Its an election year, and that means sophistry and ignorance in equal measures will be flooding the airwaves and intertubes.

We have taken it as our charge here to fight against the logically challenged and the factually incorrect. We addressed this exact issue four years ago, but given the propensity us Humans have for self-delusion, we must crank up the wayback machine, and review some basic economic and logical truths.

The latest meme making the rounds — I’ve seen it in the WSJ, on Kudlow’s show and read it online — is a move to blame the recent market turmoil on the rise of Obama at InTrade, or to correlate the sell-off with the declining polls for the incumbent party.

The WSJ fell prey to this same reasoning:

“Worry about possible policy changes can weigh on markets ahead of a presidential vote. If an incumbent seems likely to win, markets often recover by the fall. This year, with many of the candidates on both sides promising change, the risk is that the market jitters could linger.”

Markets do not recover because the incumbent seems likely to win; rather, the underlying conditions that work to the advantage of markets — robust growth, brisk consumer spending, job creation, income gains, tame inflation, etc. — also work to aid the incumbent.

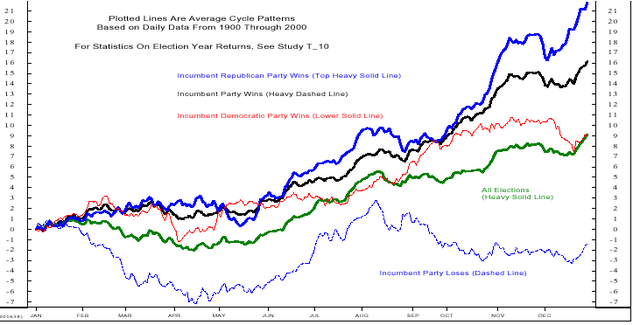

Consider the following chart, via Ned Davis Research:

click for bigger graph

>

We all fall under the spell of faulty logic sometimes, confusing what is cause and what is effect. As another example of this, consider the following:

“Obama is currently the presidential frontrunner. Note that, on Intrade, the market odds of an economic recession in 2008 are rising in tandem with the odds that Obama will be elected President. Correlation does not prove causation but this correlation is worrisome.”

All too often, we see the cause and effect relationship analyzed exactly backwards, as in the above example. These causative errors are an all-too-common analytical

blunder when reviewing market or economic data. Unfortunately, in seeking certainty in an uncertain world, confusing cause and consequence is an all-too-regular occurrence. The above quote is a perfect example of that foible.

To review: Markets are not skittish because the incumbent party is in trouble –

that’s getting it ass-backwards. When the ruling party is in election trouble, its because the future discounting mechanism of markets is incorporating a slowing economy into its pricing. Markets may be imperfect and subject to the excesses of crowd behavior, but they eventually get the big picture correct. The current market malaise reflects a recognition what is occurring in the macro-environment.

In the present case, its a weakening economy and the prospect of decreasing earnings that is most impacting equity prices. Slowing industrial production, a weak dollar, faltering consumer spending, high inflation, and $100 oil, weakening job creation and real income losses are factors that impact equity

prices — and the electorate — invariably hurting the incumbent party’s election fortunes.

People who are content with the status quo and secure in their

financial futures vote for more of the same; when they are not, they vote for change.

Thus, the Cause is the weakening economy and its discontents thereto. The Effect is the rise of candidates claiming to be change agents, and fall of those representing the status quo.

Want to see a good example of how politicians recognizing this economic discontent (aka “Cause”) ? Look at how often members of the incumbent party use the word “change.”

I’m a political independent — I supported McCain in 2000, and I would support a technocrat like Mayor Bloomberg today — but these arguments all smack of partisan cheerleading to me. I even recall back in 2004 that the same faulty argument was made in a WSJ editorial: “Kerry Up, Markets Down.” The Obama claim appears to me to be more of the same . . .

~~~

One final thought: Its even more spurious to rely on Intrade as a source of what is roiling markets. The presidential and political predictions markets are notoriously unreliable, especially far in advance of actual elections. But its not just far in advance: Recall how wrong the prediction markets were with Howard Dean and Iowa, and with the GOP retention of the Senate in 2006.

As of yesterday, the Intrade bet for Obama to win New Hampshire was over 95% — Whoops!:

Final settlement: Obama to win NH expired at 0.0.

To quote Dan Gross, these are “less futures markets than immediate-past markets.”

In an upcoming post, we will review the strengths and weaknesses of these thinly traded prediction markets . . .

>

Source:

Campaign Talk Gives Market Further Jitters

Promises of ‘Change,’ Economic News Blend To Unsettle Investors

E.S. BROWNING

WSJ, January 7, 2008; Page C1

http://online.wsj.com/article/SB119966775786271209.html

Logical Reasoning Errors: The Dow Election Year Cycle

The Big Picture, Thursday, August 12, 2004

http://bigpicture.typepad.com/comments/2004/08/dow_election_ye.html

Obama, the Election and the Economy

Jonathan

Chicago Boyz, January 6th, 2008

http://chicagoboyz.net/archives/5470.html

Iowa and Prediction Markets

The Big Picture, January 24, 2004

http://bigpicture.typepad.com/comments/2004/01/iowa_and_predec.html

WHY WERE THE POLITICAL FUTURES MARKETS SO WRONG ABOUT OBAMA AND CLINTON?

Daniel Gross

Tuesday, Jan. 8, 2008,

http://www.slate.com/id/2181745/

I’m just happy that it’s not “Republican Ken”(Mitt) Vs. “Democrat Barbie”(Hillary.

That would just be a Snoozer into november.

hey the futures are up, the market must like Hillary.(that horseshit is some of the most backwards thinking ever.)

In a stunning upset, and to the chagrin of the media, Hillary topped Barack in the New Hampshire Primary by three percentage points. Independents are allowed to vote in either party’s primary. They voted heavily for McCain and Obama. Ergo Hillary did enormously better than expected – provided the computers are legit.

The surprise result compels us to recall some important tenets of the electorate that

the late Al Sindlinger espoused.

1) Barring a major war, Americans vote their pocketbook.

2) The next consideration is ‘likeability’.

3) National minority candidates poll better than the actual results because people don’t want pollsters to perceive them as anti-minority.

Opening Bell: 1.9.08

Countrywide Sees Loan Funding Drop As Delinquencies Rise (WSJ) After taking it on the chin yesterday, amid rumors of its impending demise, Countrywide came out with December numbers this morning that are pretty bad, but maybe just ‘mixed’ enough…

If the markets were up during an election year in which there was a Democratic incumbent, you can bet that the Wall Street Journal would be trumpeting that “the markets are up in anticipation of the Republicans taking the White House in November.”

Their reporting reflects an ideological partisan bias.

You know, BR, they still interview that moron that “created” the Super Bowl stock market indicator–the all time great causation/correlation vs. two totally unrelated data series act of stupidity.

The Obama thing is ridiculous—since it means that Lady MacBeth is doing better. I would hope the market would do better if Obama does well, not worse.

Economic cycles and political cycles are co linear not causal.

The late great Herman Kahn pointed this out in his 1981 book “The Coming Boom.” Think about the 1981 economic and political conditions.

I sorely miss that old fat man. It has been said that Stanley Kubrick modeled Dr. Strangelove after Herman.

The book is still a must read in my opinion if for no other reason than his take on world demographics.

I awoke this morning and the sun came up. Damn I’m good!

Ross:

the sun hasn’t come up here yet…..

we need to be contrarian, and challenge our assumptions…

(I’m not taking issue, more making a joke)

With a weakening economy a Democratic candidate’s chances of winning are great. Losing the 15% tax on stock dividends reverting back to 28+% is almost a certainty if either of the Democratic candidates win. This would lower the attractiveness of common stocks and drop the value of the total stock market by, say 10%.

Where am I wrong?

“1) Barring a major war, Americans vote their pocketbook.”

Yes Bill and BR are correct.

Here in Atlanta, a city of 5.5 million, where 40,000 jobs are forecast to be created in all of 2008, we find this in today’s AJC, “They came in droves — high school students, retirees, young moms, the unemployed — all for a shot at a job at a new Wal-Mart on Memorial Drive in central DeKalb County.

In just two days, and with virtually no advertising or even any signs, a staggering 7,500 people filled out applications for one of the 350 to 400 available jobs.”

7500 people show up at WalMart for as yet, unadvertised jobs.

Something is up and people are not happy.

The US now has the most deaths from treatable diseases, privacy on par with China, Russia, and Cuba. The S&P has averaged 3.2% the last 10 years.

Its time for change.

After the past 7 years, it’s astounding that the Republicans (conservatives – Oy!) still try to claim the mantle as the Party of and for Business.

I guess the “faithful” (Oy! again) will ride this stock to the bottom.

The total value of the dollar, the Stock Market, and most hard assets has dropped at least 10%, and will drop much more than that, based solely on the shenanigans of the current Republican administration and immediate-past Republican Congress.

No matter which party the next President belongs to, it will be very difficult to recover from the “CEO Presidency”.

The overall cycle for the next few years is one of *contraction*. A major economic shift like this will manifest in a change in political sentiment.

Watch the smooth shift of responsibility for all “bad” things from the past Democratic president to the possiblility of the next Democratic president.

The last 10 years of Republican controlled congress and 8 years of Republican president are entirely neglible and hold no reponsibility for the screwed-up state of things. No sir! Not at all!!

And, Steve, have you read anything in the past few months about a tapped out housing market, falling CRE, credit contraction, high oil prices, job losses, over-extended consumers, rising foreclosures, dropping dollar, rising gold, etc., etc..

But I’m sure the possibility of something happening two years out if a Democratic candidate is elected is far more important than any of those immediate market factors.

While “change” is the buzz word for the primaries, I would venture to guess that the phrase, “It’s the economy, stupid” will be front and center in the national race. With more focus on the economy, and considering its weak state, there is little positive energy to be found… especially considering the fact that “change” does not often translate as a positive word, at least in the short-term, as pertaining to the psyche of investors…

Larry Kudlow and the WSJ would say nearly anything to further the cause of the Republican party. Being surprised that either claims Democrats are bad for the economy is like noticing the sky is blue and expressing amazement at the discovery.

On a different note, some sectors are starting to look good. I think a bottom is near. This is not to say markets will immediately return to new highs. Rather, it will soon be safe to jump in the water. Probably late January. More damage is ahead before that.

I don’t think a recession is here or coming soon. If one were imminent, there would be more bad news, such as huge layoffs. Rather, all we hear are finance babies screaming, pundits trying to fill air time and print, and other disappointments. The stock market is only reverting to mean, bleeding off the bubble of recent date.

Unless the coming recession will be a death by 1000 cuts, there is not one on the horizon. Other than subprime, show me a good hammer hit and then I will reconsider my statement.

>>If one were imminent, there would be more bad news, such as huge layoffs.>>

Does it occur to you that may be these companies that have been “adding jobs for 52 straight qtrs.” are now a victim of the current methodology that is used by this administration??

As to say “all those jobs we created” are not really that impressive since, in my view, those would be the first people to hit the street. The financials are really the only industry that added people at such a furious rate (and almost up to and including July of this year they were still hiring)

So what I am really saying is the reason we have not seen layoffs at a higher rate is that the BLS model is so woefully inaccurate that those jobs are (along with several things) are a fabrication of this administration.

Just as the market was bullied up to new record highs on nothing more than rhetoric and hope……we are seeing that same pattern repeat itself in other measurable data points. The brokers and banks knew what was coming so why not use the power they have to allow a large cushion as asset sales start to take place. That is what is happening now. Still above the August lows…my guess is that baring some major piece of news it will stay above it.

Ciao

MS

Hey, “me”:

You wrote: “7500 people show up at WalMart for as yet, unadvertised jobs.”

This is nothing new. In early 2006, look what happened in a suburb adjacent to Chicago:

“(Crain’s) — The new Wal-Mart Stores Inc. location opening Friday in suburban Evergreen Park received a record 25,000 applications for 325 positions, the highest for any one location in the retailer’s history, a company official says.”

Of course, the lunatics who run Chicago have done everything in their power to keep Wal-Mart away from the city. That of course hurts poor and lower-income people the most.

http://www.chicagobusiness.com/cgi-bin/news.pl?id=19286&seenIt=1

Agree with cinefoz. Start leaning against the wind. Some very good companies are starting to look like good values. Interesting technicals also. Just a thought.

Just after the rooster crows, the sun comes up. Obviously, the rooster causes the sun to come up, no?

The simple notion that correlation is not causation is a truth lost to much of science these days–in everything from positing that increased CO2 levels cause the earth’s climate to grow warmer, to medical studies attempting to show causative correlations between various foods and cancer.

Good science is humble science that sees a correlation and attempts to ascertain a causal relationship. The WSJ is just speculating.

Most political economists who forecast U.S. presidential elections use quarterly changes in the GDP, and the rate of unemployment (or the rate of new job creation) as the explanatory variable of the election outcome. The other explanatory variable is a peace/war/national security variable. See For example Michael Lewis-Beck and Charles Tien at Hunter College CUNY. Economics impacts political outcomes.

If the U.S. does go into a recession or at least stagnation, obviously GDP growth and job growth in the second quarter 08 will be negative for the incumbent Republicans. The political variable peace/war factor is highly negative for the Republicans. With virtually any candidate, the Dems will win the White House.

And frankly, it’s a good thing. The ruling party has let things go to pot economically, and it’s time for a reform/clean up effort.

Change, we want change, the front runners offer no such thing.

“Change” has already occurred, after years of being whittled away, under Bush1, the Clinton’s finally put the death knell in Glass-Steagal with Gramm-Leach, from Glass transparency to Leach parasitic. Now speeches are about how 2 terms of republicans have created the worst mortgage disaster in US history when every thing is going right according to the CFR schedule, as the new round is sanctioned contestants are considered for the next leader board. Hysterical!

Stephen Moore, “McCain Clinton rally” said it again.

and says that with the same disingenuous, Shill smile oil traders have when they talk about the horrible international events affecting oil.

Barron’s, Business Week, Fortune, and others have all documented that both the national economy and the stock markets perform better during Democratic administrations than Republican administrations, but Wall Street never lets the facts get in the way of their blind support of Republicans.

.

That story about the Walmart needs some background – it is going into an area that is hardly representative of the economy as a whole. It is in a run-down, poverty-riddled, ungentrified area of dekalb county. Here’s a link to the walmart location on Zillow – check out the property values to the south and west.

http://tinyurl.com/ys9cc5

This is inside the perimeter in traffic-plagued ATL, folks. When property values are low in a convenient location like this, it’s the ghetto, the inner city. So 7500 people showing up for minimum wage jobs does not surprise me. If anything, it tells me that, contra to the conventional wisdom, the poor and downtrodden are looking for work, not lazy welfare freeloaders.

“Cause & Effect”. I think that we would all agree that greed not Obama are the cause of the current housing crisis & credit crunch. The effects of both are being felt by the U.S. now & eventually will be felt overseas as well.

I was watching Kudlow last night and he had some Clinton supporter on there talking about how she was more presidential than Obama. His reasoning went something like; because she had the opportunity to see alot of proposals (bills) that Bill had to make decisions on before he signed them and that he would ask for her opinon before making a decision. If that’s the case then she was aware that he repealed the Glass-Steagall Act II in 1999 which was enacted in 1933 to prevent another depression by separating commercial and investment banking.

Allowing banks to realign in addition to Greenspan’s 1@ FED rate cut run has led us to where we now find ourselves eight years later. I then argue that the Clintons are more responsible for our current economical situation than is Obama potentially being elected President.

Rusty said ” it is going into an area that is hardly representative of the economy as a whole. ”

Are you familiar with the Atlanta economy? We have fewer tech jobs now than in 2000.

Of the 40,000 jobs to be created this year, 12% are “Premium” jobs. That means they pay over $40,000. So an economy with 5.5 million people creates 6000 jobs that pay 40 grand.

Is that even enough to absorb the graduates of Georgia Tech, Georgia State, UGA, plus KSU and SPSU?

I think it totally represents the economy, and the economy sucks here.

Cherokee County is asking the state where their cut of the sales tax revenue is. It ain’t there. Surprise.

It is more significant that 7500 people apply at Wal-Mart when the economy is supposedly booming. That is hardly anyone’s dream job and yet they line up to apply.

You need to take a drive outside the perimeter and see that no longer do we have Lucent, World Com, many AT&T facilities, Bellsouth, Compaq, Sprint, HP, Nortel. those jobs are long gone.

Pat Gorup

Exactly the point I attempted to make. But Obama is evry bit the CFR spokes hole that the Clintons are there is essentially no difference between the parties and their Business affiliations. The only viable non globalist candidate is Ron Paul. The rest are working from the scripted agenda.

HR1955 is an example,passed 6-404

http://www.youtube.com/watch?v=9wJsovPRTEM

Another is the gutting of the Secure Borders Act by the new spending bill. No matter what percentage of the American people want the borders protected, even in war time, a fence will never be built as it contradicts the Globalist agenda, supported by the CFR.

I live in Decatur, just a couple miles from that Wal-Mart site. I’m a tech consultant. I’m telling you, I know whereof I speak, and there is not a single neighborhood OTP that is anything like that Memorial Avenue corridor. Nothing. This is like the neighborhood around Turner Field (to give a point of reference that an OTP’er might be familiar with).

If the new Walmart was in Cherokee County, there would be 1/10th the number of applicants.

The Atlanta job market may be melting at the top, but this Walmart situation is not in any way related to that.

Hi Barry –

I’ve heard the CME Case-Shiller housing futures market is fairly thinly traded (but have no idea how thinly).

I’d be very interested to know how accurate you think this market is …particularly since there are no leading indicators for housing prices beyond maybe a year and this goes out 4 years.

Cheers and thanks for the awesome blog!

I saw that Kudlow and Company mentioned this post on tonight’s show. It seems to me like certain sectors might trade based on an election (ie: the defense sector trading lower on anticipation of a Democratic president because of possible lower military spending), but the current market state isn’t because of Obama surging, or anyone else surging. It’s all about the current state of the economy.

So if thousands upon thousands of the poor downtrodden and huddled masses are breaking down the doors at WalMart for minimum wage jobs, and if this is a sign that the poor downtrodden and huddled masses are looking for work rather than filling out welfare apps, then why in the world do we need 12 million undocumented aliens to “do jobs that ‘mericans won’t do”?

“If the new Walmart was in Cherokee County, there would be 1/10th the number of applicants.”

Of course there would, we have 1/10th the people. What is your excuse for 11,000 applicants in 4 days for a couple thousand jobs at the new KIA plant? are you overlooking the GM closed their Atlanta plant and Ford closed their Hapeville plant? KIA iws in the middle of nowhere, not the downtrodden where you live.

If you are a tech consultant, whatever that is, you must have had a real job at one of the companies no longer here that I listed.

Did it escape you the IBM in no longer IBM and oh yeah there are no IBM employees in it. Did it escape you the AT&T building on Peachtree is no longer AT&T, with no AT&T employees?

Look, if you are disagreeing with me and saying the Atlanta economy is booming then you really don’t know what you are talking about. If you are agreeing with me, you have a funny way of saying.

I am neither agreeing nor disagreeing with you. I’m simply saying that this Walmart on Memorial is not exemplary of the Atlanta jobs market at all.

I believe you are comparing the current and near future tech job market in Atlanta to that which existed in 2000. Why 2000? What was the NASDAQ in 2000 vs. now? That’s data mining.

I never worked for any of the companies you mentioned. I have worked with Peoplesoft, AKA Oracle, and TBS. Atlanta’s ERP consulting market is still booming, probably because we have the 3rd highest number of Fortune 500 HQs in the country. These HQs house tons of tech jobs.

Why 2000? Because 2001 is when IBM sent my job to India. Another day and another 2500 applied for the Walmart job. You have job in tech good for you. But if you think it is booming you better look where Coke and the banks are sending all the jobs – form Atlanta to India.

You think its great good for you and keep voting republcan but don’t tell these people tech is booming in Atlanta without facts to back it up. Anytime there is less of something whether 2000, 2001, 1997, it isn’t booming. Less is not more.