If its Saturday, that means its time for a cool chart from Floyd Norris:

>

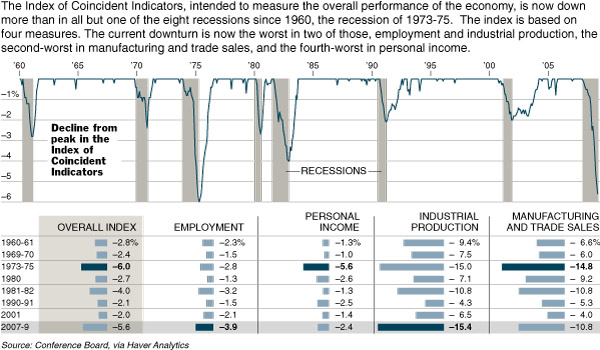

Recession, Far From Over, Already Setting Records

Chart courtesy of NYT

>

Excerpt:

“THE current recession has become the second-worst in the last half-century and is close to surpassing the severe 1973-75 downturn, according to the Index of Coincident Indicators, based on government data and compiled each month by the Conference Board, a private organization. Unlike the more widely followed Index of Leading Indicators, which is supposed to help forecast changes in the economy, the coincident index is aimed at simply recording how the economy is doing now.

The accompanying chart shows how far that index has declined from pre-recession peaks during each downturn since 1960. The figure for March, released this week, showed a decline of 5.6 percent from the high set in November 2007, the month before the recession began, according to the National Bureau of Economic Research.”

Interesting stuff . . .

>

Source:

Recession, Far From Over, Already Setting Records

Floyd Norris

NYT, April 24, 2009

http://www.nytimes.com/2009/04/25/business/economy/25charts.html

What's been said:

Discussions found on the web: