>

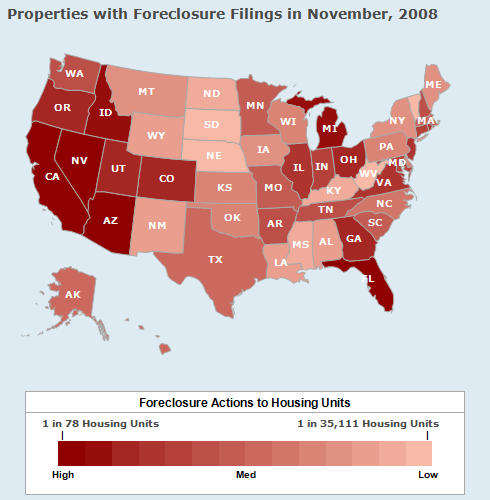

RealtyTrac released its November foreclosure numbers, and they were not pretty.

• November Foreclosure activity decreased 7% from October (the lowest level since June)

• Foreclosures up 28% from year ago levels;

• Foreclosure activity slowed in November due in part to recently enacted laws that have extended the foreclosure process in some states;

• 259,085 properties got a default notice or were warned of a pending auction or were foreclosed on last month;

Realtytrac VP Rick Sharga said: “We’re going to see a pretty significant storm next year. There are two or three clouds that suggest a pretty heavy downpour.” He expects monthly filings to move towards 303,000. The number of homes that revert to lenders, the last stage of foreclosure and known as “real estate owned” or REO properties, will increase to 1 million from as many as 880,000 this year, he said.

>

Sources:

November Foreclosures: Naughty or Nice?

ForeclosurePulse, 12-10-2008 11:47 PM

http://www.foreclosurepulse.com/blogs/mainblog/archive/2008/12/10/november-foreclosures-naughty-or-nice.aspx

FORECLOSURE ACTIVITY DECREASES 7 PERCENT IN NOVEMBER

RealtyTrac, Dec. 11, 2008

http://www.realtytrac.com/ContentManagement/pressrelease.aspx?ChannelID=9&ItemID=5543&accnt=64847

Foreclosure Storm Will Hit U.S. in 2009 as Loan Changes Fail

Dan Levy

Bloomberg, Dec. 11 2008

http://www.bloomberg.com/apps/news?pid=20601213&sid=au1wYjy9hoSE&

What's been said:

Discussions found on the web: