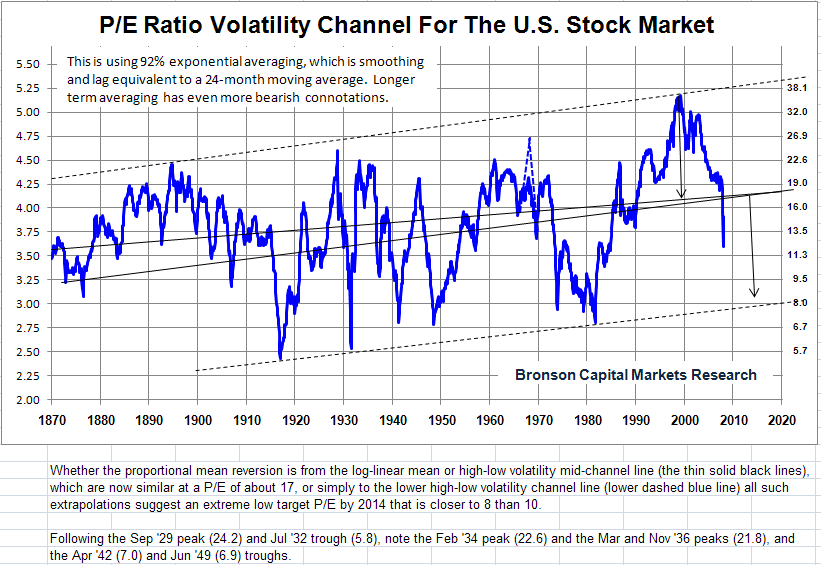

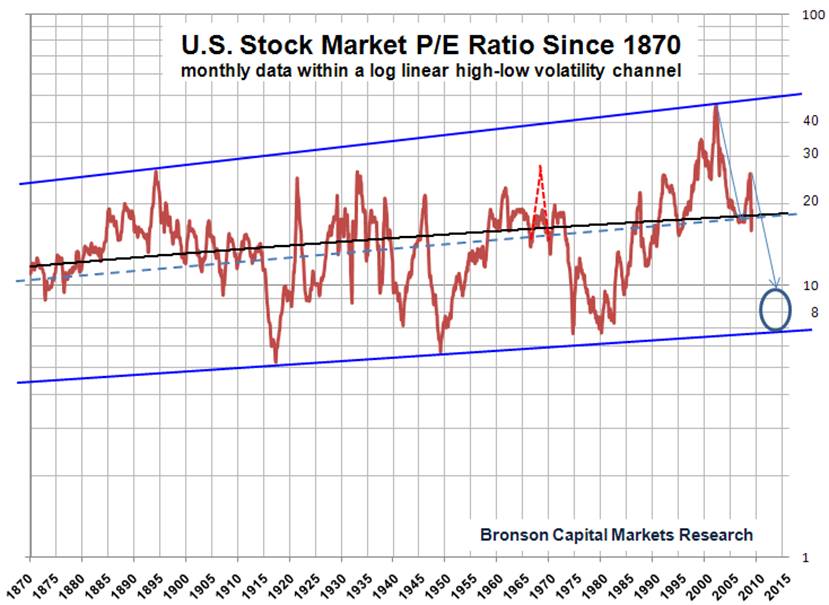

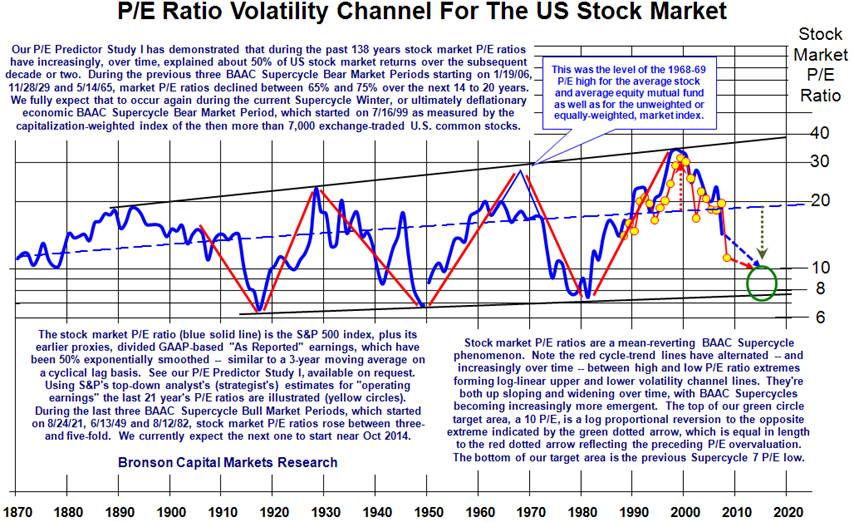

Bob Bronson (BRONSON CAPITAL MARKETS RESEARCH) looks at the long term P/E cycle:

Bob Bronson notes Supercycle Bear Market bottoms have little to do with current P/E ratios. Financial theory and 138 years of history covered in our P/E Predictor Study I demonstrates their only predictive value is if earnings in the denominator are properly averaged over a multi-year period and the results are used to predict stock market prices over the next 10 to 20 years.

It makes no difference if operating earnings or income tax-based NIPA earnings are used instead of “as reported” GAAP earnings, and it makes no difference if exact future earnings are used instead of trailing earnings. Of course, the coming stock market low can be divided by some form of earnings measured over the past or even future four quarters to get a P/E ratio, but it will have no meaningful predictive value for the stock market over the following quarter, year or even over many years. Both history and financial theory support this assertion. The stock market has had a large range of both positive and negative performances for the same such calculated P/E ratio.

>

What's been said:

Discussions found on the web: