Existing-home sales fell 7.1% from March 2008; Since February 2009, they fell 3% (seasonally adjusted annual rate of 4.57 million units). Even that weak monthly number was due to a “downwardly revised level of 4.71 million in February.”

Prices rose 4.2% from February to March, but ignore that, and stay focused on the annual datapoint, as that what matters much more (see foot note below).

Once again, “distressed” properties accounted for over half of all transactions in March. The NAR said that discounts on distressed property averaged 20% or more versus traditional homes. The national median existing-home price for all housing types was $175,200, down 12.4% from March 2008.

As noted above, I found this footnote via the NAR release to be rather interesting (is this new language?):

“The only valid comparisons for median prices are with the same period a year earlier due to the seasonality in buying patterns.

Month-to-month comparisons do not compensate for seasonal changes, especially for the timing of family buying patterns. Changes in the composition of sales can distort median price data. Year-ago median and mean prices sometimes are revised in an automated process if more data is received than was originally reported.”

Is it possible these guys are getting religion . . .?

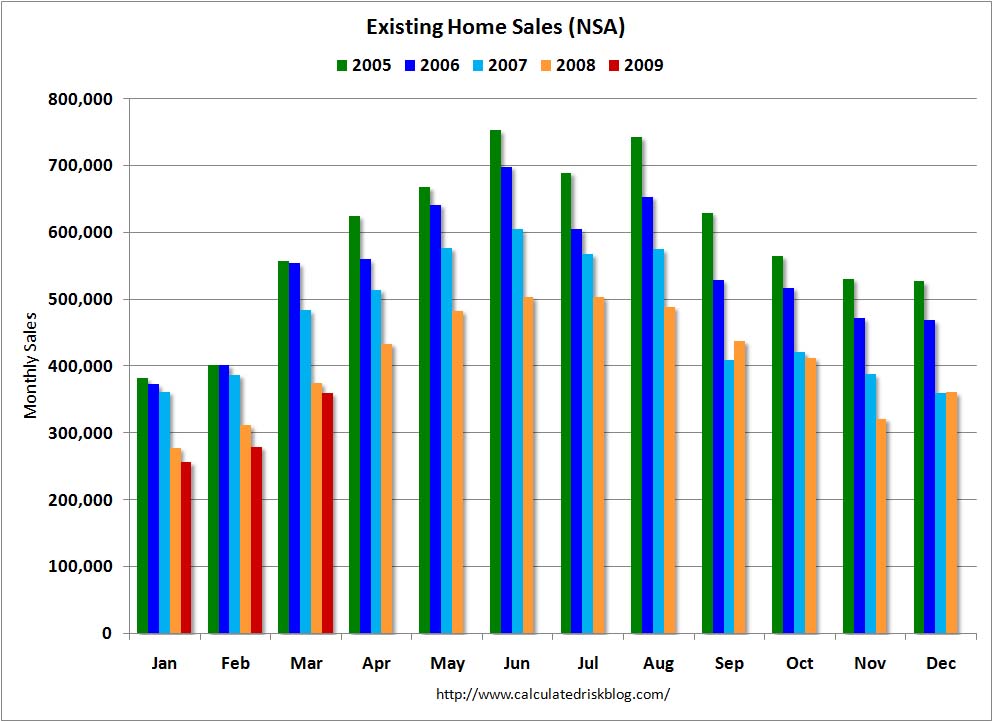

Oh, and here is my favorite Real Estate chart: Take the data before its seasonally adjusted (and therefore skewed by the 2003-06 period) and show each annual series separately.

Existing Home Sales, NSA

via Calculated Risk

>

According to an NAR survey, first-time buyers accounted for 53 percent of transactions. I would want to see the specifics and lots of prior data before drawing any conclusions from NAR surveys given their historic lack of credibility. (In other words, I don’t trust them).

>

Source:

March Existing-Home Sales Slip but First-Time Buyers Rise

NAR, April 23, 2009

http://www.realtor.org/press_room/news_releases/2009/04/march_ehs

What's been said:

Discussions found on the web: