Live! From World Economic Forum in Davos, Switzerland: Interview with Harvard University Professor Ken Rogoff Bloomberg, January 31, 2009

Read More

David Leonhardt has a huge piece in the Sunday NYT magazine section, titled, The Big Fix. ONE GOOD WAY TO UNDERSTAND the current growth...

Read More

WSJ economics reporter Kelly Evans tells colleague Phil Izzo the economy’s 3.8% drop in the fourth quarter was better than what was...

Read More

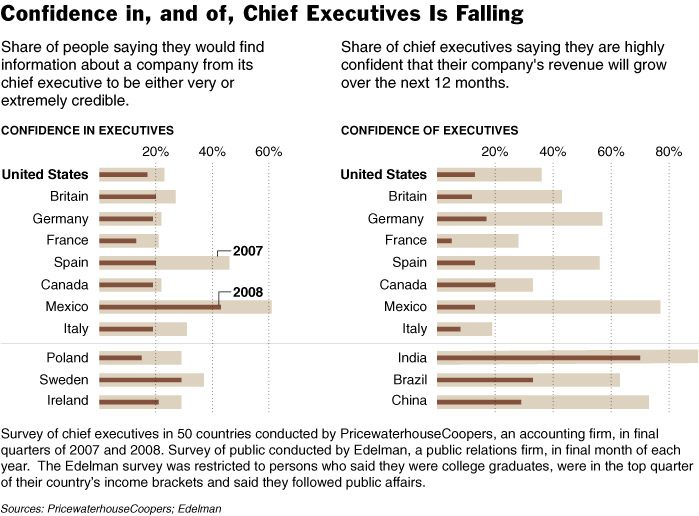

via NYT > Source: A Rise in Pessimism in the Corner Office FLOYD NORRIS NYT, January 30, 2009...

via NYT > Source: A Rise in Pessimism in the Corner Office FLOYD NORRIS NYT, January 30, 2009...

Read More

Yesterday, I was busy dealing with two big projects: John Mauldin’s newsletter, and interviewing new publishers for the next book...

Read More

Trading With the Big Boys January 30, 2009 By John Mauldin This week we are going to do something a little different. I am in Bermuda...

Read More

When the Madoff story first broke, we noted that it “smelled funny” that Bernie was working alone. Now, CBS News suggests...

Read More

Wow, what are the odds of that? 8,000 on the nose! Its the weekend — how about an open thread!

Read More