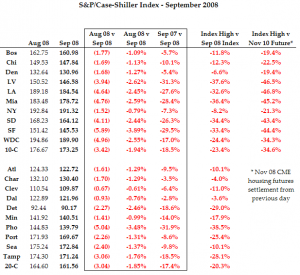

The September S&P/Case-Shiller Home Price Index of 20 US cities fell 17.4% year over year — that is the most on record and is now down 21.7% from its high in July ’06. On a month over month and year over year basis, all 20 cities saw declines.

>

Las Vegas and Phoenix saw drops of more than 30% year over year; 29.5% drop in San Francisco and 28.4% fall in Miami led the pack of mean reverters.

Prices in New York fell 7.3% y/o/y and 5.7% in Boston. The smallest decline was in Dallas, down 2.7%.

The 30 yr FNMA mortgage rate is down now 37 bps today to 5.04% — that is the lowest since mid-September, right after the FNM/FRE conservatorship idea was floated.

Peter Boockvar notes: “The irony as I’ve ranted in the past of the path the Fed has gone down is that too much borrowing and not enough savings got us into this mess and with savings accounts now paying peanuts due to a 1% ff and the Fed trying to force interest rates lower to get people to borrow, the same mistakes are being pushed.”

>

click for bigger table

>

Source:

National Trend of Home Price Declines Continues Through the Third Quarter of 2008

S&P/Case-Shiller Home Price Indices, November 25, 2008

http://www2.standardandpoors.com/spf/pdf/index/CSHomePrice_Release_112555.pdf

TFS Derivatives

Property Derviative

http://www.tfsbrokers.com/property_derivatives.html

What's been said:

Discussions found on the web: