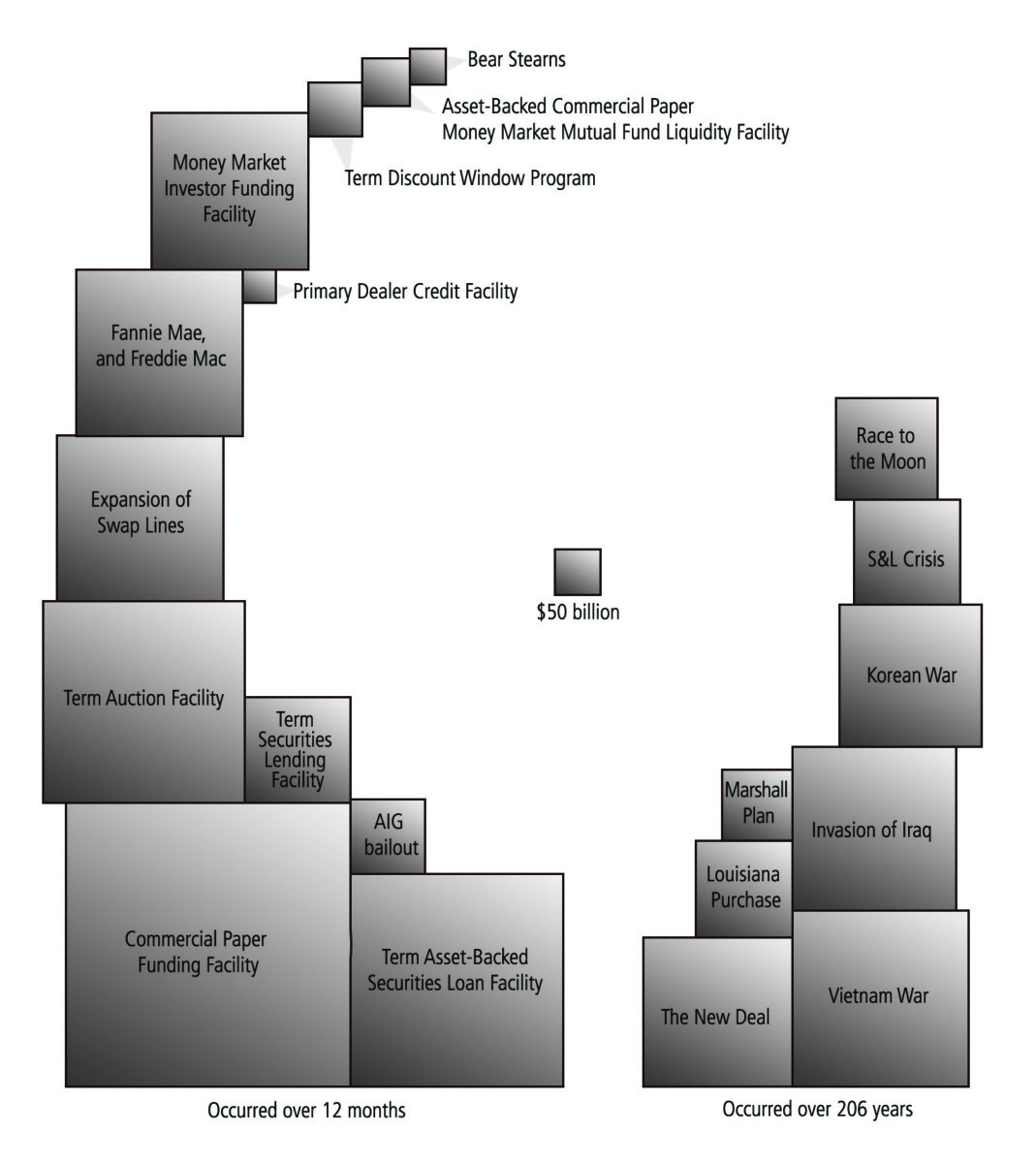

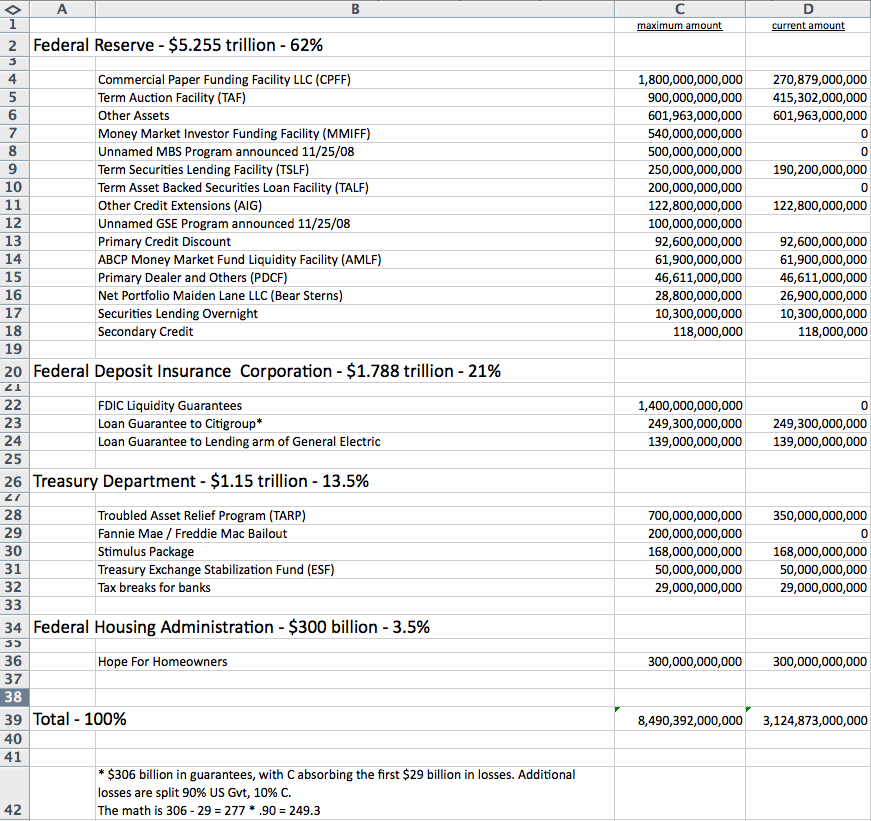

More than a few people have asked me how I came up with the the $8.5 trillion figure for the total cost of the bailouts. Below is a table, plus the Excel Spreadsheet it came from.

Note that this cost does not include the $5.2 trillion in Fannie/Freddie portfolios that the US taxpayer is now also explicitly responsible for.

>

>

Download the Spreadsheet: us-government-rescue-programs.xls

What's been said:

Discussions found on the web: