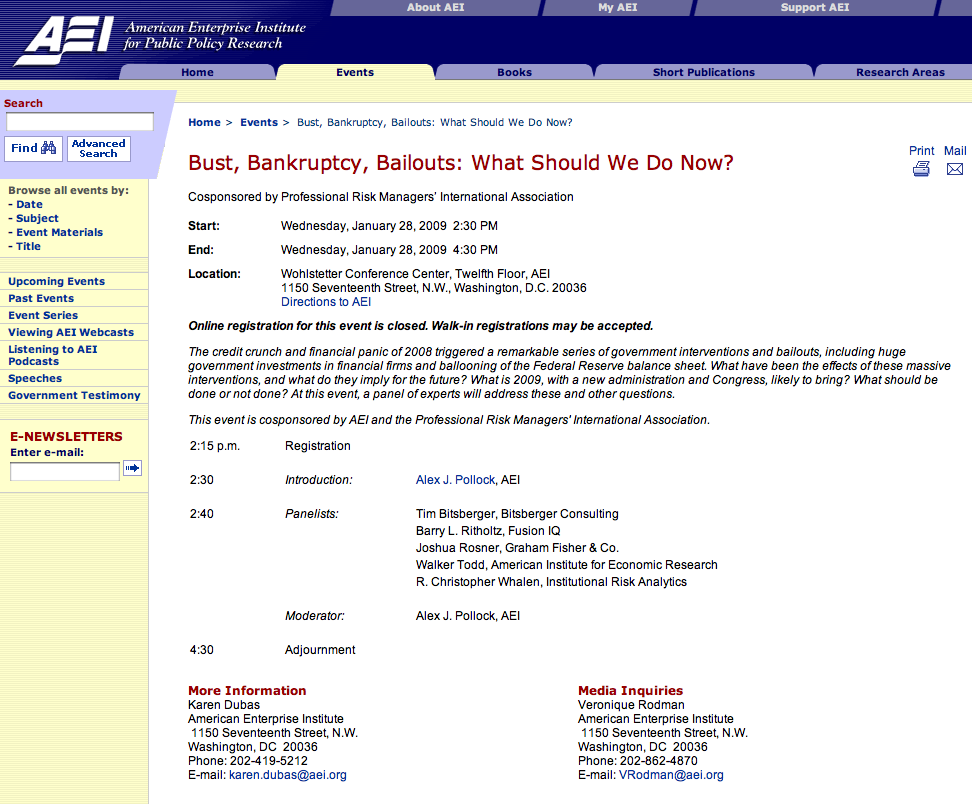

I am speaking at an AEI panel today, with Tim Bitsberger, Joshua Rosner of Graham Fisher & Co., Walker Todd, of the American Institute for Economic Research, and R. Christopher Whalen of Institutional Risk Analytics.

Summary:

The credit crunch and financial panic of 2008 triggered a remarkable series of government interventions and bailouts, including huge government investments in financial firms and ballooning of the Federal Reserve balance sheet. What have been the effects of these massive interventions, and what do they imply for the future? What is 2009, with a new administration and Congress, likely to bring? What should be done or not done? At this event, a panel of experts will address these and other questions.

If you are in the neighboehood, come on by.

What's been said:

Discussions found on the web: