We’ve reached the point where things are so bad we can only laugh at it — and that means its time for amusing and silly, time-killing web games.

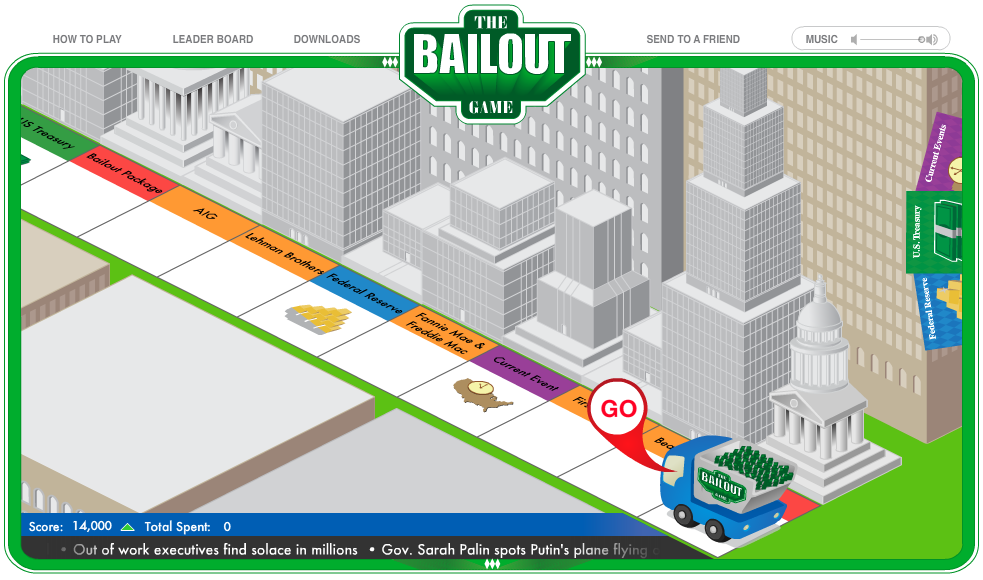

The US Economy is failing. Your job is to save it from economic ruin by choosing which companies live and which can be let go bankrupt. Interactive flash, looks like Monopoly. If you get stuck, you can always “Ask A Greenspan.”

Hey You! Stop playing that stupid game and update that resume !

>

Hat tip David Gaffen, Marketbeat

What's been said:

Discussions found on the web: