Over the weekend, a hedgie friend added to our understanding of how bad GDP really was.

We already knew that the rise in inventory contributed 1.29% points to GDP growth. Without the inventory build, the GDP number would have been down 5.1%.And, it means that we are likely looking at a very ugly Q1 GDP.

What we also knew that the deflator fell 0.1% — the first decline since the 1954. If on top of inventories, the deflator had risen 0.4%, as consensus expected, GDP would have been down -5.6%.

What else was buried in the GDP report besides inventory and falling prices that was artificially goosing the data?

The answer? TARP. It turns out that the TARP money given to banks as recapitalization was a major factor in the total GDP number. (but see update below)

How? Uncle Sam buying a financial asset does not contribute to GDP under normal circumstances. But the Treasury purchased these assets at prices discounted to market prices. (Not as cheap as Buffett’s purchases, but still at somewhat of a discount).

The Bureau of Economic Analysis, my hedgie friend informs me, records this purchase as a Capital Transfer — its the difference between the price paid and the fair market value. Capital transfers are based on Congressional Budget Office estimates, by reducing net government borrowing or lending.

From the Technical Note of the GDP release:

Troubled Asset Relief Program

In October 2008, the Emergency Economic Stabilization Act of 2008 established the Troubled Asset Relief Program (TARP). Among its provisions, the act authorized the Department of the Treasury to purchase or insure up to $700 billion in assets to alleviate the financial crisis. By the end of the fourth quarter, the program had disbursed $243 billion to banks and other institutions in exchange for shares of preferred stock and warrants. The program also disbursed a $4 billion loan to General Motors in the fourth quarter.

Purchases of financial assets are generally not recorded in the GDP accounts (though they appear in the Federal Reserve’s flow of funds accounts). However, when the Treasury purchases a financial asset (other than a loan) at more favorable terms than are available in private markets, BEA records a portion of the purchase as a capital transfer, calculated as the difference between the actual price paid for the financial asset and an estimate of its market value. This treatment is consistent with the recommendations of the newly updated international guidelines, System of National Accounts 2008. For the fourth quarter, in most cases BEA’s estimates of these capital transfers are based on Congressional Budget Office estimates, which are prepared on a net present value basis. The recording of a capital transfer in the GDP accounts does not affect GDP or net government saving, but does reduce net government lending or borrowing.

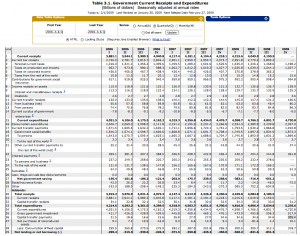

The data on capital transfer payments do not appear in the GDP news release tables, but will be presented on BEA’s Web site in NIPA tables 3.1 and 3.2 and in underlying detail table 5.10U. (emphasis added)

Let’s go to the table 3.1:

Update: Since GDP is reported as a quarterly data point, the “change in capital transfers from 3Q 08 to 4q08 was net $271 billion.” Meaning, this was about 8-10%. of the reported US economic activity — a significant (and artificial) goosing.

And there you have it: Pour billions of dollars into insolvent banks, goose the GDP for your troubles.

Ain’t DC grand?

>

UPDATE: February 2, 2009 2:15pm

Several readers have told my that BEA does not book TARP purchases as a GDP booster.

Quote: “These investments are being booked on the government’s accounts at “fair value” but they have no impact on GDP.”

I’ll see if I can verify this further . . .

>

Source:

Technical Note

Gross Domestic Product

Fourth Quarter of 2008 (Advance)

January 30, 2009

http://www.bea.gov/newsreleases/national/gdp/2009/tech408a.htm

Gross Domestic Product (GDP)

8:30 A.M. EST, FRIDAY, JANUARY 30, 2009

http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

http://www.bea.gov/national/index.htm#gdp

What's been said:

Discussions found on the web: