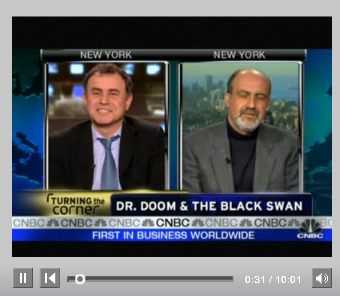

How to predict a financial crisis and the five signs of a bear, with Nouriel Roubini, RGE Monitor and Nassim Taleb, The Black Swan author.

via CNBC

Some pretty awful questions by everyone except Bill Griffeth . . .

>

UPDATE: February 10, 200 5:51am

Talking Point Memo notes:

“In this clip, Nouriel Roubini and Nassim Taleb are still being treated as a circus sideshow by CNBC… They’re predicting the end of finance, and offering the only clear path out of this mess that I’ve seen offered (with the knowledge to back it up), and CNBC keeps asking them for stock tips. It’s ludicrous. Wall Street media — CNBC at least — doesn’t realize how bad this is yet. They’re stuck in a bubble where they think everything will go back to normal in a few months….”

He hits it spot on. These two guys are talking about a deep structural crisis in the world economy. And these CNBC yahoos can’t stop asking for stock tips. Really surreal.

I’m watching it again now. This is a seminal piece of video. You have to see it. I’m not sure I’ve seen anything that captures — albeit unintentionally — the vast disconnect over what is happening today in the US economy.

What's been said:

Discussions found on the web: