>

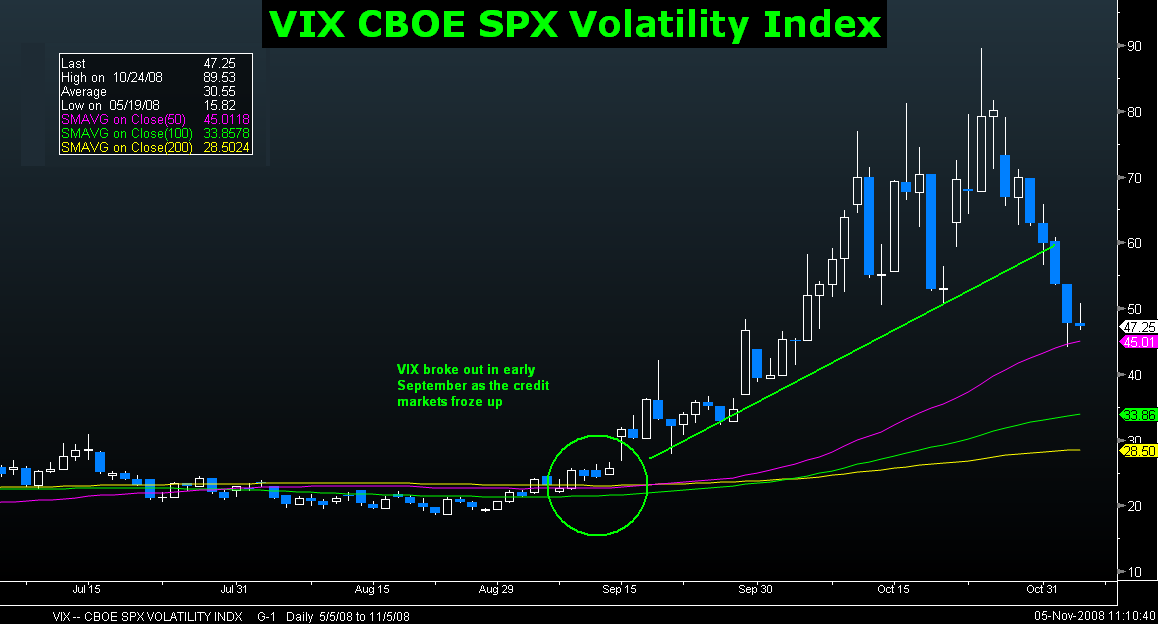

Who could have predicted that traders would be celebrating the decline of the Chicago Board Options Exchange’s volatility index below the 50 mark?

We saw the VIX peak late October, coincident with the worst of the credit freeze and market panic. The VIX closed yesterday at 47.76, down 11%, for the first close below 50 after an incredible run of 21 consecutive days above 50.

The VIX peaked late October, coincident with the worst of the credit freeze and market panic.

Volatility has begun to diminish as investors reduce their worry about the state of the markets, even as the outlook for the economy worsens.

One thing we learned: The prior measure for volatility “highs” around 30 are not reliable entry points for bad dislocations. They have in the past signaled sufficient panic that you could buy in, but that is a level that traders may no longer find much faith in.

Peter Boockvaar reminds us that the VIX has closed above 30 for 37 consecutive days, and may still surpass the period in 1998 during the Long-Term Capital Management debacle where it was above that mark for 50 days.

The current worldwide liquidity crisis may yet take a long time to stabilize . . . and I would expect the VIX to also take an equal amount of time to find a more moderate level.

>

Previously:

Fear Returns to the Markets (September 18, 2008)

http://www.ritholtz.com/blog/2008/09/fear-returns-to-the-markets/

Chart of the Day: VIX versus SPX (June 23, 2008)

http://bigpicture.typepad.com/comments/2008/06/vix-versus-spx.html

10 Year VIX versus SPX (June 24th, 2008)

http://www.ritholtz.com/blog/2008/06/10-year-vix-versus-spx/

What's been said:

Discussions found on the web: