I’ve been meaning to go over some of the details in last week’s Housing data. I was surprised to hear several commentators discuss the imminent turnaround in Housing.

Mind you, these were the people who missed the entire significance of Housing before the collapse, who insisted it was contained, and would not infect anything else. “Why are you so obsessed with Housing” I was asked repeatedly by this crowd from 2005 thru ’07. Perhaps I shouldn’t be all that surprised at what the usual crowd of shills and pollyannas states, given their horrific track record.

Recall that back in March, we noted in passing that both Bloomberg and the WSJ had misinterpreted the Existing Home Sales data. I said bluntly they both “got it wrong.” The spin doctors at the NAR scored an unquestionable propaganda victory, with a front page WSJ article that omitted the year over year data.

That led to some back and forth between myself, the reporters, and a senior editor. Our email conversations led me to the inescapable conclusion that many finance journalists simply don’t understand statistics, especially seasonality. (See Existing Home Sales, Non Seasonally Adjusted, Explained).

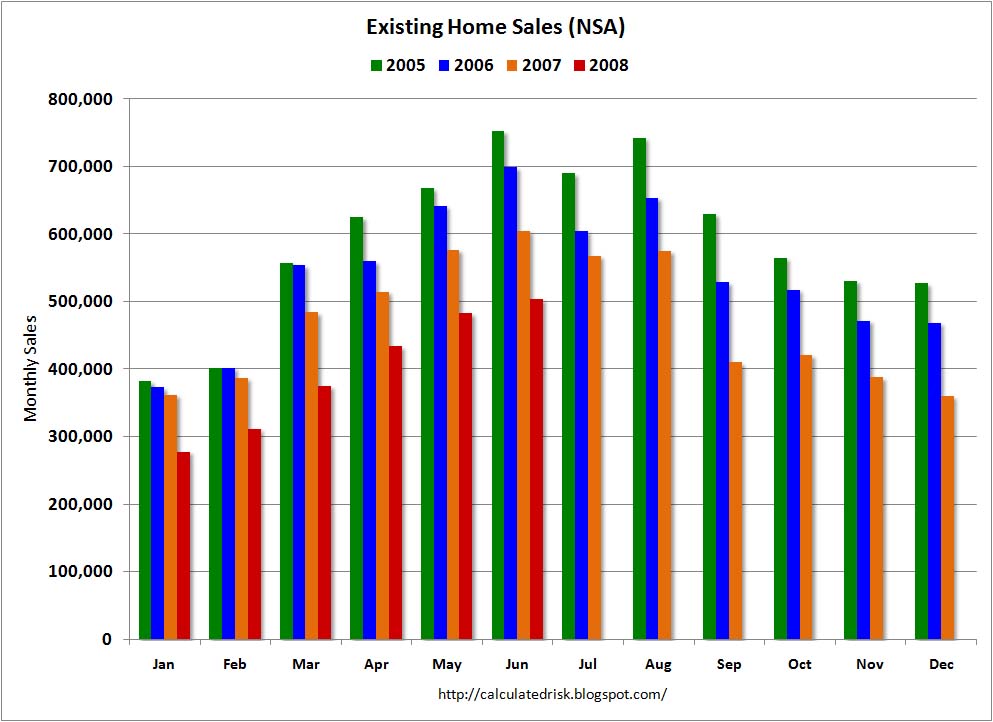

Let’s (once again) look at how seasonality affects home sales, using some charts that may help to explain this.

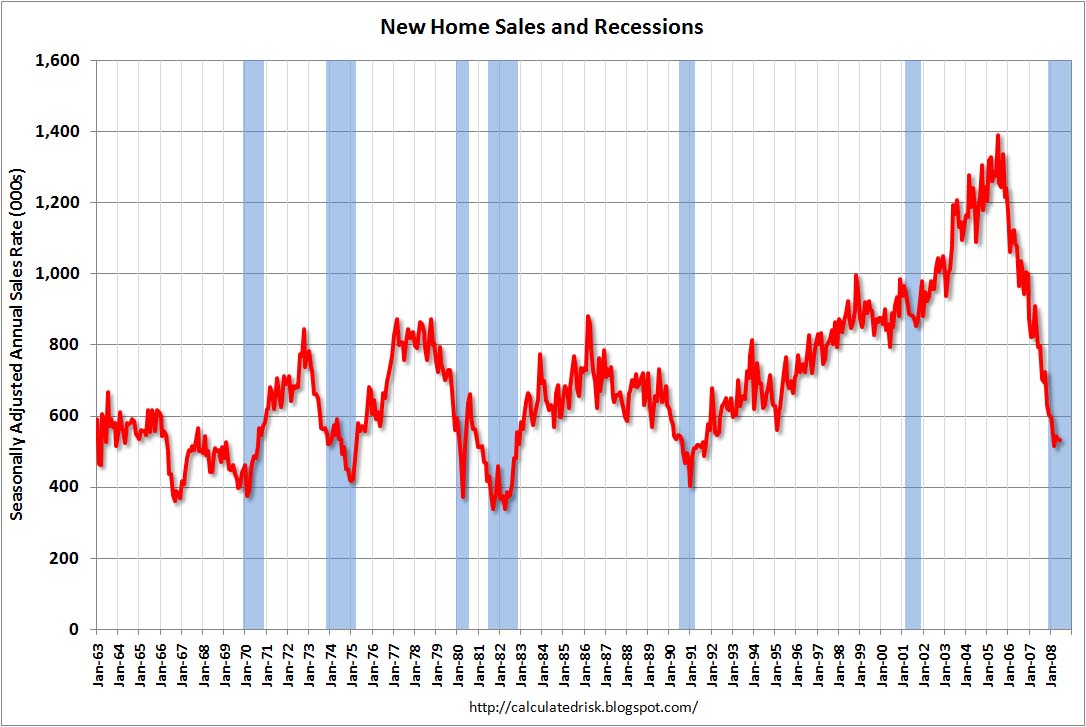

Remember, unlike New home sales, which are reported based on purchase contracts are very different from Existing-home sales (single-family, townhomes, condominiums and co-ops) which are actual transaction closings. New Homes show much less seasonality than existing homes — they tend to peak in March, then drift somewhat lower thru December.

Why? A few ideas: New Homes are a mix of already finished units, some partially built, some mostly finished but waiting for certificates of occupancy — and some have yet to even see ground broken. No one knows when a unit will actually be completed. Everyone I know who bought a new home tells stories of delays and closing postponements waiting to finally move in.

Existing homes sales (about 85% of all house purchases) behave with a more distinct seasonality. A few major and minor factors play into to the pattern, but the big ones are 1) school year, 2) weather, and 3) holidays.

What would you expect from seasonal patterns? Well, Winter weather is a less than ideal time to shop for a home, especially the further North you travel. Snow covered houses are not ideal for buyers to view or inspect — the landscaping and foliage is not visible, flaws may be hidden, roof, vents, A/C not accessible. Then there’s the holiday season. From Thanksgiving to Christmas to New Years, people tend to busy with other things — year end work, holiday shopping, travel, parties, etc.

But the really big one is the school year. As any family with school age children will tell you, its greatly preferred not to disrupt the kids’ school year, and smooth the transition to a new neighborhood in a different school district. The ideal time to start shopping is the Spring. That gives you a few months to look around, find a house, negotiate a transaction. The ideal closing date is between May and August — with the actual move in date is at the end of the school year, but before classes start in September.

Looking at the raw data — Non-Seasonally Adjusted — that is precisely the pattern we see each year.

Existing Sales (closings) bottom in January, as people ware mostly otherwise occupied in the 4th quarter. Closings pick up steadily from there, rising each subsequent month until transactions reaching a high in the month of June, followed closely by August at 2nd, and and July coming in 3rd for total monthly existing home closings. From August, they fall off the rest of the year, plateauing in November/December (perhaps for tax reasons?) and then bottoming in January.

One would imagine that the seasonal adjustments would remove the effects of this, but there are many different ways to apply these adjustments (using four key factors: Seasonal, Trend, Cyclical, and Error). I suspect the adjustments are applied in a neutral numerical way that adjusts for the annual total, but not the odd pattern that accompanies existing home sales (See BLS and Census methodologies for Seasonal

Adjustments at bottom).

Regardless, we can look at the pattern that exists in the non seasonally adjusted data, below:

>

Existing Home Sales, Non-Seasonally Adjusted

Chart courtesy of Calculated Risk

>

New Home Sales and Recessions

Chart courtesy of Calculated Risk

>

Previously:

Existing Home Sales, Non Seasonally Adjusted, Explained (March 25, 2008)

http://bigpicture.typepad.com/comments/2008/03/existing-home-s.html

How Counter-Productive is Realtor Association Spin? (March 25, 2008

http://bigpicture.typepad.com/comments/2008/03/how-counter-pro.html

Related:

Fact Sheet on Seasonal Adjustment in the CPI

Bureau of Labor Statistics

http://www.bls.gov/cpi/cpisaqanda.htm

FAQs on Seasonal Adjustments

US Census Department

http://www.census.gov/const/www/faq2.html

Source:

Graphs: Existing Home Sales

Calculated Risk, July 26, 2008

http://calculatedrisk.blogspot.com/2008/07/graphs-existing-home-sales.html

That led to some back and forth between myself, the reporters, and a senior editor. Our email conversations led me to the inescapable conclusion that many finance journalists simply don’t understand statistics, especially seasonality.

“It’s hard to make a man understand something, when his job depends on not understanding it.”

Do you have any evidence that the NAR’s seasonal adjustment is being done incorrectly? If you can perform the seasonal adjustments properly, then you will get a better view of the trend using the seasonally adjusted numbers.

Just one minor thing about school starting time:

“The ideal closing date is between May and August — with the actual move in date is at the end of the school year, but before classes start in September.”

In my state this year, classes start on August 11. (I understand that other states start school around that time, also.) It used to be that school didn’t start until after Labor Day (a thoroughly sensible date, if you ask me.) The average temperature for August here in the South is in the low to mid 90’s.

Otherwise, an excellent post as usual.

Just one minor thing about school starting time:

“The ideal closing date is between May and August — with the actual move in date is at the end of the school year, but before classes start in September.”

In my state this year, classes start on August 11. (I understand that other states start school around that time, also.) It used to be that school didn’t start until after Labor Day (a thoroughly sensible date, if you ask me.) The average temperature for August here in the South is in the low to mid 90’s.

Otherwise, an excellent post as usual.

Perennial bottom callers. Now that’s rich.

BR – do you still do your Marketletter?

Thanks for an excellent posts as usual. Seems that every time we reach a recession the bottom in the housing market is near. Reading your chart, history would say that within 6-12 month a bottom in the housing market will occur. But, of course, it could be different this time… ;)

Some additional charts from the Census data can be found by clicking through the link of my name. The most interesting to me:

Homeowner vacancies: 10%+ for homes built after 4/1/2000

Rental Vacanies: 25%+ for homes built after 4/1/2000

2.3mm new homes in inventory from Q207-Q208; 1.3mm additional vacancies over that time (~60%)

“Recall that back in March, we noted in passing that both Bloomberg and the WSJ had misinterpreted the Existing Home Sales data. I said bluntly they both “got it wrong.” The spin doctors at the NAR scored an unquestionable propaganda victory, with a front page WSJ article that omitted the year over year data.

That led to some back and forth between myself, the reporters, and a senior editor. Our email conversations led me to the inescapable conclusion that many finance journalists simply don’t understand statistics, especially seasonality. (See Existing Home Sales, Non Seasonally Adjusted, Explained).”

it’s stuff like this that just makes you want to pull your hair out. Have these people taken statistics 101. They are either purposefully spinning this data or lets face it…….they are STUPID……and should not be reporting on said matters.

Interesting parallels of Paulson’s surge:

1) They claim the (fix / war) will pay for itself

2) We’re promoting the American values like (Free enterprise using Socialism / Democracy using war and occupation )

3) (Unlimited / Endless) commitment

4) Those who support the (bill / action) will back pedal when it fails

5) (It’s not really a bail out / It’s not about oil)

6) There will be no (moral hazard / collateral damage)

7) Large (investment banks / defense contractors) will profit

8) (Mortgages / Oil) will stay cheap

9) The Administration ran on a policy of (free markets / no nation building)

10) Bush’s legacy.

11) Nevermind the nabobs, it will only cost (25/60) billion dollars.

Barry,

They knew. Their “faith” in their ability to snow anyone is part of their rigidity. It’s a challenge of wits for them; not a matter of truth or integrity. Remember that most reporters will prostitute their beliefs for money. What makes it worse is the “pride in whoredom” they have which is so popular these days. The damage they do is mostly to the naive but peddling a lie as the “accepted wisdom” ends badly for all concerned.

On a related topic, the anchoring you talked about is being erroded in Vermont housing prices. It’s only a trickle now but it didn’t exist 6 months ago. I’ve noticed many attractive properties coming on the market just below $300,000. So reality is starting to bite.

Here in Minneapolis, I heard through a friend that a new condo building that had sold its first unit for $425K (they had originally marketed them for $500K+, which was absurd) when the building was completed at the end of ’07. They’re still trying to get over $300K for the remaining units but none are moving. Since no other units (there are 12 total) have sold, so they recently held an auction for which just two people showed up. One of the two bid on a unit, and he bid just $145K for it. After a brief discussion with the bank, they took the offer. There are still 9-10 units left to be sold and the realtor I spoke with at a showing yesterday says in 21 years in the biz this is by far the worst she’s ever seen it. At that price, these units will now probably sell (in fact, I’m thinking about snapping one up and renting it out if they’ll take my $145-$150K). They definitely would rent out for anywhere from $1,000-$1,300 a month but likely no more than that, so anything higher than $145-$175K/month wouldn’t work from a rental equivalency standpoint. The building’s nothing special, but in ground parking is included, all new appliances, great floor plan, big 2 BR, 2 Bath, each have their own washer/dryer, and tons of nice amenities like being close to bike/walking paths into the city. That’s a $280K haircut from the first unit that sold. We’re not even close to a “bottom” folks, but reality is SLLOWWWLLY setting in……

this: “They knew. Their “faith” in their ability to snow anyone is part of their rigidity. It’s a challenge of wits for them; not a matter of truth or integrity. Remember that most reporters will prostitute their beliefs for money. What makes it worse is the “pride in whoredom” they have which is so popular these days. The damage they do is mostly to the naive but peddling a lie as the “accepted wisdom” ends badly for all concerned.”

Posted by: AGG | Jul 28, 2008 2:43:32 PM

Is, to me, the heart of the matter.

“It’s a challenge of wits for them; not a matter of truth or integrity.”

In this realm, most of us have a problem–we’re, for the most part, decent people, not deceitful. Our default has been to accept most others as similiar. As such, we’ve been wholly unprepapared to deal with the torrent of disinfo showered on us.

…

We should remember why Revere rode, and recall his message.

@Jeff – The problem w/Condo’s is the monthly association fee. That fee needs to be considered for any rental equivalency calculations.

More bottom calling –

http://www.bloomberg.com/apps/news?pid=20601087&sid=a06KW.qx8Wks&refer=worldwide

Why does Calculated Risk’s chart show a recession starting in Jan of ’08? GDP growth was positive in Q1 ’08 and Q2 estimates are for positive growth as well.

I hear you Jojo and thanks for the heads up. Thanks for the heads up, but condo fees are about $200/month, so even with taxes, insurance and those fees, $145-$150K makes a lot of sense if it can be rented out for $1,200-$1,300/month (that number should cover monthly mortgage payment, assuming 10% down, plus taxes, insurance, and fees). I’ll need to research that first. Don’t think these condos are going anywhere any time soon unless more vultures come in at that level.

“conversations led me to the inescapable conclusion that many finance journalists simply don’t understand statistics, especially seasonality.”

Most people that are driven to profession like journalism are in part, motivated to avoid Maths and Hard Sciences.

they were so wrong when the trend was up. everyone was talking about it like it was going up forever. they were so wrong.

now the trend is down, everyone is talking about it like it will be going down forever. could they be wrong?