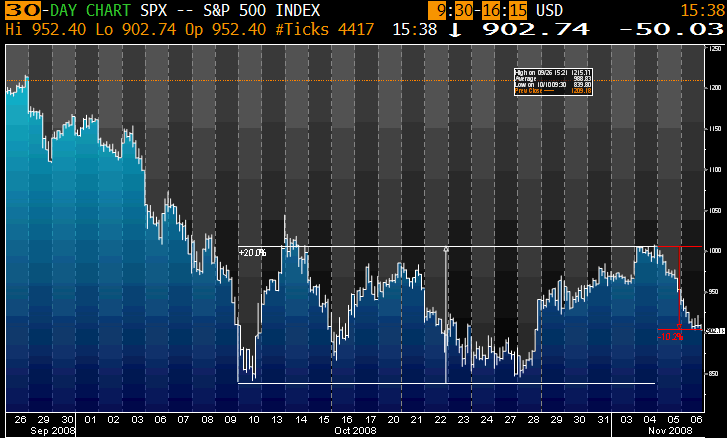

With 15 minutes left in today’s trading, let’s take a quick technical look at the past month’s market action:

>

SPX 30 Days

>

My perspective: This 2 day pullback after the sharp 20% rally from the October 10th lows in the SPX is about a ~50% retracement of the inital rally, as well as the Election Day revisit to those highs. Bloomberg noted that this was the worst two-day slump since 1987.

It appears that forays above the level 1,000 have twice brought out the sellers.

I wonder if SPX 1,000 will become the modern equivalent of the 1970s Dow 1,000 . . .

What's been said:

Discussions found on the web: