via NYT

Merrill Lynch’s Rich Bernstein adds:

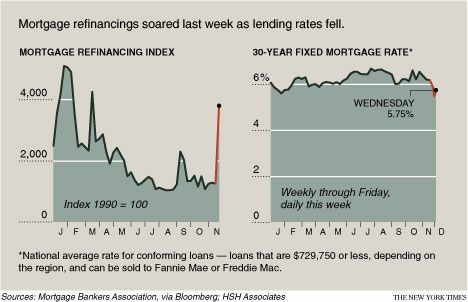

“The weekly percent change of the Mortgage Bankers Association Index of Applications was the greatest since at least 1990. However, a report last night on National Public Radio might lend some insight behind the numbers. The report suggested that mortgage applications, especially for refinancing, were rising. However, the report noted that the gap between applications and approvals was widening because home values have fallen. Situations in which applicants had extremely high credit scores and were up-to-date on mortgage payments were being denied refinancing without going through

the full home appraisal process…If this NPR report is accurate, then it suggests that the stock market has greatly over-reacted to today’s mortgage data. Rather than showing a consumer sector that is ready, willing, and able to purchase a home, it might reflect a consumer sector that is increasingly strapped for cash flow and making multiple applications in hope of being accepted for refinancing.

>

Source:

A Rush Into Refinancing as Mortgage Rates Fall

TARA SIEGEL BERNARD

NYT, December 3, 2008

http://www.nytimes.com/2008/12/04/business/04refi.html

What's been said:

Discussions found on the web: