Hey, Lama, hey, how about a little something, you know, for the effort, you know. *

>

I should take it as complement when not one but two TBP posts show up on the front page of the NYT on consecutive days. Some of this is clearly a moment of zeitgeist, with more than one person thinking of the same thing at the same time. Still, its nice to consistently beat major publications.

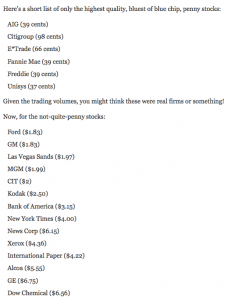

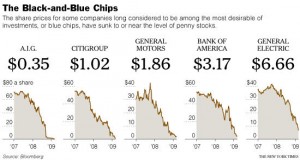

The first was our May 5th post, The Latest Craze: Blue Chip Penny Stocks, followed by the NYT story the next day Slump Humbling Blue-Chip Stocks. Once Citi broke a buck, and GE became single digit stock, the story was pretty obvious:

I do give the Times props on the chart title “Black-and-Blue Chips”

>

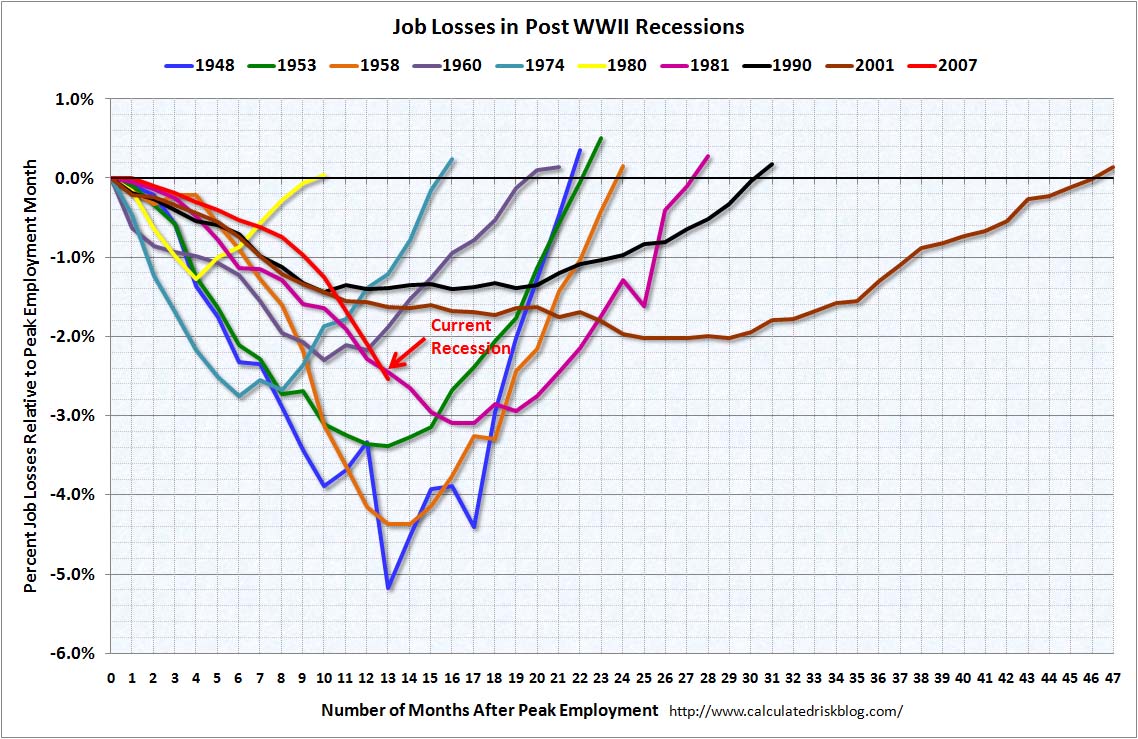

The second such example actually started with the Speaker’s office, which was picked up by Time magazine’s Swampland, which we then improved upon.

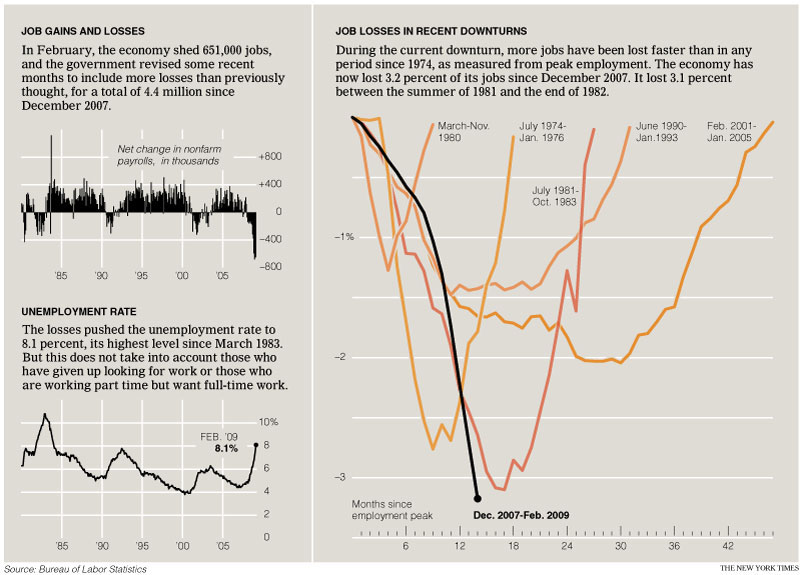

The Times article Job Losses Hint at Vast Remaking of Economy used a similar chart:

>

As I suggested, the ambiance of our chart sensitive times implies these things to more than one mind at a time — but its nice to know that we are still days and months ahead of the major media on these things.

_________________

* “Oh, uh, there won’t be any money, but when you die, on your deathbed, you will receive total consciousness.” So I got that goin’ for me, which is nice. –Carl Spackler

>

Previously:

The Latest Craze: Blue Chip Penny Stocks (March 5, 2009)

http://www.ritholtz.com/blog/2009/03/the-latest-blue-chip-penny-stocks/

Job Losses: Comparing Recessions (February 7th, 2009)

http://www.ritholtz.com/blog/2009/02/job-losses-comparing-recessions/

Post WWII Recession Job Recoveries (Months) (February 9th, 2009)

http://www.ritholtz.com/blog/2009/02/post-wwii-recession-job-recoveries-months/

Job Losses in Post WWII Recessions (February 9th, 2009)

http://www.ritholtz.com/blog/2009/02/job-losses-in-post-wwii-recessions/

Household Employment from Peak (February 9th, 2009)

http://www.ritholtz.com/blog/2009/02/household-employment-from-peak/

>

Sources:

Slump Humbling Blue-Chip Stocks

JACK HEALY

NYT, March 5, 2009

http://www.nytimes.com/2009/03/06/business/economy/06shares.html

Job Losses Hint at Vast Remaking of Economy

PETER S. GOODMAN and JACK HEALY

NYT, March 6, 2009

http://www.nytimes.com/2009/03/07/business/economy/07jobs.html

What's been said:

Discussions found on the web: