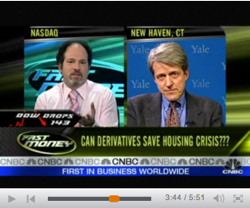

Here’s an interesting exchange on the role of financial innovation in ameliorating–that’s right, making it better–the mess we’ve created with all of the synthetic financial products. In the middle of this Fast Money appearance by Yale’s Robert Schiller, the Zach Karabell asks the most pertinent question. At about 3’44” in the discussion, Karabell wonders if we didn’t have a problem with a few firms trying to “corner the market” in swaps which led to too-big-too-fail counter-party risk.

Here’s an interesting exchange on the role of financial innovation in ameliorating–that’s right, making it better–the mess we’ve created with all of the synthetic financial products. In the middle of this Fast Money appearance by Yale’s Robert Schiller, the Zach Karabell asks the most pertinent question. At about 3’44” in the discussion, Karabell wonders if we didn’t have a problem with a few firms trying to “corner the market” in swaps which led to too-big-too-fail counter-party risk.

Schiller agrees but adds simply that there may be a role for antitrust legislation that will allow us to exploit the risk distribution of the financial innovation–earlier he made the point that regulated exchange would also serve to bring out the bright side of swaps–without the dangers of concentration that existed with AIG.

That raises an interesting wrinkle to the reform we need to think about, and it’s not the New Deal. But more on that later.

Source:

Fast Money

ZACHARY KARABELL and ROBERT SCHILLER

CNBC; January 9, 2009

http://www.cnbc.com/id/28583883