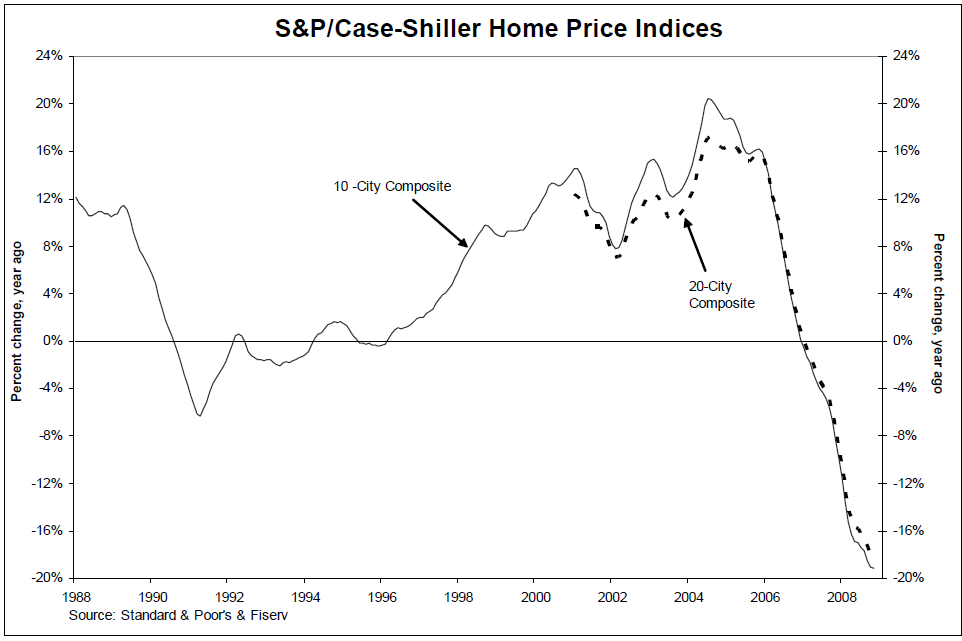

Today’s Case Shiller report for November 2008 showed a 18.2% decline y/o/y for the 20 city Home Price Index. This is the biggest decline in this cycle, and is now down 25% from its price highs of July ’06.

In contrast to the FHFA (formerly OFHEO) home price index, Case Shiller is a 20 city composite index that includes housing at all price levels, including jumbo’s but also foreclosures and distressed properties.

David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s said:

“The freefall in residential real estate continued through November 2008. Since August 2006, the 10-City and 20-City Composites have declined every month – a total of 28 consecutive months. Every region was down in excess of 1% for the November/October period, with eight of the regions recording record monthly declines. Phoenix and Las Vegas were the worst performers for the month at -3.4% and -3.3%, respectively, and also have the lowest returns over the one-year period, returning -32.9% and -31.6% respectively. Overall, more than half of the metro areas had record annual declines.”

Case Shiller Home Price Index:

via S&P

>

Source:

Home Price Declines Continue as the S&P/Case-Shiller Home Prices Indices Set New Record Annual Declines

New York, January 27, 2009

http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,0,2,1,0,0,0,0,0.html

What's been said:

Discussions found on the web: