Yesterday, we saw the release of the Leading Economic Indicators (LEI). It was the second consecutive month of a slight rise in the index.

Yesterday, we saw the release of the Leading Economic Indicators (LEI). It was the second consecutive month of a slight rise in the index.

I have not been a fan of the outfit behind LEIs — the Conference Board — as they have, in a very BLS-like manner, continually modified the leading indicators in a way that overstates growth.

Recall that a few years ago, the LEI was reconfigured — mostly to include more financial factors, and less real world economic data. Inthat way, its a bit more like government data. The reconfigurations seem to be avoid showing negatives.

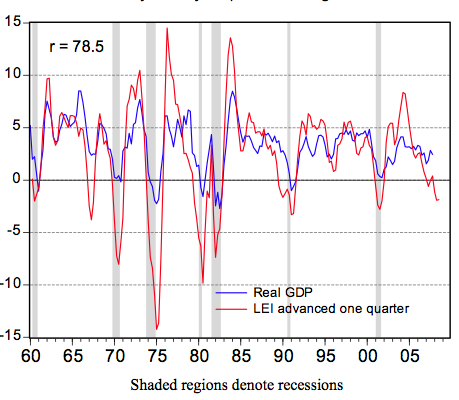

However, I have plenty of respect for the work of Northern Trust’s Paul Kasriel and Asha Banglore. Kasriel warns not to dismiss the LEIs out of hand. Kasriel notes that “year-over-year contractions in the quarterly average level of the LEI usually presage recessions.”

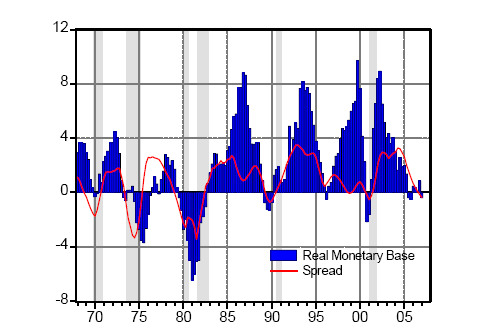

Paul also adds the LEI can be combined with other data points to enhance the reliability of recession forecasts. The “Kasriel Recession Warning Index” is a combination of year-over-year percent change in real monetary base, and 4-qtr. moving average percentage point spread between Treasury 10-yr. yield and fed funds rate. (see chart below)

Further, Kasriel’s colleague, Asha Banglore, notes that “strongly negative readings of the year-to-year change in the LEI are associated with recessions,” with 1966-67 as the sole exception.

This leads me to temper my dislike of the LEI, and try to tease out what lies beneath. So let’s take a look at the LEIs, looking at what caused this increase.

The 0.1% LEI reading was marginally positive primarily due to 3 factors: 1) increasing stock prices (.16); 2) Positive yield curve (.14); 3) An unfathomable 0.13% increase in building permits.

We know the market has bounced 10% since recent lows, and the Fed sure has steepened the Yield curve. So much for the Fed managed portion of the economy — how about the real world?

Building permits up 0.13%? That’s a big WTF? and should be ignored. Consumer expectation and the average workweek both declined 0.19%.

Hence, we see somewhat of a disconnect between the LEI and the real economy.

~~~

For those wanting more info on how to use the LEIs in econometric forecasting, see the article links discussed.

~~~

Index of Leading Economic Indicators (LEI) vs. Real GDP year-to-year percent change

Kasriel Recession Warning Index*

Sources:

U.S. LEADING ECONOMIC INDICATORS AND RELATED COMPOSITE INDEXES FOR APRIL 2008

Conference Board U.S. Business Cycle Indicators

http://www.conference-board.org/pdf_free/economics/bci/LEI0508.pdf

Index of Leading Indicators – Premature to Rule out Recession

Asha G. Bangalore

Northern Trust, May 19, 2008

http://tinyurl.com/4gma4w

LEI and KRWI – It’s Different This Time?

Paul Kasriel

Northern Trust, April 21, 2007

http://www.safehaven.com/article-7404.htm

RECESSION IMMINENT? BOTH THE LEI AND KRWI ARE FLASHING WARNING

Paul L. Kasriel

Northern Trust, March 22, 2007

http://www.financialsense.com/economy/northern/kasriel/2007/0322.html

Leading Indicators Show Economy Remains Sluggish

THE ASSOCIATED PRESS, May 19, 2008

http://www.nytimes.com/aponline/business/AP-Economy.html

Leading Economic Indicators

http://globaleconomicanalysis.blogspot.com/2007/01/leading-economic-indicators.html

Eventually, the LEI will simply be a decibel meter of who shouts the loudest:

1) the patriotic, go-to-work-every-day (but home-schooled) patriots who favor: cuts in top marginal rates, war, and States’ Rights (in certain cases.)

versus…

2) the California-Supreme-Court smooching enemy-appeasers who hate the colors red, white and blue (in that order) and sport I “heart” Hussein Rodham bumper stickers on their lavender limousines.)

‘Further, Kasriel’s colleague, Asha Banglore, notes that “strongly negative readings of the year-to-year change in the LEI are associated with recessions,” with 1966-67 as the sole exception.’

John Williams of Shadowstats says that Lyndon Johnson simply abolished the 1966-67 recession, by ordering government statisticians to tamper with the data. I find this highly believable. All of the economic series show a clear pullback at that time.

Last year, I wrote to Paul Kasriel, urging him not to assign a miss to the model for “falsely predicting” a recession in 1966-67. In all probability, the model was and is correct, while the government data claiming that the then-record expansion continued throughout the 1960s was corrupted by soiled hands, sticky fingers, and a thumb on the scale.

Thus is science contaminated by falsified statistics. Not that economics is a science. It’s revealing, and pitiful, that Paul Kasriel probably is among the handful of economists who’s ever successfully predicted a recession. Where’s his Nobel Prize, I ask you?

http://politicalcalculations.blogspot.com/2006/04/reckoning-odds-of-recession.html

In the tool below, enter the current bond yields for the 10-Year Treasury bond and the 3-Month Treasury bond. You will also need to enter the Federal Funds Rate

The recession indicator of the above-mentioned Website is stubbornly denying any high probability of recession and yet using the Fed model itself having large recognition for accuracy.

I notice that Mr Kasriel ‘s model does not include the trailing 3-months treasury bond, being at odd I am inclined as usual to give to Mr Kasriel all the credit and esteem that his studies deserve.

I will not discard the military discipline and interesting studies of the above mentioned website and I will conclude that interest rates are manipulated.

I love today’s AP treatment of the PPI report. Check out this lovely paragraph:

“The overall moderation in prices primarily reflected how the government adjusts its data to compensate for seasonal changes. Those adjustments showed gasoline prices falling last month even though motorists were seeing prices soar.”

The bigger question is whether the recession will last months or years no?

As for gas and oil prices, let’s hope they stay high enough long enough to keep recent advances in solar, wind, ocean power and mass transit moving.

Another stellar forecast by our Fed. “Oil is not in a bubble, the prices will most likely stabilize at current levels and then slowly decline as market futures prices indicate.” Haven’t we heard this in relation to other markets before (Nasdaq, housing, credit, etc). Bernanke continues to surprise me (in the wrong way).

http://online.wsj.com/public/article/SB121089412378097011-8Vxt5CKCeONJs08NWjR1BDpvcqg_20090518.html?mod=tff_main_tff_top

“What Do the Leading Economic Indicators Reveal?”

That if the FED doesn’t manage to steer us out of this mess while spending our money; that this economy is going down in flames.