Kevin Lane is one of the founding partners of Fusion Analytics, and is the firm’s director of Quantitative Research. He is the main architect for developing their proprietary stock selection models and trading algorithms. Prior to joining Fusion Analytics, Mr. Lane enjoyed success as the Chief Market Strategist for several sell side institutional brokerage firms. In those capacities he oversaw the firms’ research departments. He produced a broad range of widely followed institutional research publications ranging from industry specific notes to quantitative/fundamental reports on individual stocks. His buy side clientele consisted of many of the nations top money managers and hedge fund managers. Mr. Lane is a member of the Market Technicians Association.

~~~

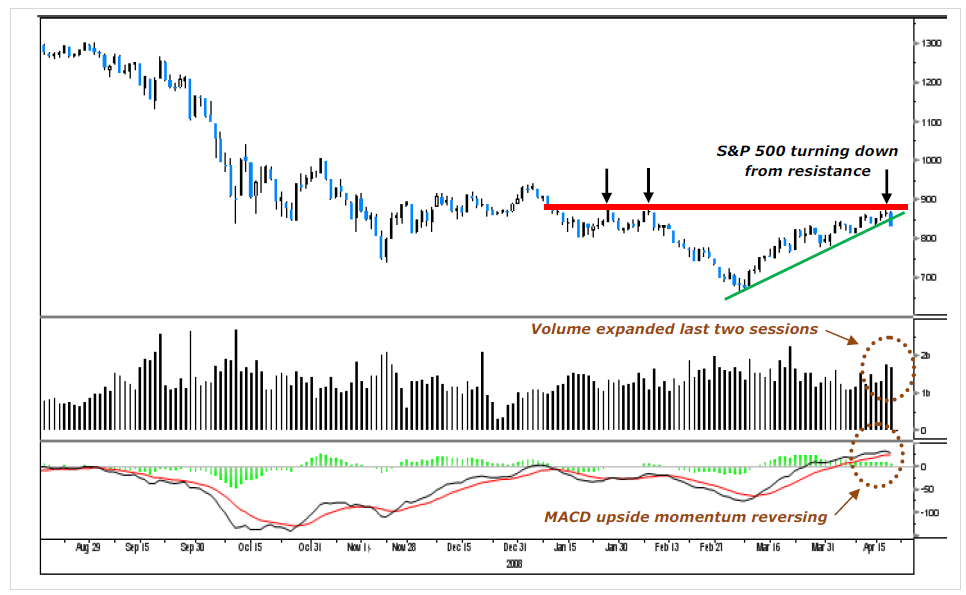

S&P500 Failing at Resistance

>

>

As seen in the above S&P 500 research note the index stalled at resistance and then subsequently broke its’ minor uptrend line on expanding volume. Directional volume is important as it suggests the conviction behind the move and as much as it was bullish not far off the lows, yesterday’s action while not equally negative was ugly. The skew of decliners on the S&P was torrential with 479 of 500 issues scoring price losses for the session.

That said for the time being (until proven otherwise) we have to assume the sellers are back in control as the skew of decliners to advancers suggested they overwhelmed buyers yesterday. We did suggest several days back that after a big rally that buyers were becoming more discriminating at what price they would pay for stocks. So part of the action yesterday was profit taking and also buyers being more selective now the question is where, when and if the buyers make a stand. For the record we believe this to be a classic retesting sequence, however what we believe and what may happen are not always in sync.

For now the market is on the defensive and it’s better to wait for reinforcements (buyers coming back in mass) before getting aggressive on the buy side.

Now not being at the front of the line may mean you miss the early part of the turn (if and when it materializes), however the odds of a successful turn once the front line has made its’ stand is far greater.

~~~

Contact Peter Greene for more information about institutional research & trading: