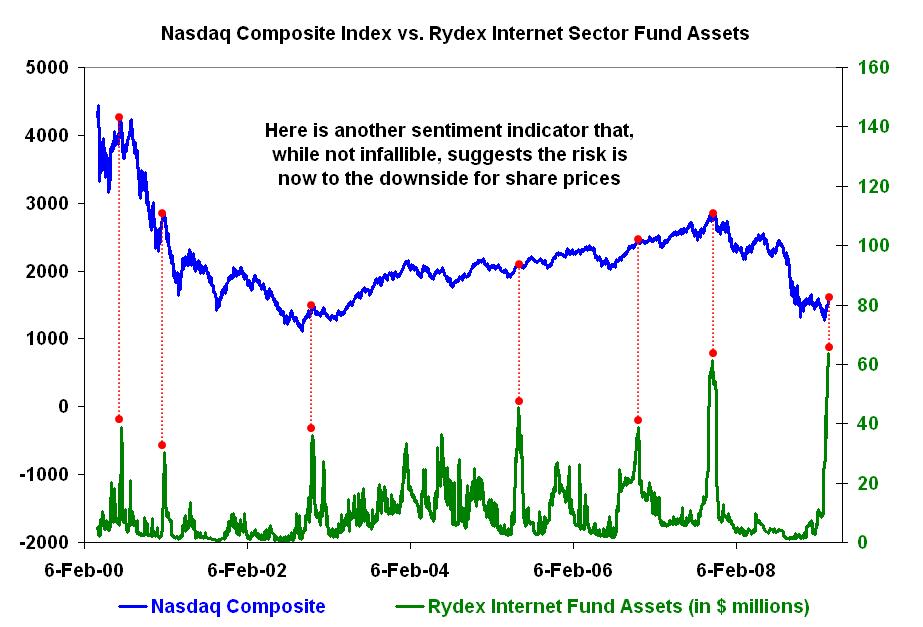

Nothing gets the speculative juices flowing like the internet sector. By the same token, when traders are piling into the shares of this group, it can signal that equity markets, especially technology shares, are ripe for at least a short-term pullback.

With that in mind, the latest reading on the total assets of the Rydex Internet Sector Fund (RYIIX) — at $63 million, it is the largest amount since the fund was first set up in April 2000 — should give the bulls cause for concern.

>

>

Rydex data source:

http://www.rydexinvestments.com/products/mutual_funds/info/navs_historical.rails

What's been said:

Discussions found on the web: