There seems to be this idea going around — both parties, both candidates, lots of economists — that the way to “fix” the economy is to stabilize home prices.

There seems to be this idea going around — both parties, both candidates, lots of economists — that the way to “fix” the economy is to stabilize home prices.

This is incredibly misguided. Prices are still terribly elevated, and until they revert back to levels that are affordable and clear out the massive excess inventory of new and existing homes, there can be no stabilization.

Of all the wrong lessons to take from the mortgage, housing and credit crises, this remains the very worst one. If you remotely believe in a free market — even one where players are regulated to prevent their own worst instincts from getting the best of the them — the last thing one should be doing is targeting asset prices. That is what Greenspan did throughout the 1990s and in the early 2000s, and it one of the primary causes of our present woes.

Yes, you can regulate behavior; No, you cannot regulate prices.

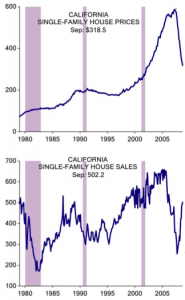

For a classic example of this, have a look at California home sales last month (see chart, top right). Home sales shot up a huge 96.7%. Why? Because home prices fell 40.9% in September alone. Foreclosures and forced sales are driving prices back to levels that are attracting buyers, and are affordable to potential buyers.

Its not just sale prices that reveal how overpriced homes still are today. Have a look at this chart, via Ed Leamer. It was part of a paper he presented at the UC Berkeley – UCLA symposium last week. This chart also shows that prices remain significantly elevated versus rentals.

Chart via Edward Leamer, UCLA

Until price reverts back towards historical norms, the excess inventory will not be removed, the foreclosures will not stop, the total sales will remain depressed. The sooner Washington D.C. figures this out, the better off the economy, and the homeowners and buyers in the US will be.

>

Previously:

Moral Hazard of the Coming Mortgage Bailout (October 31, 2008)

http://www.ritholtz.com/blog/2008/10/moral-hazard-of-the-coming-mortgage-bailout/

Sources:

C.A.R. Reports Sales Increased 96.7 Percent; Median Home Price Fell 40.9 Percent in September

BUSINESS WIRE, October 24, 2008

http://www.businesswire.com/portal/site/google/?ndmViewId=news_view&newsId=20081024005741&newsLang=en

Why are the Cycles in Homes and Consumer Durables So Similar?

Edward E. Leamer

October 2008

http://urbanpolicy.berkeley.edu/mortgagemeltdown.htm

Florida’s Existing Home, Condo Sales Increase in September 2008

Florida Association of Realtors, Oct 24, 2008

http://www.marketwatch.com/news/story/floridas-existing-home-condo-sales/story.aspx?guid=%7B65E7CF76-FF92-41CC-BE21-448C14195B25%7D&dist=hppr

What's been said:

Discussions found on the web: