I’ve been tearing through the GDP data, trying to get a handle on the actual contraction and growth reflected within. It is, to say the least, an ugly, somewhat quirky report for the quarter.

The consensus was (once again) too bullish. Why do they call it the dismal science if most practitioners are consistently over-optimistic?

Here are some of the highlights:

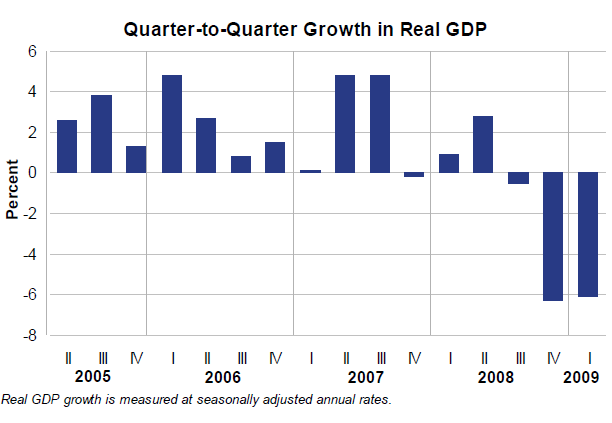

• Consensus estimates were way too high — Wall Street economists forecast a drop of -4.6% versus -6.1% actual data;

• GDP has fallen three consecutive Qs, something that hasn’t happened in since Q3 1974 through Q1 1975; (WSJ)

• These 2 consecutive quarters of minus 6% contraction is the worst 6 month span for the economy since 1957-58; (Bloomberg)

• The economy has fallen 2.6% over the past 4Qs, the biggest year-over-year decline since 1982. (Marketwatch)

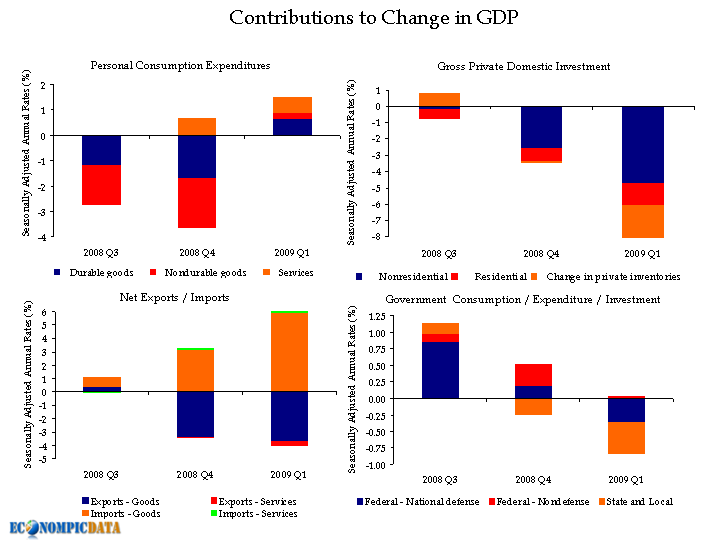

• All investment-related segments of the economy showed significant weakness; we surmise that lot of this weakness is credit crisis related;

• Real exports of goods and services decreased 30%;

• Residential building declined 38% — the deepest drop in the cycle so far.

• Commercial construction fell 44.2% in 1Q –the largest quarterly decline ever recorded (data goes back to the 1940s).

• Capex investment fell 33.8%, the 5th Q decline in a row, and the deepest decline to date.

GDP would have been even worse, if it wasn’t for how fast imports have plummeted; They are falling faster than exports, perversely creating a appearance of relative improvement . . .

There were some positives in the report — not quite greenshoots, but signs of slowing contraction:

• Price indicators suggested inflationary pressures rose in first-quarter 2009, easing fears of deflation. (WSJ)

• Companies trimmed stockpiles at a $103.7 billion annual rate last quarter, the biggest drop since records began in 1947 (Bloomberg)

• Purchases of durable goods rose 9.4% in Q1, after plummeting 22.1% in Q4 ’08;

• Consumer spending climbed at a 2.2% annual pace in Q1 — the most in two years.

Assorted charts after the jump . . .

via BEA

>

via Jake at Economopic

>

>

Source:

GROSS DOMESTIC PRODUCT: FIRST QUARTER 2009 (ADVANCE)

http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

PDF of full release

http://www.bea.gov/newsreleases/national/gdp/2009/pdf/gdp109a.pdf

What's been said:

Discussions found on the web: