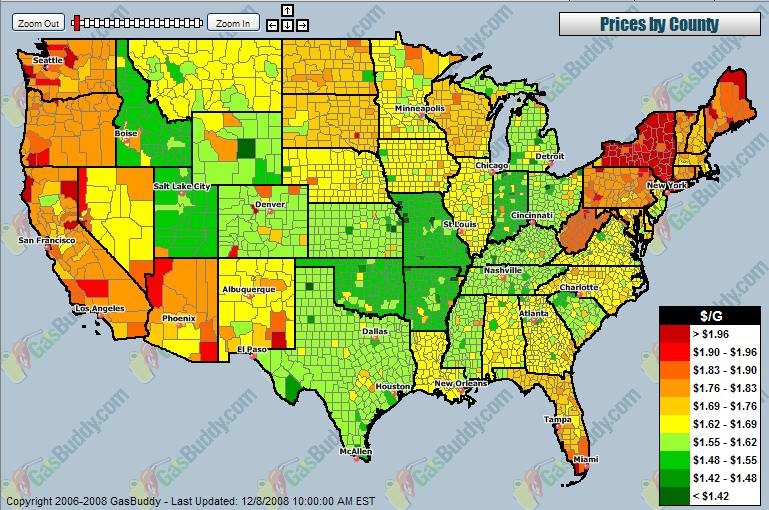

The U.S. average for gas prices dipped to $1.75 a gallon, a near five-year low, a national survey said Sunday. The average price of self-serve gasoline dropped 22 cents in the past two weeks, said Trilby Lundberg, publisher of the Lundberg Survey.

The average, tallied on Friday, was the lowest since the $1.74 average on March 12, 2004.

>

Source:

Survey: Gas prices near 5-year low

Average gasoline price has dropped 22 cents in the last weeks.

CNNMoney.com December 7, 2008: 5:05 PM ET

http://money.cnn.com/2008/12/07/news/economy/lundberg_gas_price/index.htm

Related:

US public transport use surges despite falling gas prices

AFP, December 8, 2008

http://www.google.com/hostednews/afp/article/ALeqM5jldgDT3mWkQ66hDnFvZUiu_zjWRw

What's been said:

Discussions found on the web: