>

Source:

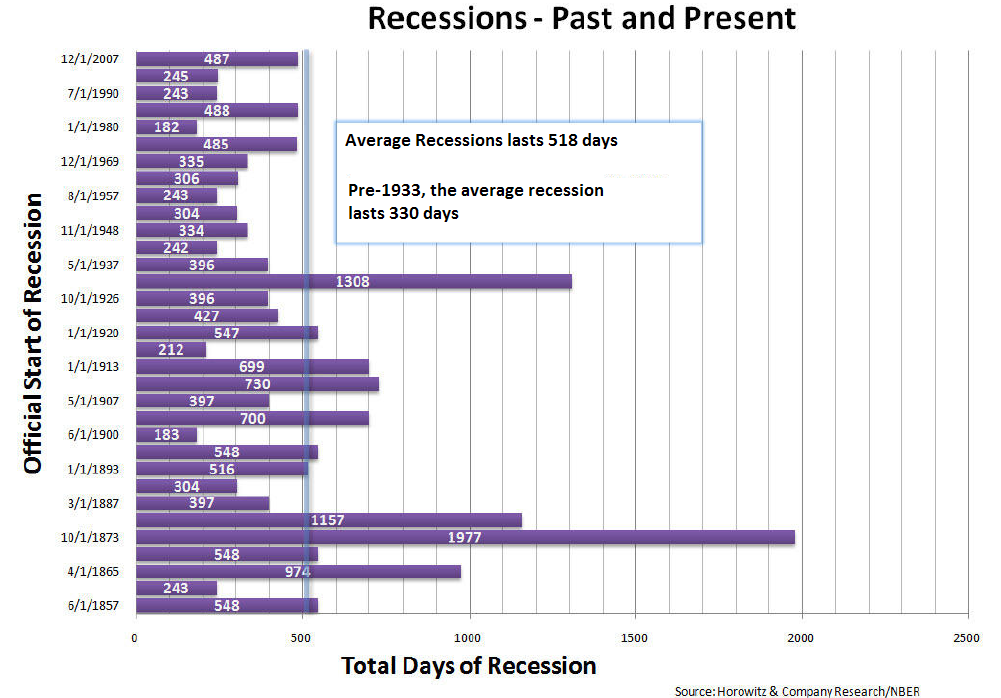

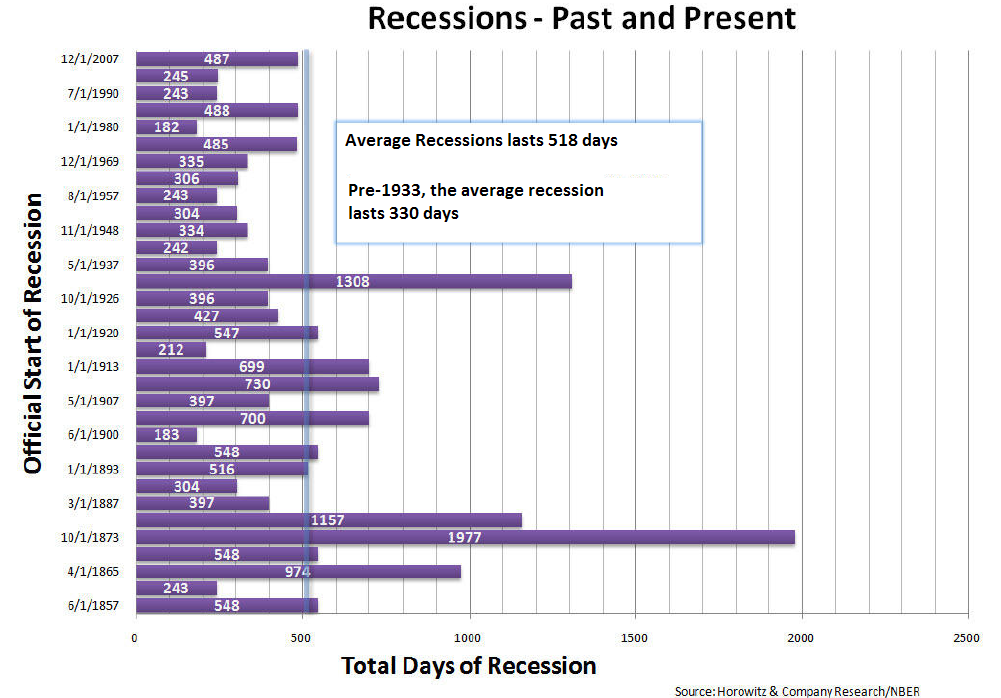

2nd Quarter 2009 Economic Commentary and Outlook

Andrew Horowitz, CFP

Kevin Hoffmann

http://www.horowitzandcompany.com/

>

Source:

2nd Quarter 2009 Economic Commentary and Outlook

Andrew Horowitz, CFP

Kevin Hoffmann

http://www.horowitzandcompany.com/

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: