“Why am I being punished for having bought a house I could afford? I am beginning to think I would have rocks in my head if I keep paying my mortgage.”

–Todd Lawrence, Norwich, CT homeowner with a traditional 30-year mortgage

>

Herein lies the simple problem in trying to “save” so many mortgages: A huge swath of them should not be saved. Some of that is due to price, some of it is due to not wanting to reward irresponsible behavior, but the bulk of it is simply because the people living in these homes cannot reasonably afford to pay for them, even after a 20-30% workout.

There are now more than 10 million “home-owers” underwater, with their mortgages greater than the present value of their homes. Since they have little skin in the game — thanks to banks that did away with down payment requirements — there is little incentive for them to tough it out.

Not surprisingly, it is FDIC Chairman Sheila Bair who is leading the push towards a mortgage workout plan. She wants policy makers to take action to help people stay in their homes — thereby taking pressure off of the FDIC, which insures the banks.

Why? More foreclosures = more bank failures = bigger FDIC obligations.

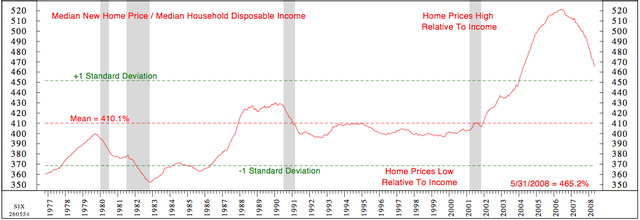

The problem with this current rescue plan is that it is designed to “prevent the continued downward spiral of the housing market.” But that is EXACTLY what the housing market needs — overpriced homes that are not selling need to come down in price. We had a normal price increase from 1996-2001, and then a near vertical set of price gains from 2002-06. Any framework for systematically modifying loans that fails to comprehend that is doomed to failure.

Here is the grim reality about home prices: They remain elevated by just about every historical metric. Look at the median income to median home price, or look at the cost of renting versus the cost of ownership. Look at the inventory for sale, relative to 5 year trailing price increases.

The bottom line is that in much of the country, prices are still too high. That’s reflected in all the inventory that is not selling.

And home sales typically tend to be a chain of prices and sales: The seller of the starter home tot he newlyweds then can move to the larger home with room for their growing family, and that seller moves to an even bigger manse, and so on and so on. But if the newlyweds cannot afford that first purchase, the entire chain gets slogged down.

The notable exceptions? Where foreclosures have driven prices down 40, 50 even 60%, home sales surge. Much of our leadership fails to understand that simple truism about home prices.

As we detailed in our “Fixing Housing Proposal,” you want to save the homes where there is a reasonable justification for a mortgage workout. This means where the home price can be reasonable, the mortgagee can afford it, and the mortgage holder willing to take a modest haircut. Otherwise, you reward bank lenders and home buyers who were utterly reckless, and punish those people who were prudent and responsible.

Moral hazard not only encourages recklessness, it leads to people looking to avoid responsibility for bad decisions. We see this in groups seeking credit card debt forgiveness — only because the current climate encourages it.

Previously:

Fixing Housing & Finance: 30/20/10 Proposal (9/22/08)

http://www.ritholtz.com/blog/2008/09/fixing-housing-finance-302010-proposal/

Sources:

Mortgage Plan May Aid Many and Irk Others

DAVID STREITFELD

NYT, October 30, 2008

http://www.nytimes.com/2008/10/31/business/31bailout.html

Treasury, FDIC Said to Craft Plan to Curb Foreclosure

By Alison Vekshin and Robert Schmidt

Bloomberg, October 29 2008

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=asOlfO5uPwIY

Relief Nears for 3 Million Strapped Homeowners

MICHAEL R. CRITTENDEN and JESSICA HOLZER

WSJ, OCTOBER 30, 2008

http://online.wsj.com/article/SB122531677860781723.html

More U.S. Homeowners Have Mortgage Higher Than House Is Worth

Dan Levy

Bloomberg, October 31 2008

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aYyk2_TLjGao

Groups seek credit card debt forgiveness

(AP) October 29, 2008: 9:47 PM ET

http://money.cnn.com/2008/10/29/news/economy/creditcard_bailout.ap/index.htm

New Loan Fix Is Unlikely the Last

FDIC Plans Mortgage Guarantees; Lawmakers Consider Pressuring Reluctant Investors

JOHN D. MCKINNON and JESSICA HOLZER

WSJ, OCTOBER 24, 2008

http://online.wsj.com/article/SB122477138431362499.html

White House Is Said to Want Limits on Loan-Guarantee Proposal

Alison Vekshin and Robert Schmidt

Bloomberg, October 31 2008

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aQomFeVyf9tk

What's been said:

Discussions found on the web: