It is one thing when the best-paid people seem to be the smartest and the most accomplished. Those who make much less may not like it, but the differential seems understandable. It is another thing when those people are shown to have committed huge blunders that would have driven their companies out of business, and them into the unemployment line, but for government bailouts.

So it is now with Wall Street. In both Europe and the United States, antipathy toward the bailout is rising amid complaints that the money has not helped the economy by encouraging loans, but has kept the bankers in Champagne and caviar.

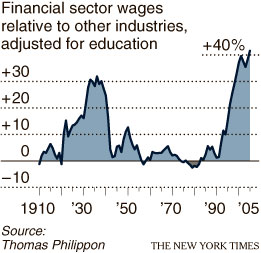

Are financial workers overpaid? And if so, will it continue? The answers, according to a new study by two economists, are yes, they are overpaid, and no, it will not last.

“Wages in finance were excessively high around 1930 and from the mid 1990s until 2006,” wrote Thomas Philippon of New York University and Ariell Reshef of the University of Virginia, in a National Bureau of Economic Research working paper released this week, “Wages and Human Capital in the U.S. Financial Industry, 1909-2006.”

Gee, I wonder why taxpayers are upset at the bailouts . . .

Source:

Wall Street Paychecks May Wither

FLOYD NORRIS

NYT, January 23, 2009

http://www.nytimes.com/2009/01/23/business/23norris.html

What's been said:

Discussions found on the web: