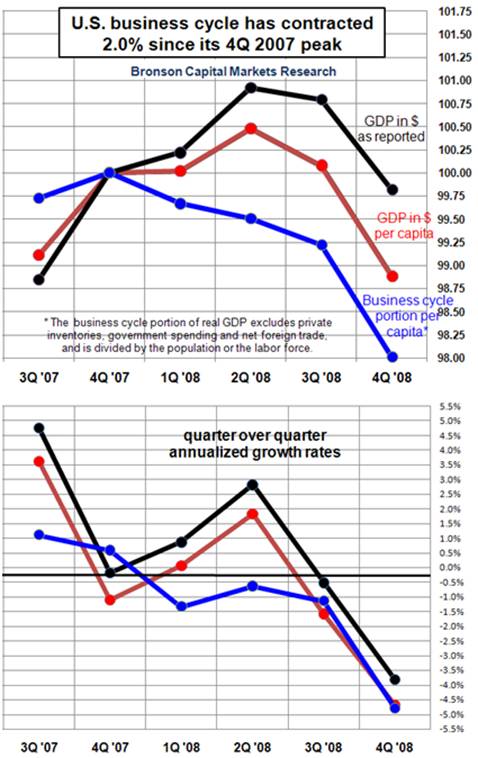

Bob Bronson observes:

“GDP charts showing instead of -3.8% for 4Q it was -4.8% when properly adjusted for both the business cycle components and/or (as it turns our) for the growth in population or the labor force.

And because of a huge pop in involuntarily accumulated inventories, working them off will cause 1Q ’09 to be even worse than the reported -3.8% for 4Q ‘08, which is an important contribution to the stock market making its selling panic low during the current quarter, which is probably the “worse point in the recession,” or when it reaches its peak negative acceleration, consistent with the history of most bear market lows.

>

What's been said:

Discussions found on the web: