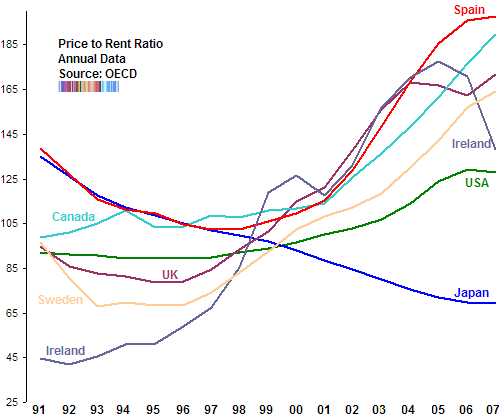

Trader’s Narrative has two excellent charts showing just how overpriced real estate remains on a global basis:

Median Home Price to Median Income Ratio

Purchase Price to Rent Ratio

Source:

Global Real Estate Ratios Show Extent Of Bubble

Trader’s Narrative November 13th, 2008

http://www.tradersnarrative.com/global-real-estate-ratios-show-extent-of-bubble-2066.html

What's been said:

Discussions found on the web: