lazy Sunday brunch with one’s sweetie,

reading the paper and trading sections back and forth, pointing

out items of mutual interest.

Not quite so romantic with two laptops.