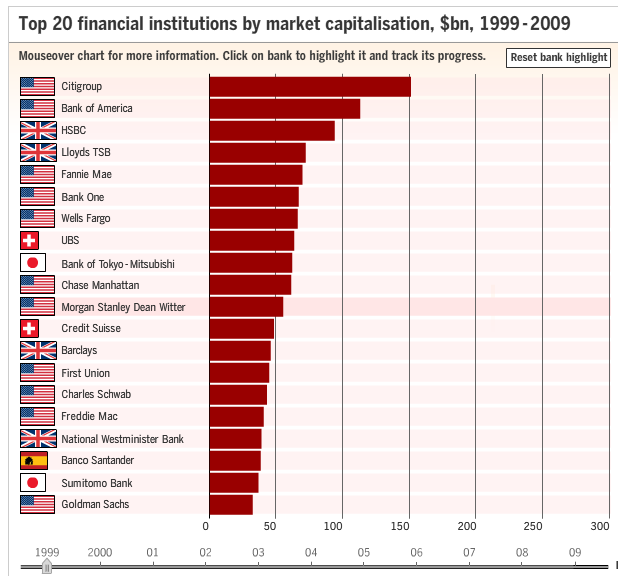

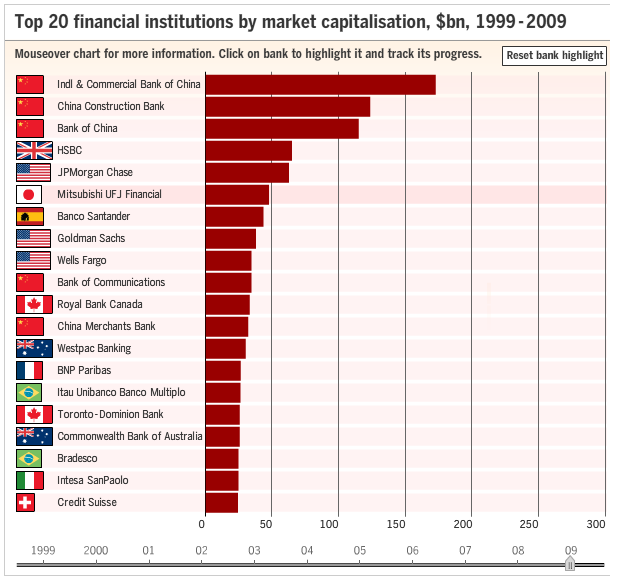

Fascinating infographic via the FT on the top twenty financial institutions, according to market cap.

Click either of the graphics to reach the interactive charts, and then use the slider to see the changes take place.

>

1999: Top 20 Financials by Market Cap

>

2009: Top 20 Financials by Market Cap

>

Source:

The decade for global banks

Steven Bernard, Jeremy Lemer, Helen Warrell, Cleve Jones, Peter Thal Larsen and Simon Briscoe

FT, March 22 2009

http://www.ft.com/cms/s/0/ea450788-1573-11de-b9a9-0000779fd2ac.html

What's been said:

Discussions found on the web: