Joe Kernan on CNBC continues to get this not just a little bit wrong, but terribly, horribly, mind numbingly wrong.

His favorite NYT article comes form 1999 (he referenced it again this morning). This piece has become a right wing meme: Fannie Mae Eases Credit To Aid Mortgage Lending. The article discusses a 24 bank, 15 market pilot program — teeny tiny in the overall total mortgage market — as if its the Rosetta stone of Housing/Credit crisis.

The article states that “banks, thrift institutions and mortgage companies have

been pressing Fannie Mae to help them make more loans to so-called

subprime borrowers. These borrowers whose incomes, credit ratings and

savings are not good enough to qualify for conventional loans, can only

get loans from finance companies that charge much higher interest rates

— anywhere from three to four percentage points higher than

conventional loans.” It was the lenders themselves who were pressing the GSEs to buy these loans. The private sector lenders were pursuing this market due to fatter potential profits — not Fannie and Freddie.

These facts don’t stop the pundits; nor does an apparent lack of understanding of the actual causes of the housing boom/bust and the credit crisis. Their cognitive dissonance has also prevented them from acknowledging the role deregulation had in these events.

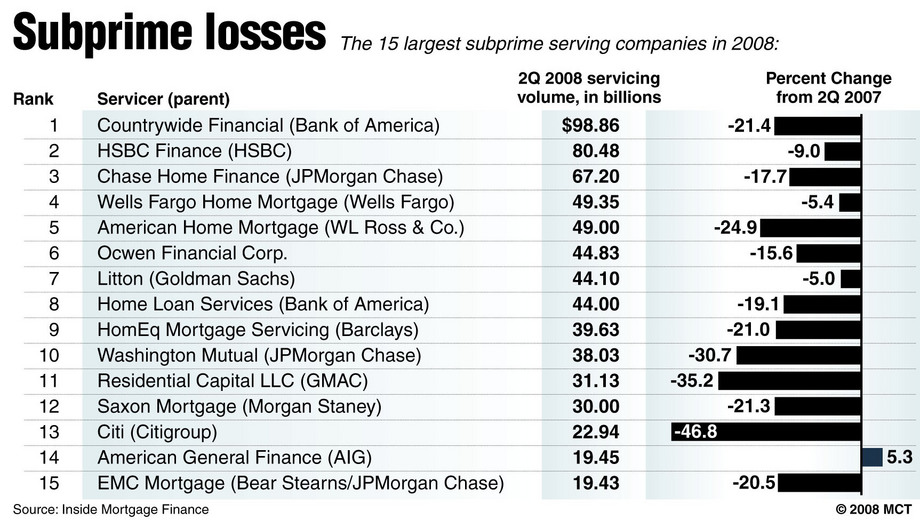

Some people actually look at the data, while others foolishly parrot talking points. Consider this Federal Reserve Board data, compiled by McClathcy. It shows that:

- More than 84% of the subprime mortgages in 2006 were issued by private lending institutions.

- Private firms made nearly 83% of the subprime loans to low- and moderate-income borrowers that year.

- Only one of the top 25 subprime lenders in 2006 was directly subject to the CRA;

- Only commercial banks and thrifts must follow CRA rules. The investment banks don’t, nor did the now-bankrupt non-bank lenders such as New Century Financial Corp. and Ameriquest that underwrote most of the subprime loans.

- Mortgage brokers, who also weren’t subject to federal regulation or the CRA, originated most of the subprime loans.

>

>

The “Blame Fannie/Freddie/CRA” crowd, do provide a service: I know anyone who repeats this meme is an empty headed parrot, a mindless drone without an ability to think. This is a huge timesaver, as it has allowed me to dismiss many of the ditto heads I might have otherwise wasted time on.

So whoever came up with this silly talking point, despite your lack of concern for facts and your attempts at muddying the waters — thanks! You’ve saved me an enormous amount of time in identifying people not to bother reading, and to ignore.

Hat tip Econbrowser

Source:

Private sector loans, not Fannie or Freddie, triggered crisis

David Goldstein and Kevin G. Hall |

McClatchy Newspapers October 12, 2008

http://www.mcclatchydc.com/251/story/53802.html

What's been said:

Discussions found on the web: