>

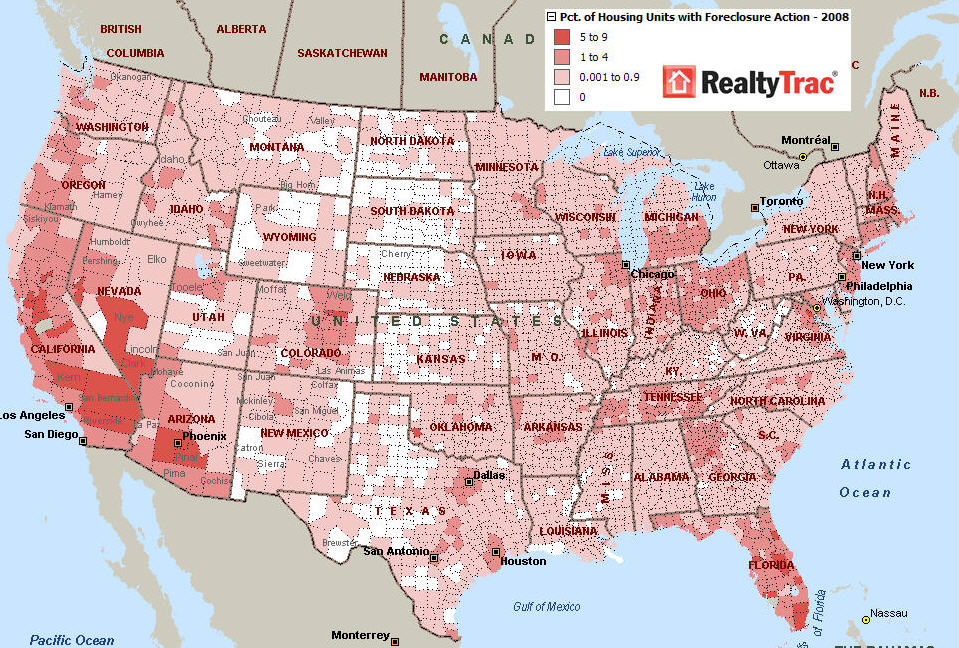

RealtyTrac reported this week that in 2008, the U.S. had a total of 3,157,806 foreclosure filings — default notices, auction sale notices and bank repossessions — on 2,330,483 U.S. properties. This was an 81% increase over 2007, and a 225% percent increase from 2006.

The report also shows that 1.84 percent of all U.S. housing units (one in 54) received at least one foreclosure filing during the year, up from 1.03 percent in 2007.

>

Sources:

2.3 Million Properties with Foreclosure Filings in 2008

http://www.foreclosurepulse.com/blogs/mainblog/archive/2009/01/14/year-end-2008-foreclosure-data.aspx

FORECLOSURE ACTIVITY INCREASES 81 PERCENT IN 2008

RealtyTrac, Jan. 15, 2009

http://www.realtytrac.com/ContentManagement/pressrelease.aspx?ChannelID=9&ItemID=5681&accnt=64847

What's been said:

Discussions found on the web: