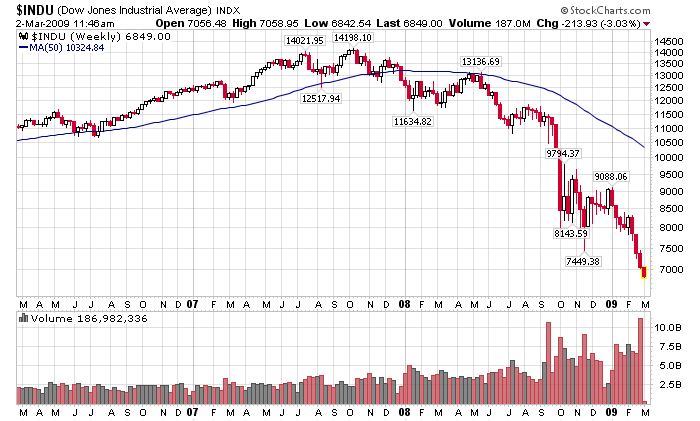

Yes, yes, emailers, I see. We have a DOW with a 6800 handle — low of the day is 6,755.97.

Let’s discuss one of the all time worst calls — and all time best analyses — of my career.

Back in 2006, I wrote the now infamous Cult of the Bear series for the TheStreet.com. The response was both surprising and fascinating. All of the attention was on the random round number — 6,800 — forget the short term upside forecast, or the actual analysis; instead, all people saw was the big negative downside forecast.

The pushback was fierce — highly emotional, totally subjective. At the time, no one wanted to pay attention to any warnings remotely like this:

“It starts with the consumer, who after years of spending, finally tires. Soon, it infects corporate revenue and profits. Slowly, it cascades its way across different sectors: housing, durable goods, discretionary spending, entertainment. Eventually, the decay spooks the markets.”

I thought that economic breakdown was all very foreseeable, and yet even the mere mention of its possible occurrence was fought tooth and nail. It was as if a negative forecast was like BeetleJuice (say its name 3X and it appears!).

What I found so very surprising was that even the “bull call before the fall” portion was widely ignored. Despite having the highest forecast for the Nasdaq amongst all of the Business week prognosticators, and being amongst the top of the S&P500 forecasters –all anyone could see was that huge threatening worst case number. It was weird to me.

I was surprised anyone took the year end numbers so seriously. I had been on record repeatedly stating that guessing a number on the market 12 months hence was an exercise in futility. In a column written years earlier, The Folly of Forecast, I couldn’t have been more explicit that these exercises are just for $h*ts & giggles, nothing more. And when I ended up having the most accurate forecast for in WSJ competition the next year, I told Mark Haines it was nothing more than lucky guesswork. And yet still, people took it very very seriously.

The whole experience was really quite instructive to me.

The year end forecast I made was obviously wrong. These sorts of predictions are about timing, and my timing was awful. Markets rallied far beyond my bullish forecasts — 2000 points and 18 months on the Dow — before the eventual collapse. So I get zero points for timing.

Where I will take some props is on the psychology of market collapses: “The move from Dow 8800 to 6800 won’t be a rational, calmly contemplated affair. No one will be quietly wondering about option-expensing or multiple compression. Instead, it will be a severe overreaction to some external event.” — that was astute.

Also prescient: The analysis as to what was structurally wrong in the economy, and what was likely to go eventually cause major problems. Looking at Long-term cycles, trading ranges, and P/E mean reversion was the correct approach. The 1966 to 1982 range was also instructive, as was noting we were likely to have “violent moves down and rapid blastoffs.” Reviewing that analysis, the cyclical, technical and economic reasons for a potential market collapse from Dow 12k to 6800 is still worth reading today.

But the timing? Not so much . . .

>

Dow January 2006 to Present

>

Sources:

The Folly of Forecast

The Street.com, 06/07/05 – 01:05 PM EDT

http://www.thestreet.com/comment/barryritholtz/10226887.html

Cult of the Bear, Part 1

The Street.com, 01/05/06 – 07:18 AM EST

http://www.thestreet.com/markets/marketfeatures/10260096.html

Cult of the Bear, Part 2

The Street.com, 01/09/06 – 07:12 AM EST

http://www.thestreet.com/comment/investing/10260656.html

Cult of the Bear III: Getting to Dow 6800

The Street.com, 01/18/06

http://www.thestreet.com/markets/marketfeatures/10262175.html

What's been said:

Discussions found on the web: