Earlier this morning, we discussed how badly the Treasury department, along with Congress, had bungled the bailout monies.

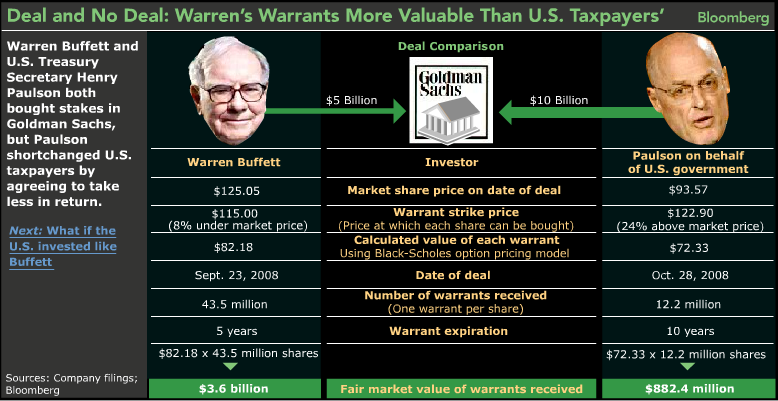

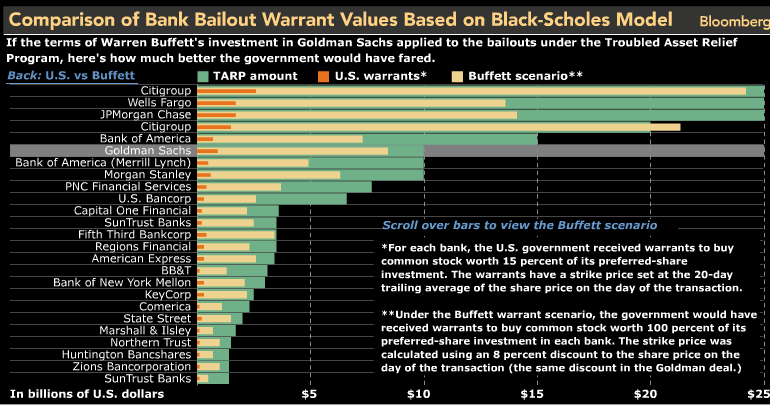

These two graphics show exactly what an awful deal the taxpayer got for our monies.

Buffett’s Better Deal

>

Source:

Paulson Bank Bailout in ‘Great Stress’ Misses Terms Buffett Won

Mark Pittman

Bloomberg, Jan. 10 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aAvhtiFdLyaQ&

What's been said:

Discussions found on the web: