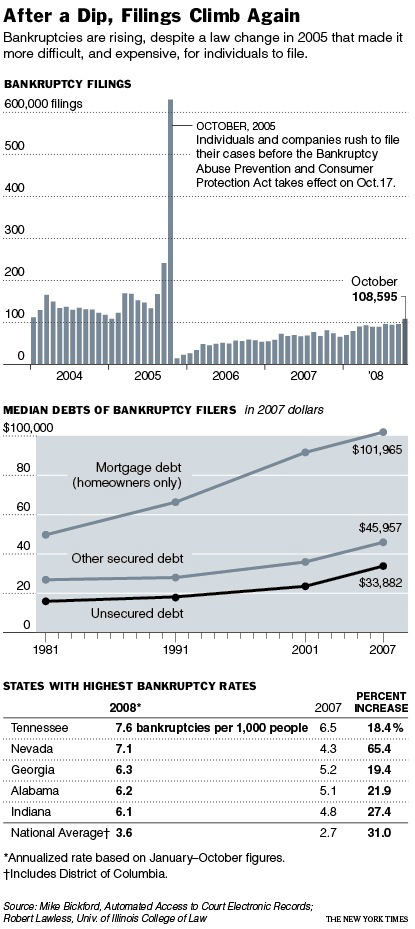

Front page NYT article on the increasing number of personal bankruptcy filings:

The number of personal bankruptcy filings jumped nearly 8 percent in October from September, after marching steadily upward for the last two years, said Mike Bickford, president of Automated Access to Court Electronic Records, a bankruptcy data and management company.

Filings totaled 108,595, surpassing 100,000 for the first time since a law that made it more difficult — and often twice as expensive — to file for bankruptcy took effect in 2005. That translated to an average of 4,936 bankruptcies filed each business day last month, up nearly 34 percent from October 2007.

Let me remind you that this bill was pushed by the credit card industry — mostly based on claims that were factually inaccurate. Now, the same industry weasels who pushed this legislation thru are going back to DC begging for TARP money and a handout.

Question: How long before The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 act — a 1997 credit card industry drafted boondoggle, signed by President Bush — gets revised or even revoked?

The wide-opposed bill — dislike by consumer advocates, legal scholars, retired bankruptcy judges — was passed after the credit card industry spent more than $100 million lobbying for the bill. (See this Bloomberg video on Credit Cards and the TARP)

>

>

Source:

Downturn Drags More Consumers Into Bankruptcy

TARA SIEGEL BERNARD and JENNY ANDERSON

NYT, November 15, 2008

http://www.nytimes.com/2008/11/16/business/16consumer.htm

Update: November 17, 2008 12:32pm

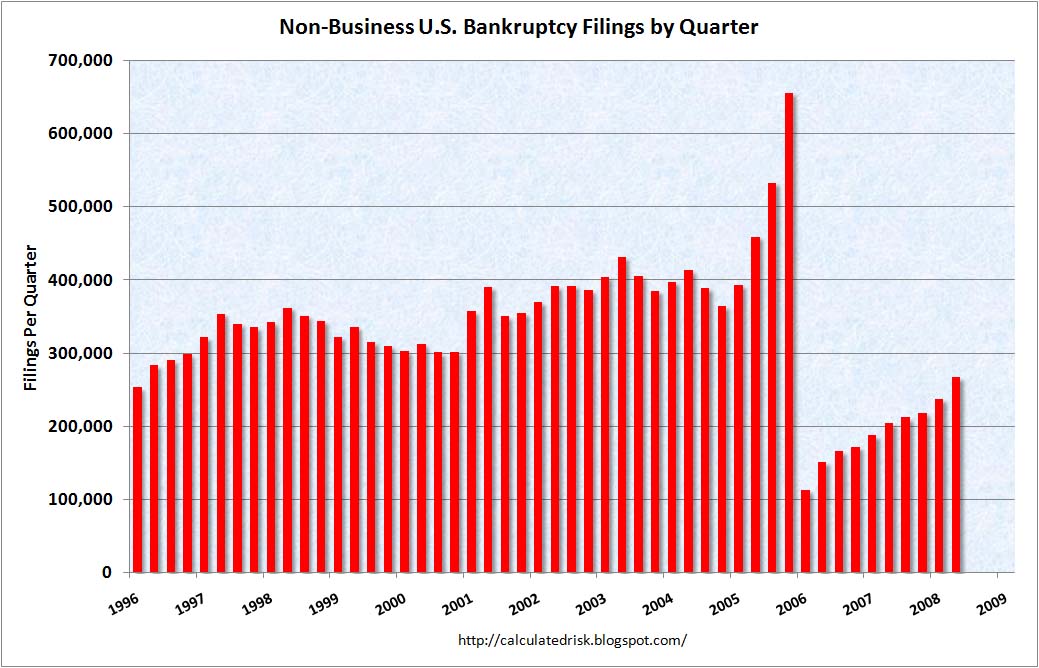

Here is the same chart, only on a quarterly basis, via Calculated RIsk

What's been said:

Discussions found on the web: