Terrific l o n g article in the Sunday Times Magazine by Joe Nocera, titled Risk Mismanagement. Its all about how Wall Street developed and still uses VaR — Value at Risk.

The application of VaR remains hotly debated today. Did it contribute to the credit crisis — or was it ignored/misapplied/distorted, and THATS what was a key factor.

Excerpt:

Risk managers use VaR to quantify their firm’s risk positions to their board. In the late 1990s, as the use of derivatives was exploding, the Securities and Exchange Commission ruled that firms had to include a quantitative disclosure of market risks in their financial statements for the convenience of investors, and VaR became the main tool for doing so. Around the same time, an important international rule-making body, the Basel Committee on Banking Supervision, went even further to validate VaR by saying that firms and banks could rely on their own internal VaR calculations to set their capital requirements. So long as their VaR was reasonably low, the amount of money they had to set aside to cover risks that might go bad could also be low.

Given the calamity that has since occurred, there has been a great deal of talk, even in quant circles, that this widespread institutional reliance on VaR was a terrible mistake. At the very least, the risks that VaR measured did not include the biggest risk of all: the possibility of a financial meltdown. “Risk modeling didn’t help as much as it should have,” says Aaron Brown, a former risk manager at Morgan Stanley who now works at AQR, a big quant-oriented hedge fund. A risk consultant named Marc Groz says, “VaR is a very limited tool.” David Einhorn, who founded Greenlight Capital, a prominent hedge fund, wrote not long ago that VaR was “relatively useless as a risk-management tool and potentially catastrophic when its use creates a false sense of security among senior managers and watchdogs. This is like an air bag that works all the time, except when you have a car accident.” Nassim Nicholas Taleb, the best-selling author of “The Black Swan,” has crusaded against VaR for more than a decade. He calls it, flatly, “a fraud.” . . .

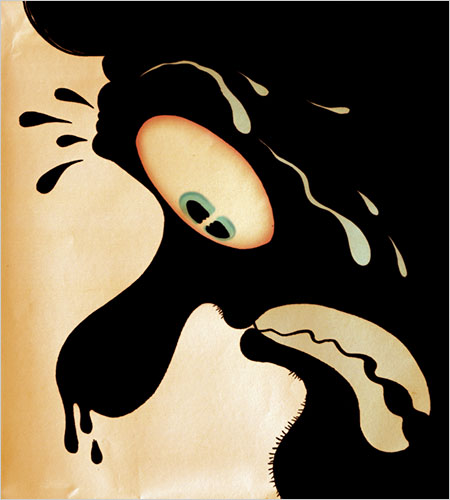

What will cause you to lose billions instead of millions? Something rare, something you’ve never considered a possibility. Taleb calls these events “fat tails” or “black swans,” and he is convinced that they take place far more frequently than most human beings are willing to contemplate. Groz has his own way of illustrating the problem: he showed me a slide he made of a curve with the letters “T.B.D.” at the extreme ends of the curve. I thought the letters stood for “To Be Determined,” but that wasn’t what Groz meant. “T.B.D. stands for ‘There Be Dragons,’ ” he told me.

Best line in the article: “When Wall Street stopped looking for dragons, nothing was going to save it.”

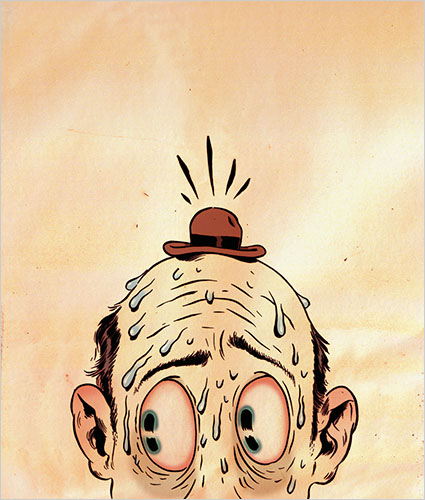

I particularly loved the graphics and illustrations that were part of it:

Cover Image

>

Source:

Risk Mismanagement

Joe Nocera

NYT Magazine, January 4, 2009

http://www.nytimes.com/2009/01/04/magazine/04risk-t.html

What's been said:

Discussions found on the web: