Paul Brodsky & Lee Quaintance run QB Partners, a private macro-oriented investment fund based in New York.

~~~

This month, as promised, we give gold and the Fed a break from our raves and rants for a more diverse menu:

1. Lee’s Tier-One, Non-Risk Adjusted Paella

2. Put us in Coach, We’re Ready to Play

3. Hedge Funds & PIPs

4. MBS agency fixed-rate structured IOs – four modifiers, two acronyms, one good investment play

Lee’s Tier-One, Non Risk-Adjusted Paella

Ingredients (use an authentic paella pan) for serving up to 8 people:

4 large yellow onions (chopped in half and then sliced)

4 large green peppers (diced)

6 large tomatoes (diced)

8 cloves of garlic (halved)

2 large links (12 or so inches each) of Chorizos (Spanish sausage)

8 large chicken thighs (browned in olive oil – can then be baked awhile under foil cover to tenderize)

2 quarts chicken stock (add saffron and chopped fresh parsley to stock and heat)

8 good handfuls of Spanish Bomba Paella Rice (Italian-style Arborio rice can be used as well – easier to find)

Preparation:

1) Combine Chorizos (sliced into bite-sized pieces), veggies and garlic in frying pan with a liberal splash of olive oil and reduce until soft and cooked throughout (you can cover the pan and simmer for awhile – stir occasionally)

2) Once browned and heated through, add chicken thighs to well-oiled cold paella pan (olive oil)

3) Add the simmered-down veggies evenly around the breasts

4) Add a bit of wine if you like (any old white will do)

5) Evenly disperse the rice around the pan (not on top of the chicken thighs as it won’t take the liquid as well)

6) Add a few ladles of broth to the pan and put the pan on medium heat

7) As the paella cooks, gradually add more broth as needed to soften the rice – move all ingredients around as they cook to prevent burning/sticking

8) Cook until rice is done to taste

9) Let rest for 15 or so minutes before serving

Folks, paella is what you want to make of it. You can add peas and any other veggie when it comes time to spark it up. Shrimp and other delicate fish and shellfish should be added near the end so they maintain their flavor and firmness. I typically steam some clams on the side and add the broth to the pan when cooking as well. The clams, once open, may simply be placed on top of the finished product. Add any spice you like while cooking. It’s really a dish that you’ll never prepare the same each time to put it together. That’s OK and makes it more interesting. Enjoy.

Put Us in Coach, We’re Ready to Play

We just completed our second full year on January 31. One dollar invested in the fund on February 1, 2007 would be worth about $0.90 today. It would have been better to have placed all our money in gold bullion over that time – $1.42 (COMEX spot) or long-term Treasuries -$1.19 (TLT Index). A dollar invested in the S&P 500 would be worth $0.58 (not including dividends) and a basket of commodities – $0.74 (CRB Index).

We think the principles behind many of our monthly letters over the past two years – namely that global policymakers would ultimately be forced to greatly compromise the real value of their currencies so they might protect nominal output and asset values – is finally starting to gain traction. The fund is highly concentrated in assets we feel would best exploit this macroeconomic view. We believe our core positions will produce substantial nominal gains that overwhelm true inflation, which, as we see it, is already substantial and will continue to accelerate. Global money and credit growth is growing at a double-digit annual pace, which better reflects the true loss of purchasing power than more popular price baskets currently indicate or that demand destruction implies.

We think more capital would be accretive to fund returns presently. It is time and we are, as they say, “all in”. We reduced the fund’s minimum investment from $1 million to $500,000. The fund has a best-in-class outside administrator (Pinnacle Administration) that directly accesses the fund’s daily records and statements from Citigroup, the fund’s prime broker. Pinnacle interfaces directly with Deloitte and Touche, which in turn generates the fund’s financial statements and produces the fund’s annual audits. Deloitte also produces limited partner K-1s. Investors commit for one year at a time (a rolling one-year lock up), based on their subscription anniversary dates. The first $100,000,000 million in subscriptions (aggregated across US and Cayman funds) are classified as “Class B” subscriptions, eligible for gradually declining management and performance fees as total assets rise above $100,000,000. (Should gross assets of US and Cayman funds exceed $1 billion, Class B investors would pay a quarterly management fee of 10 basis points and no performance fee.) We feel the fund’s structure combines proper incentives and rewards for early investors and adequate disincentives to potential hot-money investors capable of compromising its stability. We accept money from accredited investors only, and only in amounts small enough relative to their investment portfolio so that each doesn’t threaten to corrupt the independence of our investment strategy or the quality of our funding. Producing stable monthly returns is not an objective of the fund.

Hedge Funds & PIPs

We’ve given the hedge fund business a little thought over the years. We think the following points make sense.

1. Privately syndicated investment pools should not be considered an asset class and they should have never been promoted as “an industry”. Various strategies and degrees of portfolio leverage within and across hedge funds may give them different risk/return profiles than other vehicles investing in the same asset class. Since generating a different risk/return complexion could also be achieved by adjusting the asset/cash/borrowing exposure in more conventional vehicles, labeling hedge funds “an asset class” seems absurd. They are more accurately conduits for strategies, leverage and, in a perfect world, independence.

2. Hedge funds should be cottage businesses that attract independent-minded managers and investors willing to take market risk and who are willing to benefit accordingly or suffer the consequences. The scale of “the industry” is naturally shrinking to reflect this reality.

3. The proper definition of a “hedge fund” should be a private investment pool that uses some form of riskweighted arbitrage strategy. If a hedge fund doesn’t intend to hedge or pair-off its exposure, then it should be called something else. Maybe the term for all private investment pools should be, well, “PIPs”?

4. One of the best reasons for investing in a PIP is because it can invest independently and behave in a sophisticated fashion. Rigid investment disciplines and unrealistic return expectations demanded by a broad population of institutional and individual investors with varying objectives defeats the intended purpose of a private fund – to optimize risk-adjusted returns by having the ability to be flexible and independent Portfolio rigidity tends to ADD risk and diminish returns over time because it doesn’t allow the professional to adapt to changing conditions during major economic or market shifts or to increase exposures when they feel markets have moved further away from equilibrium values. Independence, discretion and flexibility are the prime advantages that PIPs should offer over other types of investment vehicles. The irony is that most current and potential investors – and even most PIP managers, it seems – still don’t get this.

5. PIPs don’t need advocates. They are merely syndicates of private investors that give managers discretion to invest their money. There is no structural difference separating a partnership that invests in movies, multifamily rehabs in The Bronx, senior secured bank loans or large-cap stocks. PIPs that buy publicly traded Securities must abide by capital market rules and regulations in the same way as every other investor.

6. Investment managers worthy of giving discretion are the ones who: 1) seem to make money over time; 2) have well-audited books, which prove they indeed have made the money they claim to have made; 3) have more than one set of eyes on the fund’s money and holdings between audit periods, and; 4) have a cogent plan to continue making money in the future (though not necessarily in the same manner they have in the past). If these conditions are satisfied, then everything else should be unimportant to investors.

7. PIP investors should look for funds with lock-ups. If an investor trusts the talent of a manager to make money over time, he should want the manager to mitigate the collective power of the fund’s investors to destroy the vehicle prematurely through untimely redemptions.

8. PIP fees are what they are (period). Just as a corporation’s value is based on earnings, not revenues, so too should a fund’s value to investors be based on net performance. Hedge fund investors attracted to a fund because they feel it offers the promise of high net returns should not care about fees. PIP returns are typically quoted and judged net of all fees. If an investor has a problem with a fund’s fees, he should recognize that he is implicitly judging the fund to be unworthy of his investment at any fee level. There are some PIP managers that consistently prove they are unworthy of their fees and others that consistently prove they aren’t charging enough. Maybe the most vocal complainers (aside from professional kibitzers) are the intermediaries that would like a better sharing arrangement?

9. PIP investors should not want to invest in funds with high-water marks on performance fees. High-water marks tend to ensure most funds’ demise following poor years by making it much more likely that fund management companies will lose talent, in turn giving further incentive to otherwise loyal investors to redeem and, ultimately, giving incentive to the founders to completely liquidate the fund. Additionally, in a well-balanced partnership that combines the manager’s investment acumen and the investor’s money, a periodic loss to all investors – including equal losses to the General Partner and to the managers’ personal capital accounts – is not offset by a change in the fee structure. A high watermark punishes managers twice as much. There is no rational economic justification for a high watermark when compared to the risk it adds to the fund.

10. Portfolio opacity does not necessarily suggest devious manager intentions. When combined with

transparent and/or arms-length administrative and audit procedures, vague disclosures should not frighten investors. Investing successfully over time requires taking risk and losing money daily in certain areas. If fund investors compelled (or paid) to monitor interim risk do not intend to professionally judge and then act on managers’ interim performance, then there is no rational justification for wanting full portfolio transparency (beyond mere curiosity). And of course if investors do intend to judge and act based on a fund’s interim performance, then there is no rational reason for investing in the fund in the first place. That investor should simply try to execute the strategy herself.

11. A completely transparent portfolio does not necessarily mitigate risk. A manager of a transparent, self administered fund (regulated or not) with inferior audits that issues fraudulent statements…well, you know.

12. All PIPs are dangerous partnerships for investors and managers if either of them enter their partnership lazily. If investors (or their counselors and intermediaries) perform adequate diligence on prospective funds prior to investment and only then invest suitably, then it is highly likely that their risk will be limited to the ongoing investment decisions of the manager. If the manager is a capable investor yet diminishes her money-making/risk-managing talent by succumbing to fear-based influences of an amateur constituency, then it is highly likely the fund will not perform up to the manager’s talent, or to investors’ expectations.

13. Once adequate due diligence is performed, a person or institution considering investing a portion of their portfolio in a discretionary fund (regulated or unregulated) should either: a) buy into the fund whole hog and give it full discretion on a suitable investment amount; or b) not invest a penny. There should be no inbetween.

14. There is no ideal size or style for a private investment pool. Funds managed by teams of sophisticated money managers with far flung operations on three continents and funds managed by a couple talented individuals who keep an office down the hall from a dentist are equally valid. The true edge of each fund will continue to lie in the market (not marketing) acumen of their portfolio management. PIP investors, now likelier to view all their investments as “speculative”, will likely invest less in each fund and diversify among them. This is as it should be.

15. The current “deal” unregulated investment funds have with market regulators – outright and in spirit – is that they are eligible to receive an exemption from substantial scrutiny as long as they don’t hold themselves out to the public as “investment advisors”. In theory, only well-to-do sophisticated investors invest “excess wealth” in them and therefore they are not in need of regulatory protection. This is a good framework and serves to protect “widows and orphans” from predators looking to take advantage. Many of the scams we’ve read about recently did not seem to breach this basic understanding as it relates to protecting public markets. For example, as far as we know all of Madoff’s trades settled and his fund did not engage in insider trading. Even though his investors may have been defrauded on a grand scale, which threatens public confidence, the public and the public markets suffered no direct monetary damages in the alleged fraud. What seems to elicit the greatest outrage from us all derives from: a) the willingness of a person to allegedly exploit others’ trust with such ease and energy; 2) the human tragedy of trusting investors to commit substantial portions of their portfolio to one investment program, and; 3) the painful reminder that investing is not the same as saving – a notion consumers of financial products as well as market authorities seemed to have forgotten (and a notion financial television still seems to promote).

16. Investors in PIPs know in advance that they don’t have claims beyond what’s detailed in their limited partnership agreements, unless the managers don’t abide by those agreements or commit fraud. There is arbitration and courts to resolve such private disputes. When investors choose to trust investment managers to invest on their behalf, the minimum personal threshold they are obligated to meet is reading their legal agreements and judging the validity of fund audits. If they choose to trust funds-of-funds or other intermediaries to invest on their behalf that then fail to perform reasonable diligence on their portfolio funds, then investors have recourse against them consistent with their partnership agreements.

17. Given the collective nature of private fund investing (using substantial bank leverage to invest, which can collectively overwhelm the balance of daily trade), PIPs have been able to meaningfully affect (directly or indirectly) the lives of most of the US economy’s capital-holders, employers and employees. This means that PIPs greatly helped to raise the nominal prices of stocks, bonds and real estate prior to the recent bust. It also implies that PIPs played a major role in generating commercial output that was driven by easy financing terms.

18. Beyond the political optics of publicly beating up bad hedge funds, legislators know that leveraged money investing in the US capital markets has stoked nominal output and employment (and they clearly think it would do the same again). Additionally, Wall Street banks, which policymakers seem to have put first on their list of industries to save, probably doesn’t need convincing that their highly profitable PIP clients should be given wide latitude to borrow again. So regardless of public perception, we doubt there will be new legislation that raises meaningful hurdles for PIPs to invest aggressively in public markets.

19. We would not be surprised if new fiscal and tax policies attempt to influence the asset types that PIPs find attractive. A cynic might argue that had PIPs continued placing their levered bets in US equities and mortgage and asset-backed securities – even after they became wildly overvalued – rather than shifting their investments toward global commodities like oil futures – which made life difficult on Main Street and in Washington – then the credit build-up (bubble) might still be building. (We take it that Secretary Paulson’s utterance about getting “the bad hedge funds” had something to do with this?)

20. Trix are for kids – PIPs are for adults. If investors in PIPs are incapable or unwilling to analyze and size their investments properly – and therefore don’t know whether or how to trust their managers, and managers are incapable or unwilling to accept investment funding that promises to keep the fund in tact when adversity strikes – and therefore can’t trust their investors, then “the industry” can’t survive. And it hasn’t. The hedge fund industry is dead. Long live independent private investment pools.

MBS agency fixed-rate structured IOs – four modifiers, two acronyms, one good investment play

About 4% of our portfolio is invested in “MBS agency fixed-rate structured IOs”. We added them late last year and we wish we had more. They were issued by Fannie Mae and Freddie Mac and their creditworthiness is now directly backed by the US Treasury. They will, in all likelihood, have terms somewhere between six months and 2 years. The reason we don’t know their exact terms is because they are highly contingent on the speed with which homeowners with conforming 30-year 6.5% fixed-rate mortgages (who underlie the mortgages backing the instruments) prepay their mortgages. Prepayments occur when homeowners refinance their mortgages or when their homes are sold. The

slower that prepayments occur on the mortgages from which these IOs were structured, the greater their returns will be. They have “negative duration” meaning their market values move in the same direction as underlying mortgage rates. They have extreme embedded leverage to changes in interest rates. We think being long these instruments is tantamount to carrying extraordinarily cheap puts on long term interest rates. In fact, we think we are being paid quite a bit for the privilege of owning them. Small, non-fungible, peculiarly structured mortgage assets have historically found market pricing through option-adjusted spread (OAS) modeling – a valuation metric that seeks to distill an instrument’s future cash flows down to its likeliest outcome. This metric provides relatively stable market pricing 95% of the time, during periods in which there is a high degree of confidence about: a) the likeliest path or range of future mortgage rates; b) the likeliest path or range of future

housing values, and; c) the likeliest level of investor sponsorship within the mortgage-backed securities market. It doesn’t work so well when the mortgage market resembles a bar fight where everyone is swinging at everyone else, including the bartender (the Fed) and the bouncer (Treasury).

Nevertheless, we bought our IOs thinking they will take longer than six months to return our investment (which must have been the implicit assumption of sellers). Our reasoning is that even though the government may subsidize mortgage rates by maneuvering a rate below where they would otherwise be in a free market, the more macroeconomic issues associated with – a) a recently decimated mortgage lending infrastructure; b) recently decimated homeowner balance sheets, and; c) a substantial lag period common in mortgage refinancing even during the best of times – would combine to delay a substantial rise in prepayment activity. There are insufficient data to provide adequate input assumptions for these variables in common OAS models, which rely mostly on empirical statistical relationships and volatilities of mortgages rates/prepayment speeds over a long time frame. It is still too early to tell whether we will be right, but very slow January prepayment speeds already surprised career mortgage OAS extrapolators that had been predicting a sudden rise in prepayments of up to five times their autumn levels.

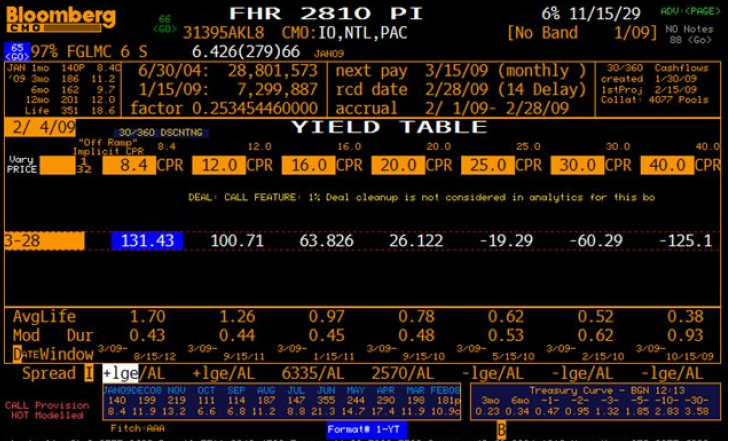

The white numbers in the middle of the yield table above shows yields for one of our IOs across certain prepayment assumptions (the numbers directly above them in the yellow boxes). If prepayment speeds continue at last month’s pace (8.4CPR or about 8% per year), then we would expect a cash-on-cash (unlevered) return of greater than 100% in 2009. We do not expect this because we think prepayments speeds will gradually rise (UNLESS mortgage rates also rise, which they have already begun to do). We are highly confident, however, that regardless of how benchmark Treasury yields, mortgage rates or housing prices may change, these instruments will generate a minimum of 20%. More likely, we think their overall returns will approach 40%. And, if interest rates generally rise as we think they will, these things may really make something of themselves.

Best,

Lee & Paul

~~~~~~~

January 2009

THIS MATERIAL IS NOT AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO PURCHASE SECURITIES OF ANY KIND. RETURN FIGURES HEREIN ARE ESTIMATED NET OF ALL FEES AND CHARGES. PAST PERFORMANCE MAY NOT BE INDICATIVE OF FUTURE RESULTS. ANY COMPARISONS HAVE BEEN OBTAINED FROM RECOGNIZED SERVICES OR OTHER SOURCES BELIEVED TO BE RELIABLE. THIS REPORT MAY CONTAIN FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS INVOLVE INHERENT RISKS AND UNCERTAINTIES, AND WE MIGHT NOT BE ABLE TO ACHIEVE THE PREDICTIONS, FORECASTS, PROJECTIONS AND OTHER OUTCOMES WE MAY DESCRIBE OR IMPLY. A NUMBER OF IMPORTANT FACTORS COULD CAUSE RESULTS TO DIFFER MATERIALLY FROM THE PLANS, OBJECTIVES, EXPECTATIONS, ESTIMATES AND INTENTIONS WE EXPRESS IN THESE FORWARD-LOOKING STATEMENTS. WE DO NOT INTEND TO UPDATE THESE FORWARD-LOOKING STATEMENTS EXCEPT AS MAY BE REQUIRED BY APPLICABLE LAWS. NO PART OF THIS

What's been said:

Discussions found on the web: