One of the questions I seem to be getting all the time is “When is this recession going to end?”

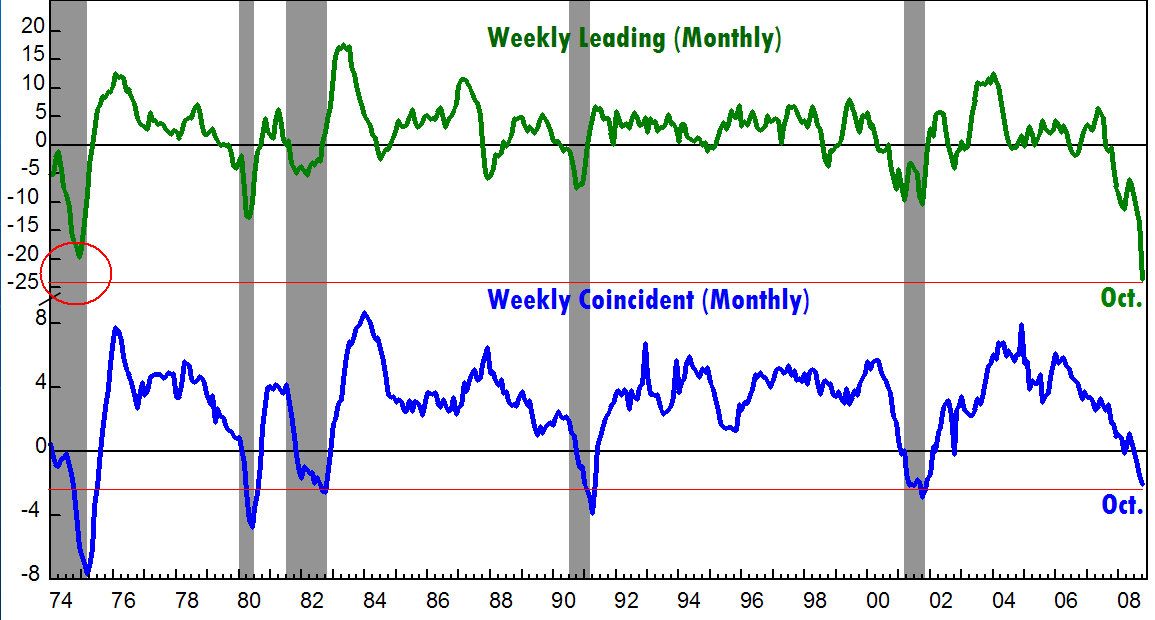

To answer that, I turned to Lakshman Achuthan of the Economic Cycle Research Institute (ECRI). Their leading vs coincident chart provides insight into that question.

The cyclical turns in the leading occur before the coincident — they seem to diverge now and then, and that can be telling.

The current story they tell is clearly one of a quickly worsening recession with no end in sight:

>

ECRI Leading and Coincident Indicators

Source: Economic Cycle Research Institute

>

Short answer: No time soon. . .

What's been said:

Discussions found on the web: