Earlier this week, we discussed several anecdotal pieces of evidence that suggested we were closer to the bottom then the top.

Today, we look at specific data and charts that can provide some insight as to how extreme these present levels are. All these suggest to us that we are increasingly close to a bottom that can be purchased for an upside trade of 20-30% from these levels.

NOTE: We scale in over time, in 10% increments, and recognize that the bottoming process can take several months to several quarters to complete. Hence, slowly buying in is the key.

~~~

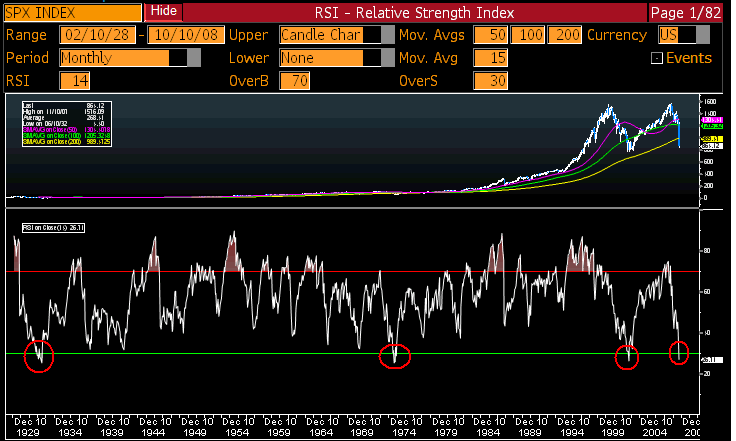

1. Relative Strength Indicator, SPX, 1928-2008

Ever since the beginning of the S&P500, the RSI’s monthly indicator has only dropped below 30 on four occasions: 1929, 1973, 2002, and 2008.

All 3 prior instances were very close to lows.

~~~

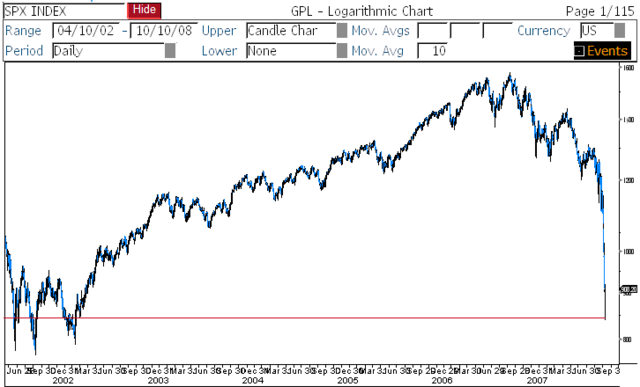

2. SPX Losses

The S&P has given up nearly the entire gain from the 2002-03 period to the October ’07 highs.

This is a major correction that, like the many trading rallies in the 1970s, should set the stage for the next leg up.

Note that these were not buy and hold rallies, but 6 – 18 month trades.

~~~

3. Dow Components and the 200 Day Moving Average

All 30 Dow stocks are below their 200 day moving average — a condition that has only occurred once before — and the last time was right after the 1987 crash.

~~~

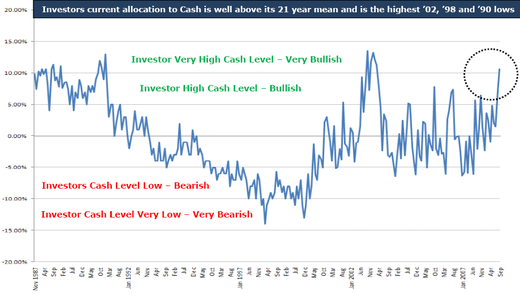

4. Cash Allocation

Investors current allocation to Cash is well above its 21 year mean and are at the highest levels since ’02, ’98 and ’90 lows.

Chart courtesy FusionIQ

~~~

5. 90/10 days

This week has seen three 90% downside days, reflecting massive liquidations.They can only continue for so long.

As noted above, we believe in scaling into long positions. We would become more aggressive buyers after the first 90% upside day. This has historically created a good entry for a 1 to 3 to 6 month holding period.

~~~

6. Percentage NYSE over 200 Day MA

The percentage of stocks trading over their 200 day moving average is at multi year lows:

Yet another historically excellent entry point.

~~~

7. Gold vs SPX

The cost of an ounce of Gold is now greater than the S&P500; This last occurred in the early phase of the 1982-2000 bull market — around 1984.

~~~

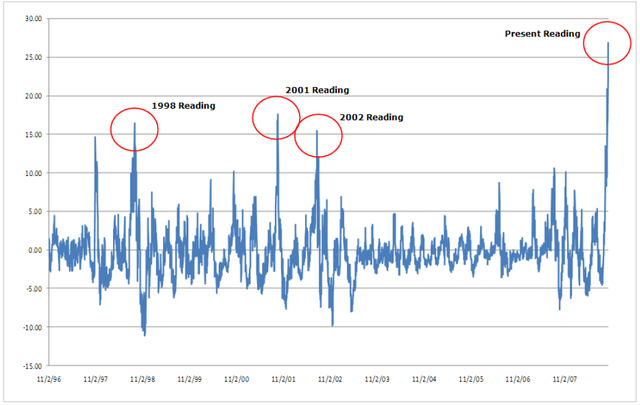

8. VIX Moving Average

The VIX (also known as the Fear Index) hit a multi-year high of 70.90, reflecting extreme levels of emotion in the markets. We like to look at this on a 50 day moving average

VIX Deviation From 50-Day Moving Average

Readings above 15 over the last 10 years have produced significant rallies. The present reading on this indicator is 26!

1998 Reading Market Up + 27 % (3 Months Later) and + 36 % (6 Months Later)

2001 Reading Market Up + 22 % (3 Months Later) and + 22 % (6 Months Later)

2002 Reading Market Up + 14 % (3 Months Later) and + 19% (6 Months Later)

If History bears out this should be a good buying opportunity with a 3 to 6 month horizon.

~~~

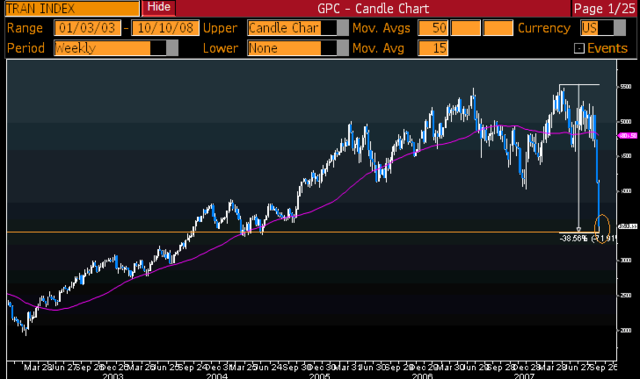

9. S&P500 is down 47% from its peak level one year ago. Transports are down 38%. These are relatively rare degrees of loss, and suggest a near term upside move.

~~~

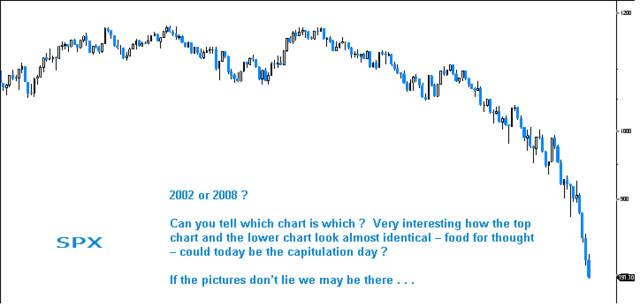

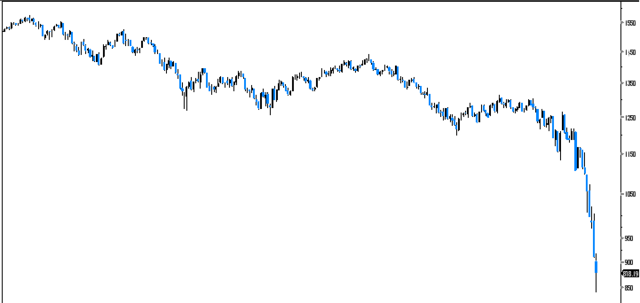

10. The following two charts show the 2002 lows, and the current market. Can you tell them apart?

Highlight for answer: The first chart is 2002, the second chart is current as of 10/10/08

What's been said:

Discussions found on the web: