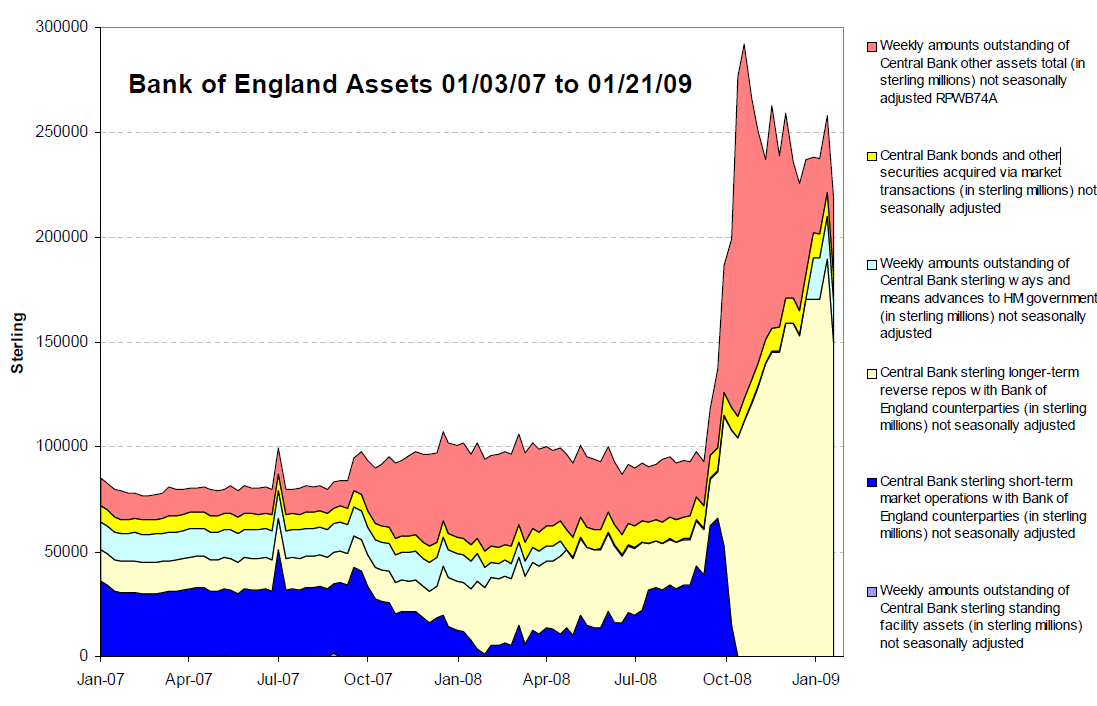

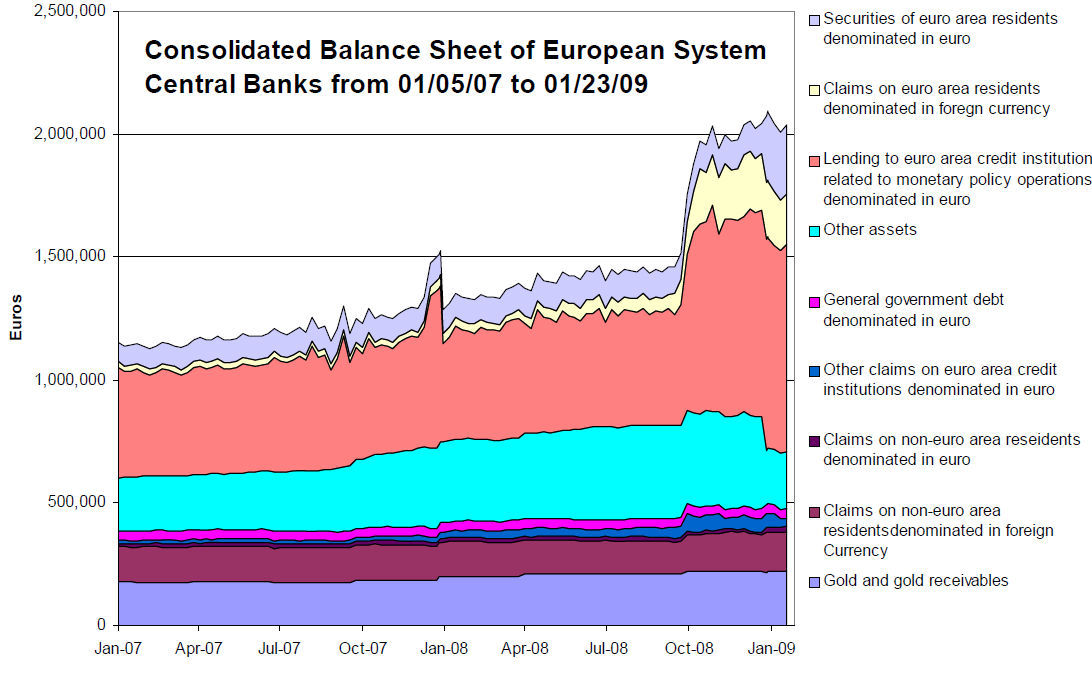

Its not just the Federal Reserve that has seen its balance sheet skyrocket — the European Central Bank and the Bank of England have also ramped up the assets they hold significant in their attempt to unfreeze the credit markets:

>

Bank of England

>

European Central Bank

>

All charts via David Kotok, Cumberland Advisors

>

Previously:

Reserves and Off Balance Sheet Securities Lending (June 27th, 2008)

http://www.ritholtz.com/blog/2008/06/reserves-and-off-balance-sheet-securities-lending/

What's been said:

Discussions found on the web: