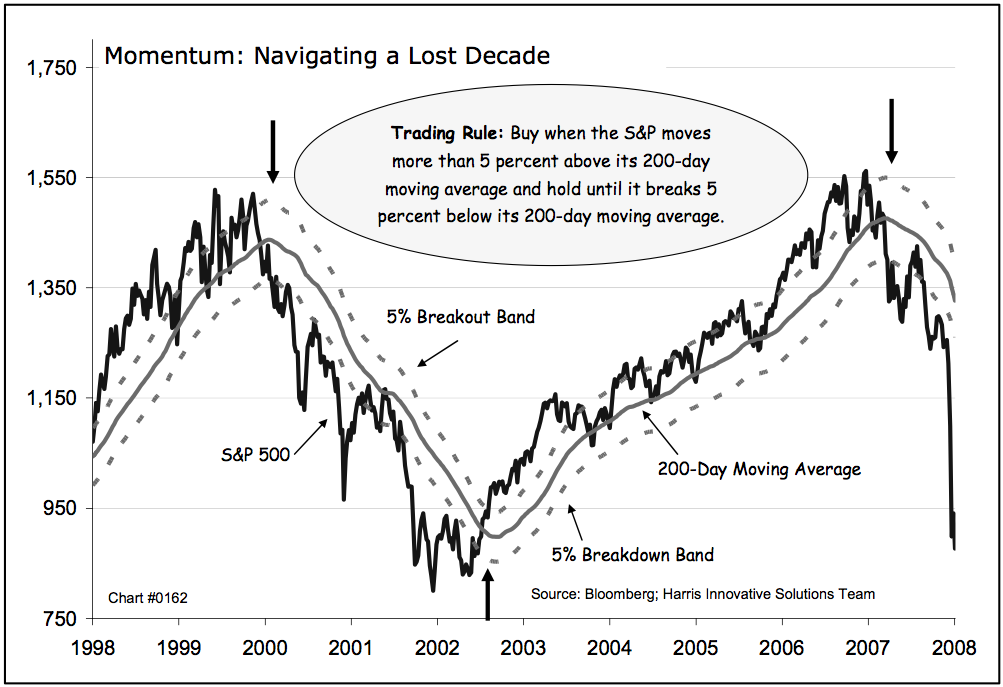

Fascinating chart via Jack Ablin of BMO:

>

I would modify Jack’s rule: In a bear market sell off, you want to buy for the trade in the 15-20% zone, not 5%.

I haven’t backtested the reverse, but I would guess thats true too — selling into a 20% pop over the 200 day moving average in Bull markets.

>

Source:

Playing a Sideways Market

Jack Ablin

BMO, October 31, 2008

U.S. Portfolio Strategy

What's been said:

Discussions found on the web: