“Nobody ever sold a stock because they thought it would go up. And as a group, corporate insiders obviously are scarcely enthusiastic about the prospects for a genuine bull market.”

>

Or so said Alan Abelson in this week’s Barron’s.

Is he right? How fallible are the CEOs, CFOs, and other execs regarding their own firm’s prospects? Consider:

“If those now infamous shoots of recovery are popping up all over, why would insiders be so aggressively dumping stocks?

Yet, they indisputably are. According to a study prepared for Bloomberg by Washington Service, a research outfit, directors, officers and the like have sold $353 million worth of stock in this fading month, or 8.3 times the total bought. As a matter of fact, according to the firm, insider purchases of $42.5 million are on track to make April the skimpiest month for such buying since July 1992. (emphasis added)

The pace of selling in the first three weeks of this month, incidentally, was the swiftest since the market peaked and the bear came out of hibernation with a vengeance in October ’07.”

There’s more than anecdotal information in insider sales. Bob Bronson, who tracks insider buys and sales, notes “We’ve found insider activity to be a very useful market timing indicator – when used in combination with others — over the short term (weeks) to intermediate term (months).”

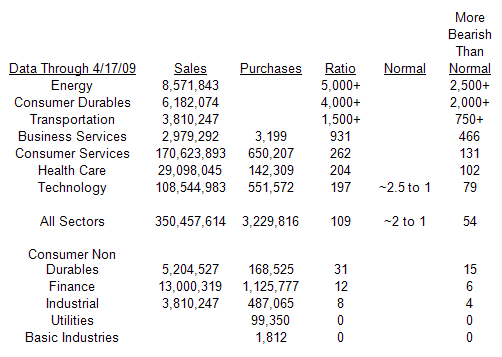

Bronson shows that Energy, Consumer Durables and Transports look particularly bearish now:

>

Back to Abelson — he concludes:

“We’re quite aware that insiders are not infallible. But they are, after all, in the front lines of commerce and industry and so presumably have a better fix on the economy and the prospects for recovery than analysts and economists, whether of macro or micro persuasion.

And just as they wouldn’t be laying off people in such extraordinary numbers if they thought their business was about to rebound soon, they’d be loath to liquidate their holdings in such an emphatic way if they espied a turnaround in the offing.”

One could argue that sellers are merely taking advantage of the big rally in the markets — the S&P 500 has jumped 28% in 33 trading days, the sharpest rally since the 1930s. But what does that say regarding the bull-tards cry that the longest recession since World War II will soon end?

This may be a classic case of “watch what they do, not what they say . . . ”

>

Sources:

Shareholders Be Damned!

ALAN ABELSON

Barron’s APRIL 25, 2009

http://online.barrons.com/article/SB124061355986854673.html

Insider Selling Jumps to Highest Level Since 2007

Michael Tsang and Eric Martin

Bloomberg, April 24 2009

http://www.bloomberg.com/apps/news?pid=email_en&sid=au8cyqeJFifg

Note: For those of you who wish to track this on your own, here are a few resources:

INSIDER SPOTLIGHT

WSJ Sales Tracker

http://online.wsj.com/mdc/public/page/2_3024-insider1.html?mod=mdc_h_usshl

Insider Monitor

http://www.insider-monitor.com/sellday.html

What's been said:

Discussions found on the web: